Since the 2 April announcement by US President Donald Trump introducing a wide range of punitive tariffs on 9 July, a lot has happened, both in terms of regulatory updates and companies’ responses.

Key things to note from a regulatory perspective:

- All punitive tariffs beyond the 10% baseline have now been postponed, notionally for 90 days. Some may be reintroduced quicker, some may never come back, depending on trade deal beings struck that will benefit the US. The agreement just announced between the US and the UK suggests that the 10% baseline is here to stay for the foreseeable future.

- Tit-for-tat actions between the US and China mean that a significant proportion of merchandise trade between these two territories was no longer economically viable. Specifically, e-commerce B2C trade from China to the US is badly impacted. The current truce between the US and China is welcome but does not remove the uncertainty beyond it.

- Various exemptions on specific goods in both China and the US, even if only temporary, mean that the actually applied average tariff rate is much lower than the newspaper headlines suggest. As a result, some trade has continued unabated.

- A wide range of trade delegations are in discussion with the US Administration about possible trade deals in order to avert the threat of significant tariffs. It is expected that such deals will be narrower and shallower than typical Free Trade Agreements, focusing on reducing the US’s merchandise trade deficits with many of its trading partners. The US – UK agreement supports this expectation.

Key things to note from a business response perspective:

- The rush to get goods into the US before the end of the 'tariff pause' has put serious pressure on manufacturing capacity and shipping availability and cost.

- Although many companies talk about shifting supply chains and investments in the US, for most, these are not actions that are easily or quickly implemented.

- More typically, companies are looking to adjust product pricing as well as reduce US import values to mitigate the immediate pain, while they consider longer terms business strategies.

- The increased focus on country of origin and customs value declarations by the CBP, but also – on the back of pressure from the US – around Asia is leading many companies to reassess the supportability of their claims, be they historic or going forward.

Read on to find out more about the latest developments and what they may mean to you.

