Download the publication

We have observed a significant shift towards self-employment in Singapore as well as around the world. The growth of digital platforms, notably fuelled by the COVID-19 pandemic, has increased the ubiquity of independent workers seeking flexible, on-demand employment. This is evident in the domains of ride-hailing, food delivery, e-commerce and logistics. As on-demand employment becomes increasingly prevalent, we have observed an egregious increase in the challenges and limitations faced by a particular self-employed segment – the platform workers.

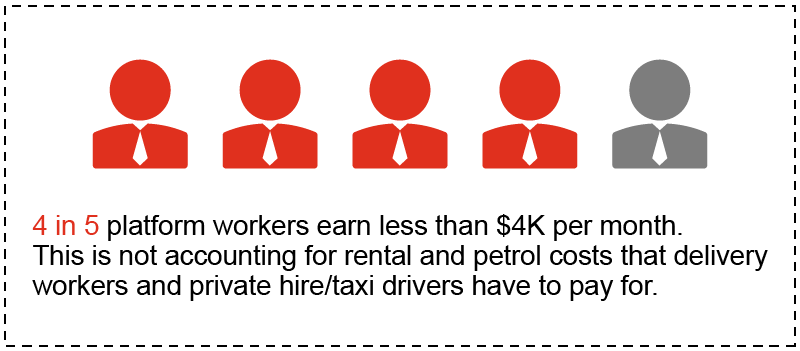

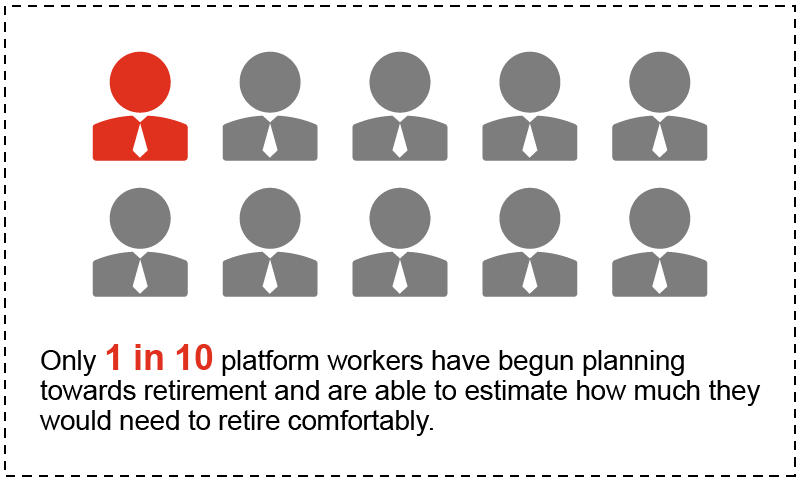

Despite their invaluable contributions to Singapore's economy, self-employed persons find themselves in a unique financial position, distinct from their salaried counterparts. Unlike traditional employees, these individuals are solely responsible for topping up their Medisave accounts and do not receive Central Provident Fund (CPF) contributions. This particular circumstance raises substantial concerns, as it often translates to a shortfall in retirement savings and an inadequate CPF payout, leaving many self-employed individuals with an uncertain financial future, ill-equipped to sustain themselves during their later years.

Key trends affecting platform work

The changing landscape of work has led to a significant rise in the gig economy, a trend that is expected to continue growing in the coming years.

Barring infant deaths, road accidents, air pollution-related fatalities, cardiovascular or chronic respiratory diseases, and those linked to unsafe water or inadequate hygiene practices, Singapore has one of the world’s lowest mortality rates.

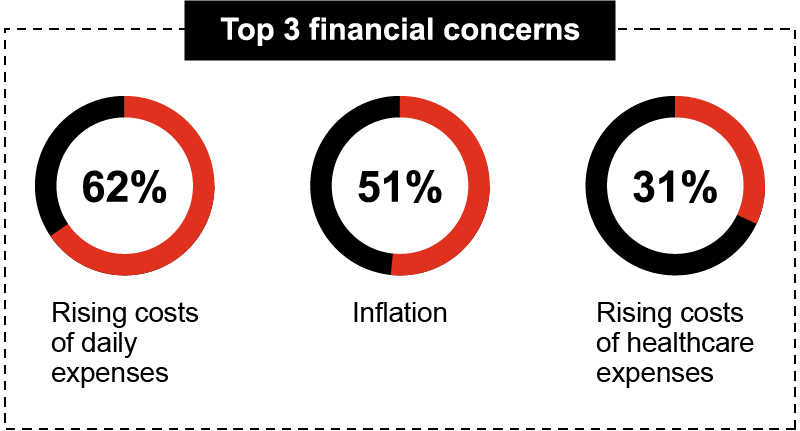

While Singapore has long been coveted for its quality of life and employment opportunities, the cost of living in Singapore remains high, claiming the top position as one of the most expensive places to reside in.

The impact of global inflation reverberates across the country, resulting in surging prices for essential commodities such as real estate, petrol, gas, electricity and food.

Singapore's real estate and rental market is experiencing an unprecedented upsurge, defying the global slump despite government measures to curb it.

Financial empowerment and protection

Conclusion

This publication will share more insights on the growth of platform industry and find out more about what we have learnt from the recommendations and proposed changes by the Advisory Committee, developments of platform workers in the region and the potential options of financial wellbeing and protection benefits for the ever-growing population of platform workers. It also provides insights and views from the platform companies on the implementation of these changes.

Download the full publication

Financial freedom for platform workers and the self-employed

Survey methodology

The Financial Freedom Index is a study commissioned by Singlife, with the objective of understanding the current perception of financial freedom amongst individuals in Singapore and was conducted online from December 2022 to January 2023. Apart from the initial study, Singlife conducted a separate quantitative survey with 500 Singaporean and Permanent resident (PR) platform workers, the Financial Freedom Index for platform workers.

This independent survey, targeted at the platform workers, aimed to gain insights into their motivations for remaining in this industry, the challenges they confront, and the effects on financial independence. Singlife then drew comparisons against the results of the Financial Freedom Index study to compare the perception of financial freedom of the platform workers against the general Singapore population.

Additionally, qualitative interviews with nine platform companies were conducted to capture their perspectives on the proposed recommendations regarding work-related injury compensation and increased CPF contributions.