Treasury Services

Delivering the value you are looking for

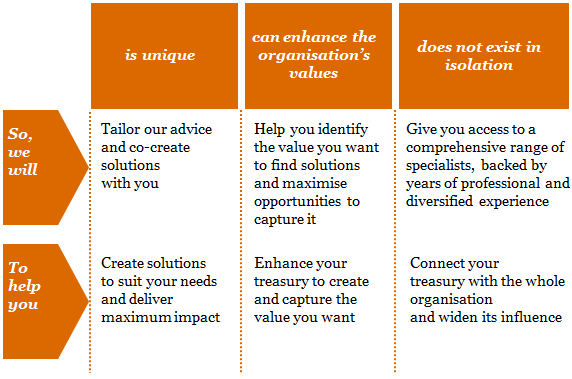

Like your organisation, your treasury is unique. So we address your individual challenges, opportunities and perspective with a customised approach to:

Cash and banking management

- Liquidity management and forecasting

- Funding and trade finance

- Accounting and valuations support

- FX, credit and interest rate risk management

- Investment and debt management

- Commodity risk management

- Working capital management

- Corporate finance

- Change management

And your supporting infrastructure:

- Technology

- Controls and reporting

- Processes

- Strategies

- Organisational structure

PwC’s Corporate Treasury Solutions specialists can work with you at every stage of your treasury project, from assessment and design through to implementation and beyond.

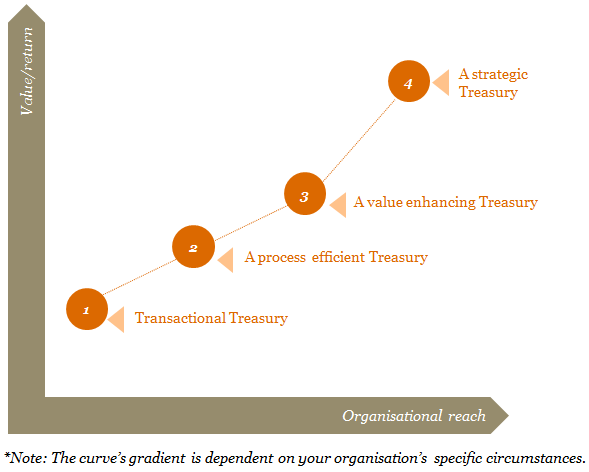

Which treasury model works best for you?

- The treasury development model

- 1. Transactional treasury

- 2. Process efficient treasury

- 3. Value enhancing treasury

- 4. Strategic Treasury

- We believe that every treasury....

The treasury development model

1. Transactional treasury

Plays a focused execution role, enabling the business to carry out necessary transactions; primarily impacting financial functions.

2. Process efficient treasury

Provides excellence in execution, ensuring optimal use of cash via integration with underlying finance processes and banking providers.

3. Value enhancing treasury

Delivers quantifiable value for the business as a whole, optimising financial flexibility and efficiency, enabling the business to achieve its strategic goals.

4. Strategic Treasury

Actively contributes to the strategic decisions of the whole business and provides financial leadership.

We believe that every treasury....