Regulatory developments

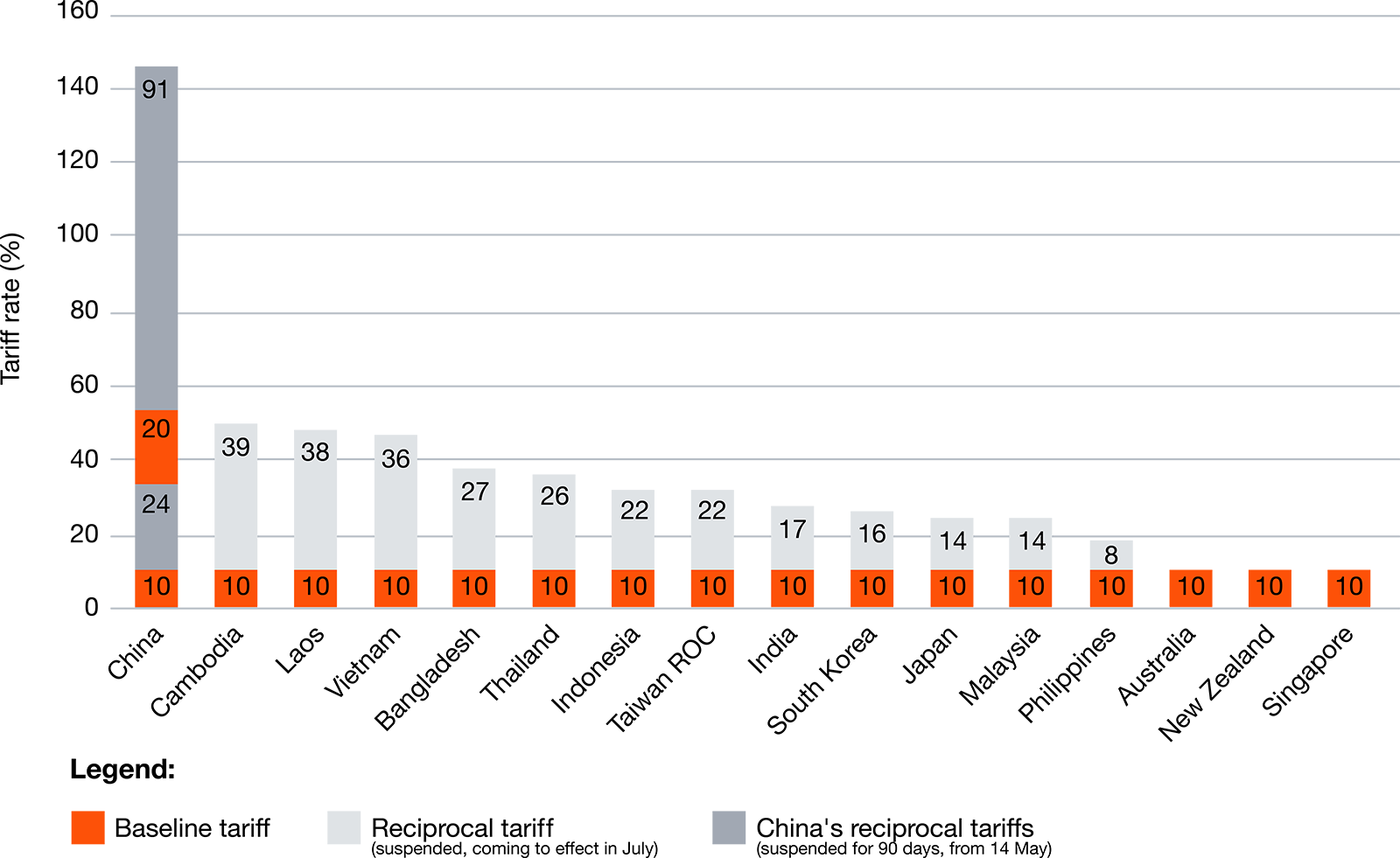

Following President Trump’s announcement of a wide range of significant tariffs on imports of goods from its trading partners under the International Emergency Economic Powers Act (IEEPA) of 1977, a number of other executive orders adjusted those tariffs. Shortly thereafter, retaliatory tariffs were imposed on goods from China in response to China’s retaliation, in a number of steps that lead to a top line additional punitive tariff of 145% in the US and 125% in China.

Many other territories saw a respite for their exports to the US, with President Trump capping the applicable tariffs to a baseline rate of 10% for a 90-day period, likely to end on 9 July, when the originally announced higher 'reciprocal' tariffs would be reintroduced.

The current application of new punitive tariffs therefore looks roughly like this:

* Goods from China were already subject to new punitive tariffs of 20% introduced earlier this year, that remain in effect as well as the baseline 10%. The remaining 24% of the additional reciprocal tariff of 34% and all of the additional 91% in response to China’s retaliation are paused for 90 days from – probably – 14 May.

However, neither the date for nor the reintroduction of those tariffs is a given. Territories that have not reached out to the US to negotiate trade deals may see higher tariffs reintroduced earlier. Territories that manage to negotiate some kind of trade deal with the US may see their rates stay at 10% or at least be lower than the originally announced ones.

Meanwhile, some additional tariffs were introduced on specific industries, such as 25% automotive, steel and aluminum. They may be cumulative or mutually exclusive. For other goods, such as those from the pharmaceutical and semiconductor industries, investigations have commenced under the national security provisions of US law (Section 232) which are likely to lead to significant tariffs on such goods in no less than 270 days. There is an expectation that tariffs on goods from such industries would probably be introduced much earlier. Section 232 tariffs are also expected to remain in place for a long time, rather than be negotiated down.

The de minimis allowance for goods from China was first delayed and then re-introduced and took effect on 2 May, currently at 54% ad valorem import tax or a specific US$100 per item.

Other than China, most territories in Asia have struck a cautious tone and have not threatened or introduced punitive tariffs on goods from the US. Many of them have sent delegations to the US to try to negotiate trade deals to avoid higher punitive tariffs being introduced on their exports. Although it is likely that some, possibly many, such deals will be struck, they are likely to be narrow and shallow. Meaning to say, they will likely only affect a relatively small number of goods and only offer high level generic benefits. They also need to address the US’s core concern of trade deficits, essentially resulting in a need for those territories to commit to buying more US goods. Such commitments will be closely monitored by the US, and any failure to honour them may well lead to the reintroduction of higher tariffs. Any offers of lowering tariffs on imports of US goods will likely be harder to implement and not satisfy US demands.

There is also a risk of the US pressurising countries in Asia to reduce their purchases from China. In response, there is a risk of China introducing measures, whether tariff or otherwise, against territories that give in to such US pressure.

