Are you ready for GST InvoiceNow?

GST InvoiceNow

Inland Revenue Authority of Singapore (IRAS) has announced that businesses applying for voluntary GST registration will need to use an InvoiceNow-ready solution to send invoice data to IRAS through the InvoiceNow network. There are also plans to progressively extend this requirement to other GST registered businesses.

What is InvoiceNow?

InvoiceNow is a nationwide e-invoicing initiative that facilitates the direct transmission of invoice data in a structured digital format from the finance system of the supplier to the finance system of the customer based on the open standard Peppol network.

This network allows businesses to send and receive invoices digitally, facilitating smoother and faster transactions without any manual paperwork. However, in order to start transmitting e-invoices, the business must first be connected to the InvoiceNow network via an Access Point (AP) provider accredited by the InfoComm Media Development Authority (IMDA).

What is the GST InvoiceNow requirement?

The GST InvoiceNow requirement refers to the transmission of prescribed invoice data, referred to as Mandatory Data Elements (MDEs) to IRAS.

Under the GST InvoiceNow requirement, affected businesses will be required transmit a copy of their invoice data to the IRAS in addition to the current arrangement of transmitting the invoice data between suppliers and customers.

IRAS mandate

IRAS has announced that businesses applying for voluntary GST registration will need to use an InvoiceNow-ready solution to send invoice data to IRAS through the InvoiceNow network. There are also plans to progressively extend this requirement to other GST registered businesses.

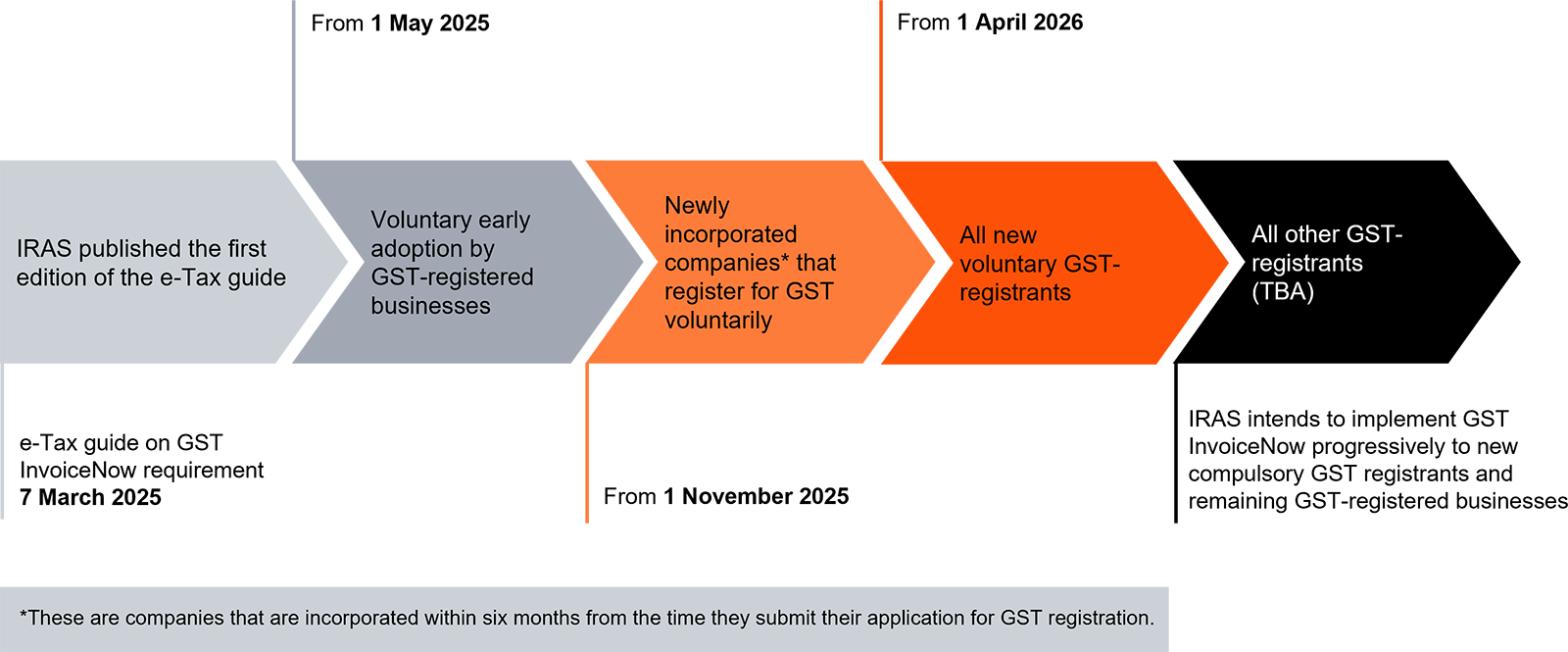

This requirement will be implemented in stages:

Advantages of moving early to GST InvoiceNow

Streamlined and standardised invoicing

Enable seamless, IRAS compliant invoicing across partners using Peppol formats for consistency and tax alignment.

