We decode data risk complexities so you can steer with clarity

Data Risk Framework

There is a general lack of standardised, evidence-based set of measurements for different types of data risks, creating ambiguity on how these risks can be addressed at enterprise level (commonly with the same set of root causes) with senior management oversight.

Key players in the dynamic financial institutions (FI) ecosystems

There are four key players navigating the increasingly complex realm of data risks. Each of these players faces unique challenges and responsibilities in managing a broad spectrum of data-related risks to maintain the integrity, security and innovation potential of the financial services sector.

CISO, CDO, Compliance and other CXO are separately in charge of different data risks (i.e. data security, privacy, quality, governance and other data control activities).

Enterprise risk management (ERM) includes only reportable incidents classified with data characteristics (i.e. data security incidents, data privacy breaches, material data quality incidents etc.).

Data is managed compliantly, however requires advanced data readiness to fulfil novel use-cases as first movers that lacks precedence.

Regulators conduct observation and audit to ensure FIs are operating compliantly, and works with various interpretation and implementation models for different FIs.

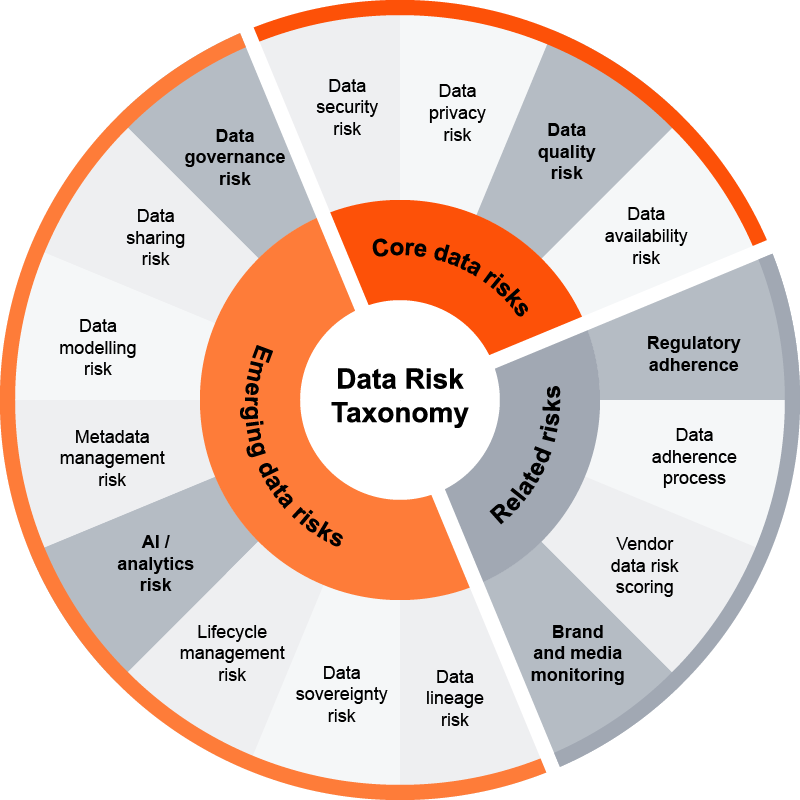

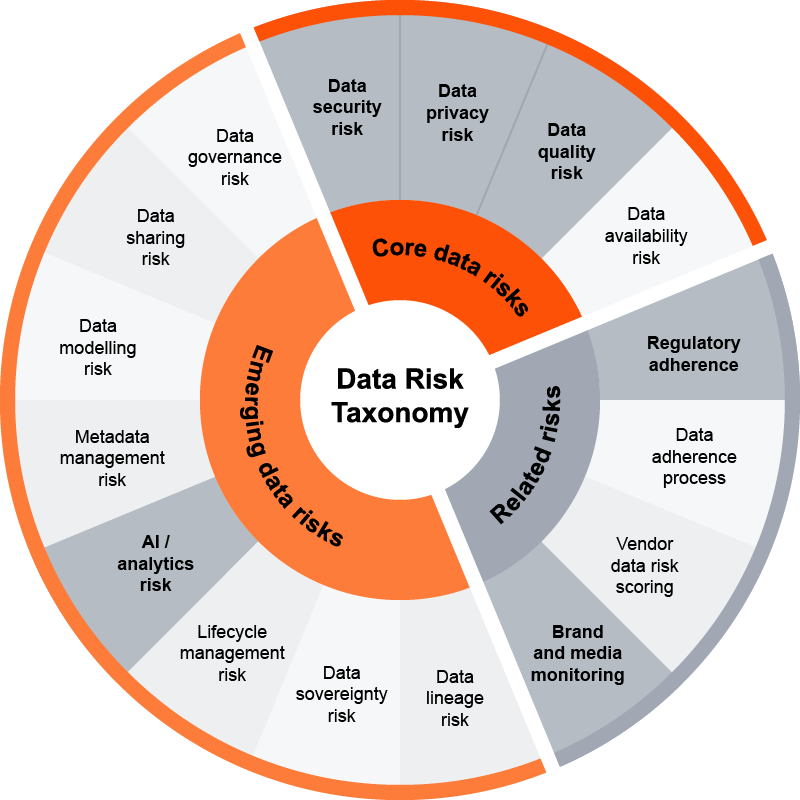

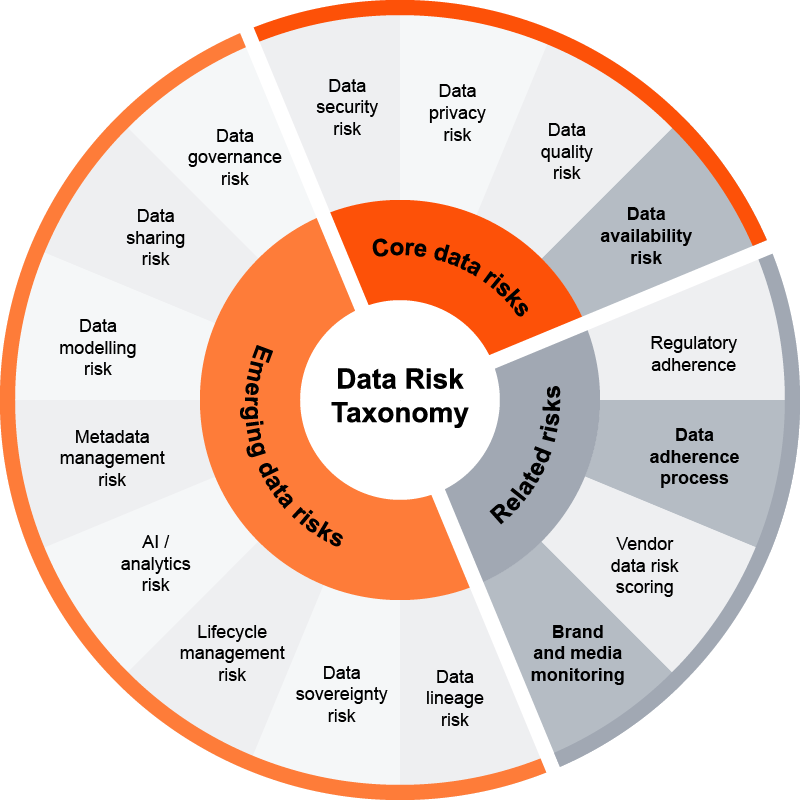

Data Risk Taxonomy

The data risk taxonomy categorises risks into three primary areas: core data risks, emerging data risks, and related compliance and operational risk monitoring. It facilitates an understanding of interconnected relationships, dependencies, and impact-chains, which are crucial for holistic management of data, as it reveals the cascading impacts that data risks can trigger. Senior management can leverage these network relationships to take pre-emptive actions, ultimately reducing data costs.

Explore these scenarios of data risks, revealing the intricate web of cascading impacts and emphasising the necessity for strategic, holistic oversight.

When CXO manages data risks in isolation

Poor data quality can have a cascading effect on AI and analytics, leading to inconsistent regulatory compliance. This disjointed approach increases the likelihood of regulatory breaches and reputational damage due to negative media exposure. Poor data quality can also manifest as a data governance risk to be managed by all three lines.