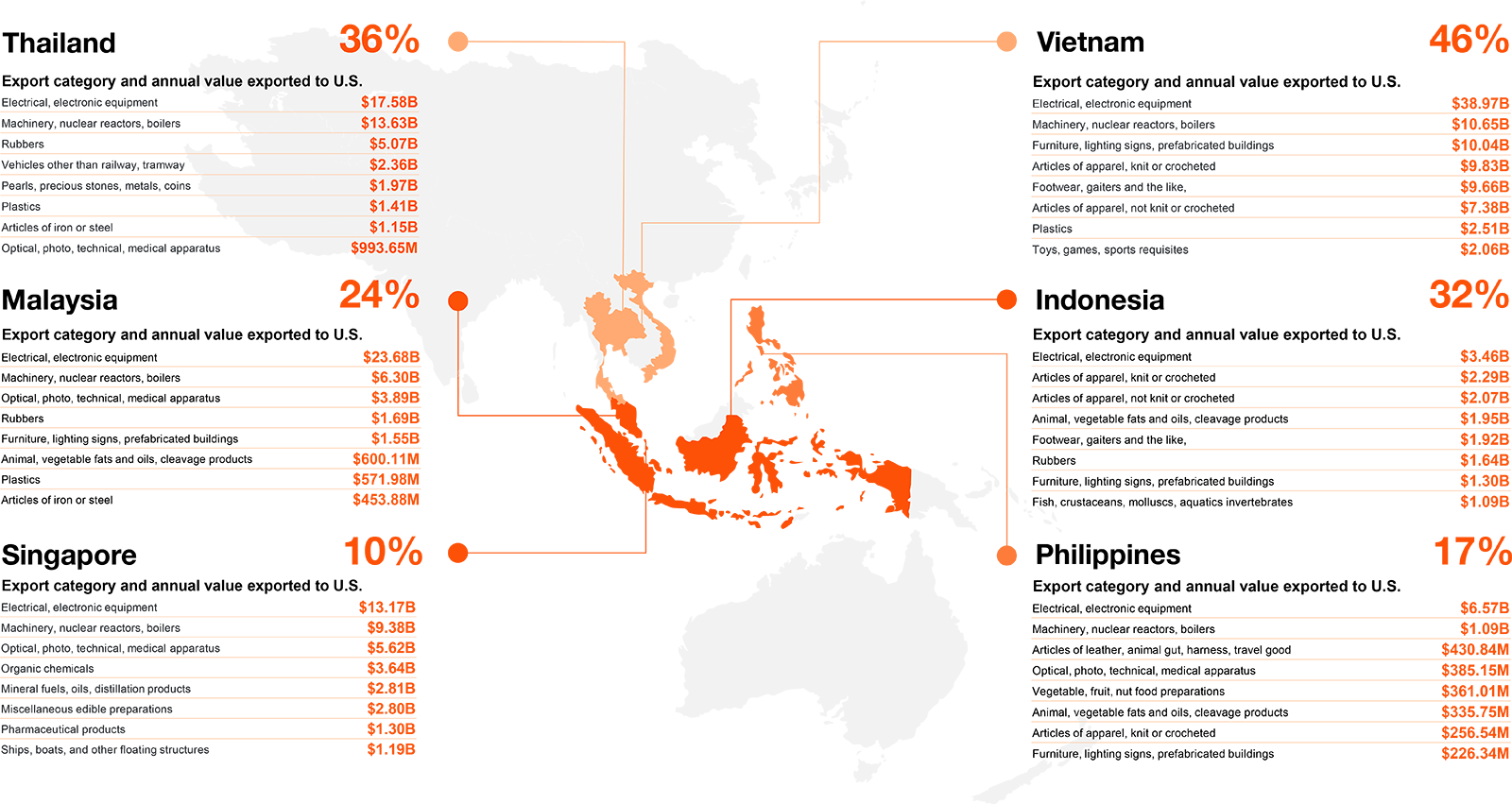

Impact on Singapore and selected ASEAN territories

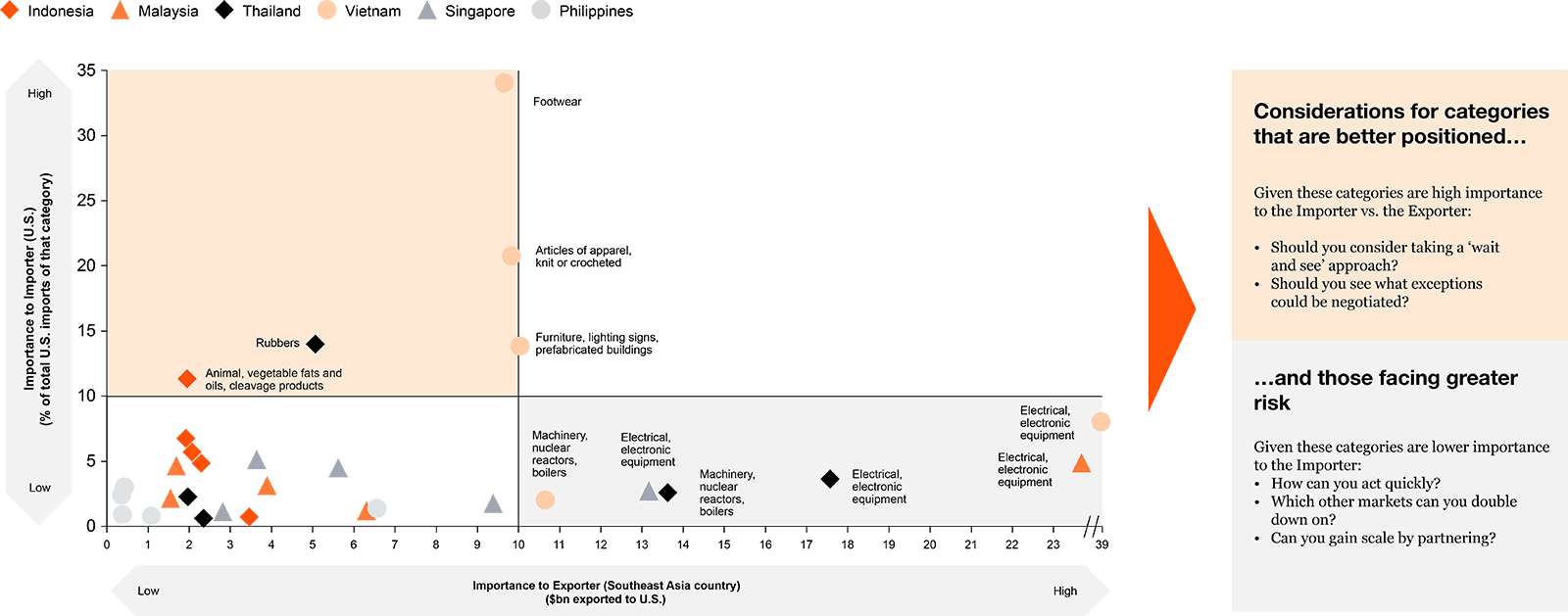

PwC analysis shows that the impact on Singapore and territories around ASEAN will vary widely, as demonstrated in the following charts:

Top 8 most impacted export categories in the 6 largest SEA economies

Relative importance of a category to Exporter (SEA country) vs. the Importer (US)

The trade flows reflected here are only those direct to the US. Clearly, the complexity of current international supply chains means that many other exports, notably to China, will be incorporated into goods destined for the US market. Hence, the total impact will be at a much higher scale. However, the core messages remain the same: impact is widespread, varies enormously, and requires detailed analysis to understand and plan for such uncertainties at a company level.

How are companies responding?

