Navigate IFRS 18 with ease, turn regulatory change into strategic opportunity

IFRS 18 - Redefining financial performance reporting

Chen Voon Voe

Partner, Capital Markets and Accounting Advisory Services, PwC Singapore

"IFRS 18 transforms how companies convey their performance story.

Standardised categories, mandated subtotals, and disciplined management-defined performance measures (MPMs) disclosures will significantly impact all industries. For successful implementation, it's crucial to assess early the necessary changes to your systems and reporting processes, ensuring a smooth transition."

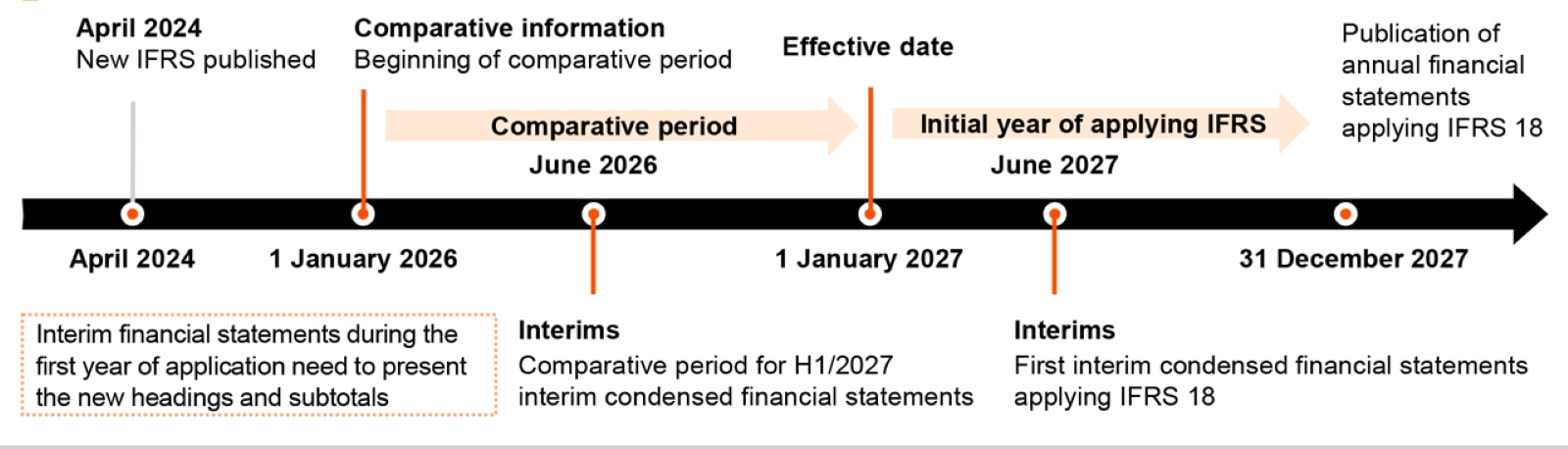

The IASB has issued International Financial Reporting Standards 18 (IFRS 18), Presentation and Disclosure in Financial Statements, introducing new requirements for financial statement presentation, with significant updates to the statement of profit or loss. The standard is effective for annual reporting periods beginning on or after 1 January 2027 and requires full retrospective application. Adoption may involve system and process changes for many entities, so early preparation is essential.

IFRS 18 timeline – comparative period starts from January 2026

In the first year of application, a reconciliation between each line item in the statement profit or loss presented by applying IAS 1 and each line item presented under IFRS 18 for the immediately preceding comparative period. This also applies to interims.

Key changes introduced by IFRS 18

Tay Phaik Sin

Director, Capital Markets and Accounting Advisory Services, PwC Singapore

"By taking charge of the complexities of IFRS 18, you can unlock compliance benefits from the outset.

At PwC Singapore, we combine deep technical expertise and proven implementation methodology so you can experience a smooth transition, maximising the value of compliance."

Areas of vulnerabilities to look out for

Segregation of foreign exchange differences

Segregation of foreign exchange differences

Classification of foreign exchange differences would have to follow the same category as the income and expenses from the items that resulted in the forex differences.

Hedging instruments and derivatives used to manage identified risks

Hedging instruments and derivatives used to manage identified risks

The classification of gains and losses follows the related income and expenses affected by the risks, which may vary depending on the nature of the underlying item.

Reclassification adjustments required for group consolidation

Reclassification adjustments required for group consolidation

Assessment of main business activity at group and subsidiary level may differ, reclassification adjustments are required on consolidation.

Expenses related to financial liability or other liabilities

Expenses related to financial liability or other liabilities

Introduces specific classification rules to distinguish income and expenses from transactions that involve solely raising of finance (i.e. financing liabilities) from those related to other liabilities.

Practical considerations for IFRS 18 implementation

Updating internal processes and controls

- Closing processes and controls

- Level of data disaggregation

Evaluating ERP systems

- Chart of accounts definition and mapping

- Re-evaluate financial master data

Changes to other reporting systems

- Re-configure existing reporting environment to include required changes

Communication

- Impact on financial releases

- Investor communication

- Upskilling of stakeholders

Start navigating IFRS 18 with ease

Looking to stay ahead of the accounting change?

Connect with our experts today to understand how IFRS 18 may impact your entity.

Contact us

Chen Voon Hoe

Partner, Capital Markets and Accounting Advisory Services, PwC Singapore

Tel: +65 9817 0978

Tay Phaik Sin

Director, Capital Markets and Accounting Advisory Services, PwC Singapore

Tel: +65 9755 3510

Wu Di

Senior Manager, Capital Markets and Accounting Advisory Services, PwC Singapore

Tel: +65 9731 6997

Alexie Xie

Senior Manager, Capital Markets and Accounting Advisory Services, PwC Singapore

Tel: +65 9770 7491