10 years of crisis

Smaller but unreformed corporate economy

In 2018, Greece officially exited the longest and deepest crisis that has been recorded in the Western world. Eight years of constant drop of economic activity, one could imagine that the productive tissue of the country has been destroyed.

(PDF, 1,4mb)

The crisis left its marks on Greece

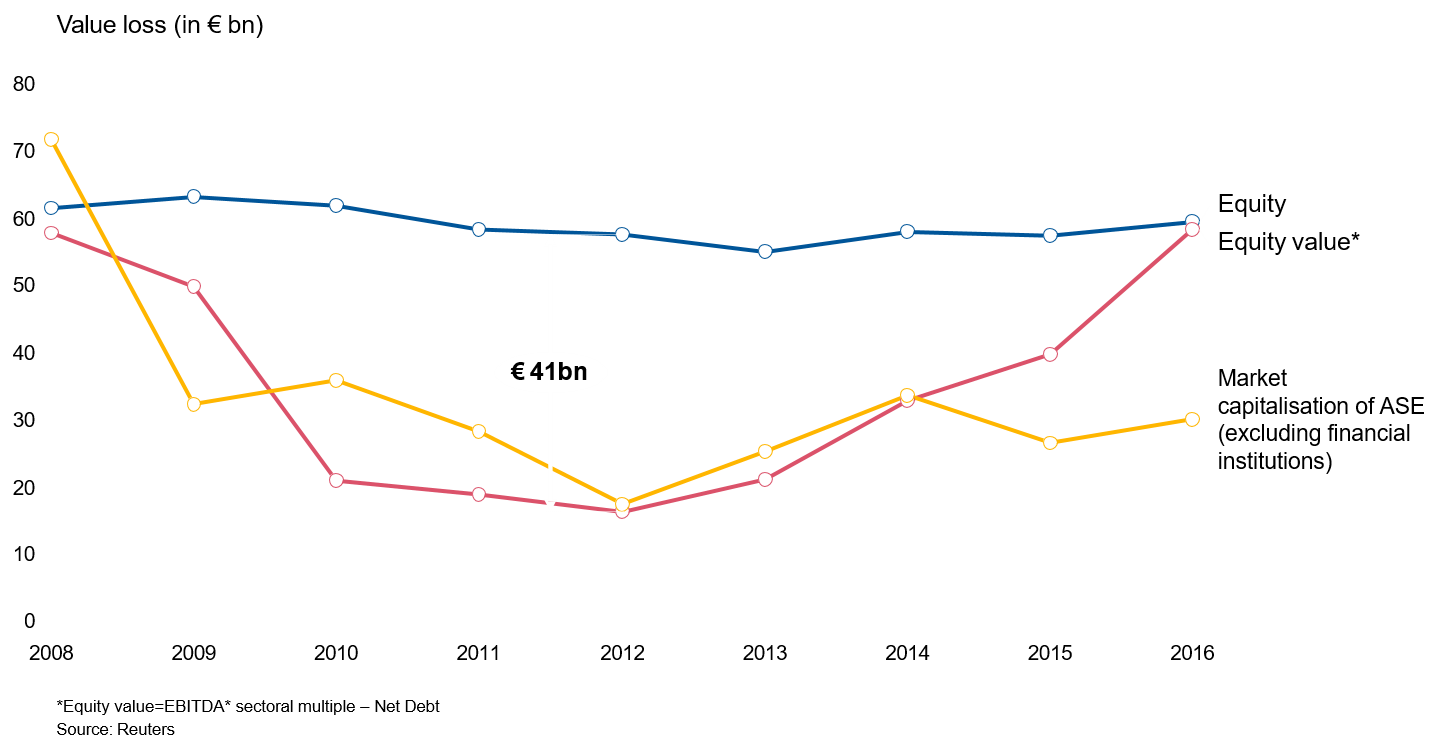

There was a huge value loss in the corporate economy, as company valuations recorded a 72% decline, but after 2012 equity values have recovered.

Few things changed in the structure of the economy as a result of the crisis. Even though the top companies in all sectors shrank in size, most of them remained in the same position while there were no new market share contenders.

The impact of the crisis on firms

What has really happened?

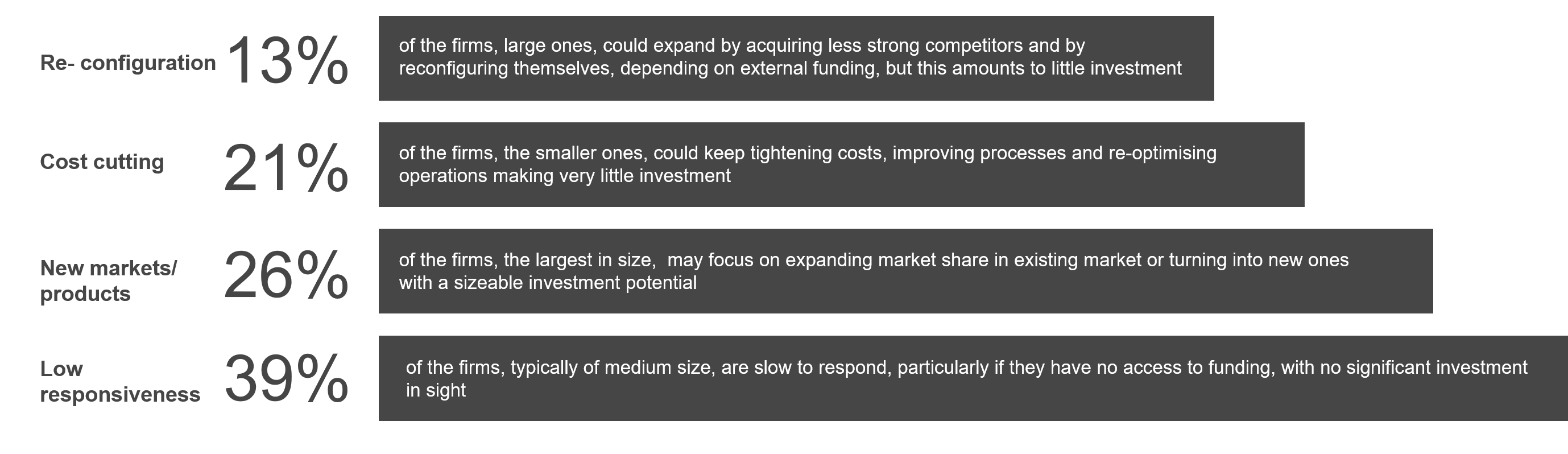

The economy did not transform as a result of the economic shock. Instead, it mostly retained its structure, resisted change, drained from investment, its technological base weakened and lost value added

To set in motion and fund growth, corporates need to identify projects with returns in excess of the long term cost of equity

3 broad policies must be implemented simultaneously aiming at reinstituting conditions

- The corporate landscape must be cleared of Zombies at a fast pace. At the same time, the banking system must be cleared from NPLs, which absorb regulatory capital, so as to resume lending to the economy

- A well orchestrated trust building effort with a clear and convincing plan for the future has to be initiated in order to reduce sovereign risk and attract international strategic investors

As a result of investment, the economy will be rebalanced to higher value added services and products and expand into new markets. Coherent sectoral public policies promoting size, concessionary funding towards last stage R&D, demand and supply aggregation and clustering are necessary in facilitating this shift

Download Full report (Greek version)

Further languages:

Other documents:

Contact us

Director, Internal Firm Services, Marketing & Communications, Athens, PwC Greece