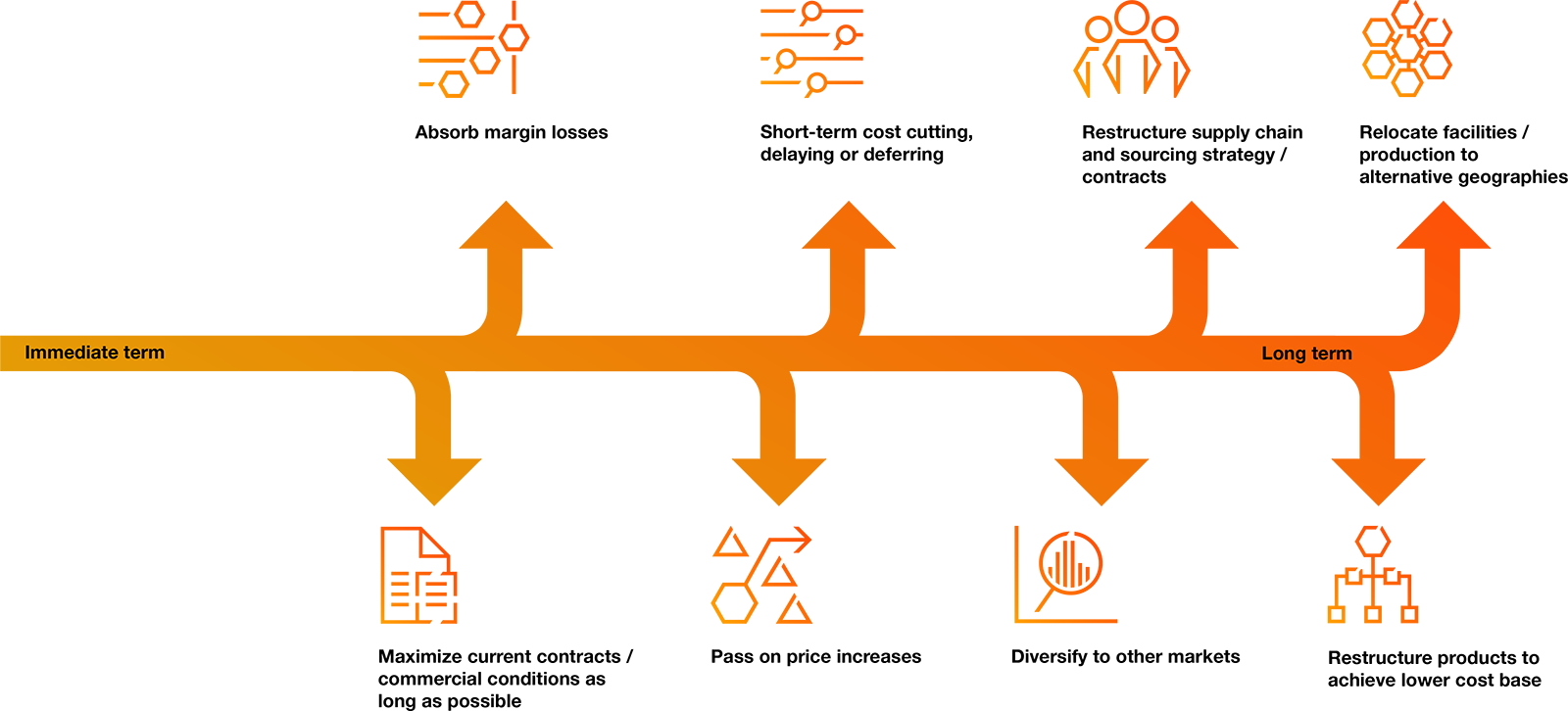

Both the speed and level of change in the regulatory landscape have left many companies reeling. The uncertainty caused some of them to do nothing, on the basis that any tactical or strategic decision they take today may turn out to be a wrong one. However, it may not be the wisest choice. An increasingly costly and fragmented international trade landscape is likely to persist for a long time. We, at PwC, have identified a number of ‘no regrets’ actions that companies can take which are scalable and reversible as the regulatory landscape changes.

Most of those actions are industry-agnostic. Although it is useful to understand the impact of the various tariff measures at a macro-economic level, for many companies, macro-economic statistics are meaningless: they need to understand the impact on their specific business, as well as the options they have to respond. For example, although it is likely that many players in the pharmaceutical industry will face a significant impact, as they paid low if any tariffs in the US in the past, specific companies may have operations and supply chains that are broadly shielded from tariff impacts, or be in a position where they can easily redirect trade flows or diversify suppliers or customers. Other companies may have no such luxury.

We are seeing and helping companies along the following path:

Companies reliant on global sourcing should proactively evaluate the evolving trade environment to mitigate financial and operational risks across the value chain and develop short, medium, and long-term actions. This would necessitate a multi-faceted approach across the supply chain, trade and customs, and tax departments to address not only operational challenges, but also accounting and compliance challenges. Some examples of actions to consider are as follows:

| Short | Medium | Long | |

| Custom | Implement 'no regrets' options

|

Incorporate customs mitigation strategies

|

Incorporate customs considerations in any changes below |

| Tax / Transfer Pricing | Evaluate and adjust transfer pricing | Reform transactional and functional characterisation | Value chain redesign |

| Supply chain / Operations | Conduct US sourcing and manufacturing dependency analysis

|

Evaluate alternative sourcing / country of origin / manufacturing options | Revise supply chain strategy Reevaluate onshoring or nearshoring options

|

| Commercial | Raise prices vs hold prices | Weigh market share capture options | Re-balance or Re-engineer complete business model |

More specifically, we would advocate companies not to waste the 90-day respite and focus immediately on the following:

| What should you do today? | How will this help? |

| Obtain your trade data, map your trade flows in detail and scenario-plan various regulatory landscapes |

|

| Strengthen your trade compliance |

|

| Review and optimise your pricing strategies to be in line with your tariff strategies |

|

Obviously, the pace and level of change in the trade and tariff landscape has been dramatic and unsettling. Nevertheless, we have seen many options and even opportunities for companies to use this disruption to strengthen their compliance, de-risk their supply chains and start planning for future efficiencies and growth.

For a more in-depth discussion on the above specific to your business, please do not hesitate to contact us.

Contact us