Cost of ignoring data interconnectedness

Siloed management overlooks the interconnectedness of data security, privacy and quality. Security breaches that result in privacy violations compromise data quality and trust, which in turn undermine AI and analytics integrity. This fragmented oversight escalates regulatory non-compliance and amplifies reputational risks amidst intense media scrutiny.

Operational risks of independent data management silos

Independent risk management silos are ill-equipped to handle situations where system downtime significantly impacts data availability and critically disrupt operations that heavily depend on data. This lack of coordinated oversight can lead to significant operational inefficiencies and customer dissatisfaction, exacerbating reputational damage due to the ensuing negative public sentiment.

Prioritising interconnected data risks: A leadership imperative

PwC’s data risk framework builds in standardisation and transparency, enabling streamlined compliance so FIs can navigate the data risk landscape and make informed decisions with confidence.

Thematic challenges addressed by our data risk framework

Data risk governance as horizontal

We implement strategic data risk governance so you can make informed decisions with clear ROI visibility.

Standardised risk metrics

We streamline data risk assessment so you can efficiently evaluate risks using clear thresholds and comprehensive view on dependencies.

Self-service, tech-enabled

We provide scalable, automated risk monitoring so you can streamline compliance and audits effortlessly.

Accelerated data maturity

We enable transparent data risk monitoring and by-design behaviours so you can accelerate data maturity through strategic oversight.

Benefits for you and the financial services industry

| Individual FIs | Financial services industry |

|---|---|

| Utilise quantifiable metrics to surgically drive adoption and oversight | Standardised, evidence-based set of data risk measurements to set clear best-in-class standard |

| Breaks CXO silos per data risk area and enable enterprise level solution | Holistic tracking of inter-dependent regulations and data risk requirements |

| Proactive risk management with adverse trend analysis before incident management | Standardised supervision criteria to promote a stable and resilient financial landscape |

| Accelerated organisational data maturity for cost efficiency | Accelerated overall data maturity of the industry via tech-enabled processes |

gsap_scrolltrigger

Contact us