Overview

Although the newly-introduced law on transfer pricing makes the annual reporting of transfer pricing mandatory, its enforcement and sanctions are yet to be seen. The Revenue Department (RD) may take some time before it issues practical guidelines for taxpayers to follow. In the meantime, the RD may be less active in imposing sanctions on taxpayers due to its unfamiliarity with the new transfer pricing regulations.

This is not to say that the RD will be less focused on collecting all other sorts of taxes as they will continue to remain proactive in collecting both direct and indirect taxes. The RD revealed that in the first seven months of the 2019 fiscal year, it has collected taxes of Baht 956 billion, thereby exceeding its target by Baht 22 billion or 2.5%.

The RD plans to continue enhancing its efficiency in collecting taxes by adopting data analytics to transform the tax collection system into a fully-digital organisation. Data analytics will be used to forecast income of taxpayers, analyse tax filing records, linking information with other organisations and, above all, to decipher taxpayers’ behaviour. This high-tech system will not only help the RD to identify audit targets but also to reduce the time necessary for tax examinations.

Given the above dynamic changes, taxpayers are encouraged to keep up with the new environment of tax collection. Are you aware of your existing tax exposures and do you have a strategy for how to manage your risks? Have you set up a process to prevent issues of non-compliance with the tax law before they occur? Would it be better if you can employ preventive control so as to reduce the risk of non-compliance? All these matters will be addressed in this seminar.

This seminar will cover:

- Tax collection, tax audit trends and Risk Based Audit System (RBA)

- Interesting tax audit cases and common tax pitfalls

- Best practices and control for the tax function

Date & Location:

Wednesday, 10 July 2019

From 09.00 am to 12.00 pm

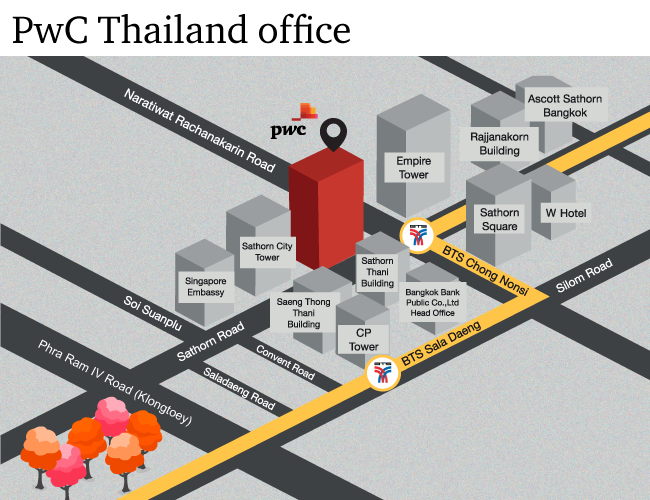

PwC Thailand office

Conference room, 15th Floor

Bangkok City Tower

179/74-80 South Sathorn Road,Bangkok

Programme:

| 9.00 - 9.30 am | Registration |

| 9.30 - 12.00 pm | Seminar |

Remarks

- Please kindly register no later than Friday, 5 July 2019.

- This seminar can count towards CPA & CPD hours (subject to confirmation by the relevant authorities).

- This seminar will be conducted in Thai.

- This seminar is completely free of charge and will be on a first-come, first-served basis.

- A maximum of two seat will be given to one registrant per company.

- Your registration will be confirmed by email.

- PwC reserves the right to change or cancel any part of the published programme due to unforeseen circumstances.