Enhances accuracy and strengthens security

Invoices are transmitted securely through the Peppol network with tamper-proof, traceable records that minimise the risk of data loss, and unauthorised changes ensuring audit-ready documentation.

Improved record-keeping and compliances

Digital invoices are easy to manage, support faster GST audits and refund, and promote paperless operations.

Boost efficiency and shorten payment cycles

Automate invoices delivery into buyer systems to reduce manual work and speed up processing.

Gearing up for success

Your roadmap to seamless implementation of GST InvoiceNow.

How PwC can support you

We’re here to help you navigate the GST InvoiceNow requirement with confidence. To ensure a smooth transition, our approach is structured into two key phases.

Explore each phase and evaluate your data integration options for GST InvoiceNow.

Phase 1: Impact assessment

As a first step in preparing for the GST InvoiceNow requirement, we recommend conducting a comprehensive impact assessment. This assessment is designed to help you evaluate your current state and define a clear, actionable path to compliance.

Why this matters?

The purpose of this impact assessment is to:

- Identify the gaps between your current invoicing data, processes and system, and the required state for the implementation of GST InvoiceNow.

- Evaluate the extent of changes required from data, processes and system aspects and the corresponding timeframe.

- Receive tailored recommendations and a clear roadmap of actions to support a smooth and compliant implementation.

Our approach

Led by a multidisciplinary team of Tax and Technology professionals, we bring deep experience across industries. Our approach is collaborative, structured, and tailored to the unique needs of your industry. We work closely with your internal stakeholders to assess your current GST invoicing landscape.

We evaluate your readiness for GST InvoiceNow across three key dimensions: data, processes and systems. Based on our findings, we identify any gaps or inefficiencies and provide actionable, tailored recommendations to help you meet the GST InvoiceNow requirements, covering both compliance and technology enablement.

Contact us

Phase 2: Direct integration via ERP solutions

This option links up your Enterprise Resource Planning (ERP) with the Access Point.

It is recommended for companies whose ERP systems are Access Points and support direct integration with InvoiceNow (e.g. SAP/Oracle).

Why choose this option?

- Additional modules offered by ERP to meet GST InvoiceNow requirements.

- Using your in-house integration platform to connect with Access Point.

Contact us

Phase 2: Integration through middleware

This option uses a middleware to connect to Access Provider.

It is recommended for companies whose ERP systems are not IMDA-accredited Access Points, and require external integrations to connect to InvoiceNow.

PwC provides an in-house e-Invoicing tool for businesses opting for middleware integration. PwC is a certified Peppol Service Provider and an IMDA-accredited InvoiceNow-Ready Solution Provider. Our solution enables secure and seamless electronic invoice exchange via the InvoiceNow network.

Built on Peppol standards, it ensures interoperability and reliability across systems. Additionally, businesses can submit invoice data directly to IRAS, supporting regulatory compliance with minimal effort.

Why choose this option?

- Ease of compliance - Minimal changes required to ERP systems to connect to PwC’s Access Point.

- Decoupling of updates - Our Middleware can be updated independently of ERP systems in response to changes in IRAS requirements.

- Trackability - Availability of dashboards to monitor errors and submission status.

What makes our middleware different?

Flexible connection options

Our PwC e‑Invoicing Tool supports both file upload method that requires minimal to no system changes, as well as direct ERP integration via SFTP or API.

Virtually unlimited transactions

PwC e‑Invoicing Tool is designed to handle high-volume transactions, supporting up to 1 million transactions annually. This ensures scalability and reliability, allowing you to focus on core business priorities without worrying about transaction limits.

Proven global experience

Our PwC e-Invoicing tool is developed by PwC Hungary, has been rolled out to 500+ entities across 5 countries, that supports high-volume transmission.

Custom features

PwC’s e‑Invoicing Tool can be customised to meet specific business needs. Beyond the default compliance features, additional functionalities can be developed to support unique operational requirements. For example, enabling intercompany e‑invoicing or other specific needs.

We ensure that all features offered through PwC’s e-Invoicing tool are aligned with regulatory requirements:

- Send and receive invoices via the InvoiceNow network, in compliance to BIS and PINT requirements (based on Peppol standards)

- Submit invoice data directly to IRAS from PwC’s e-Invoicing tool

- Validate and transform data within the tool to meet prescribed XML format requirements

- Monitor invoice status, error messages, and IRAS validation receipts via a dashboard, including cancellation and rejection functionality.

- Generate downloadable e-reports based on pre-set filters to track sent and received invoices.

- Maintain robust role-based access control and audit trails for user actions.

Contact us

Sasha Quak

Want to stay ahead?

Contact us for a GST InvoiceNow impact assessment

gsap_scrolltrigger

Contact us