2024 was another landmark year for the Greek economy

Despite international challenges, the economy demonstrated resilience, recording double the growth rate compared to the eurozone. The Athens Stock Exchange reported profits for the 4th consecutive year, with a 13.7% annual increase in the General Index.

.jpg)

PwC #1 financial advisor in Greece for the third consecutive year

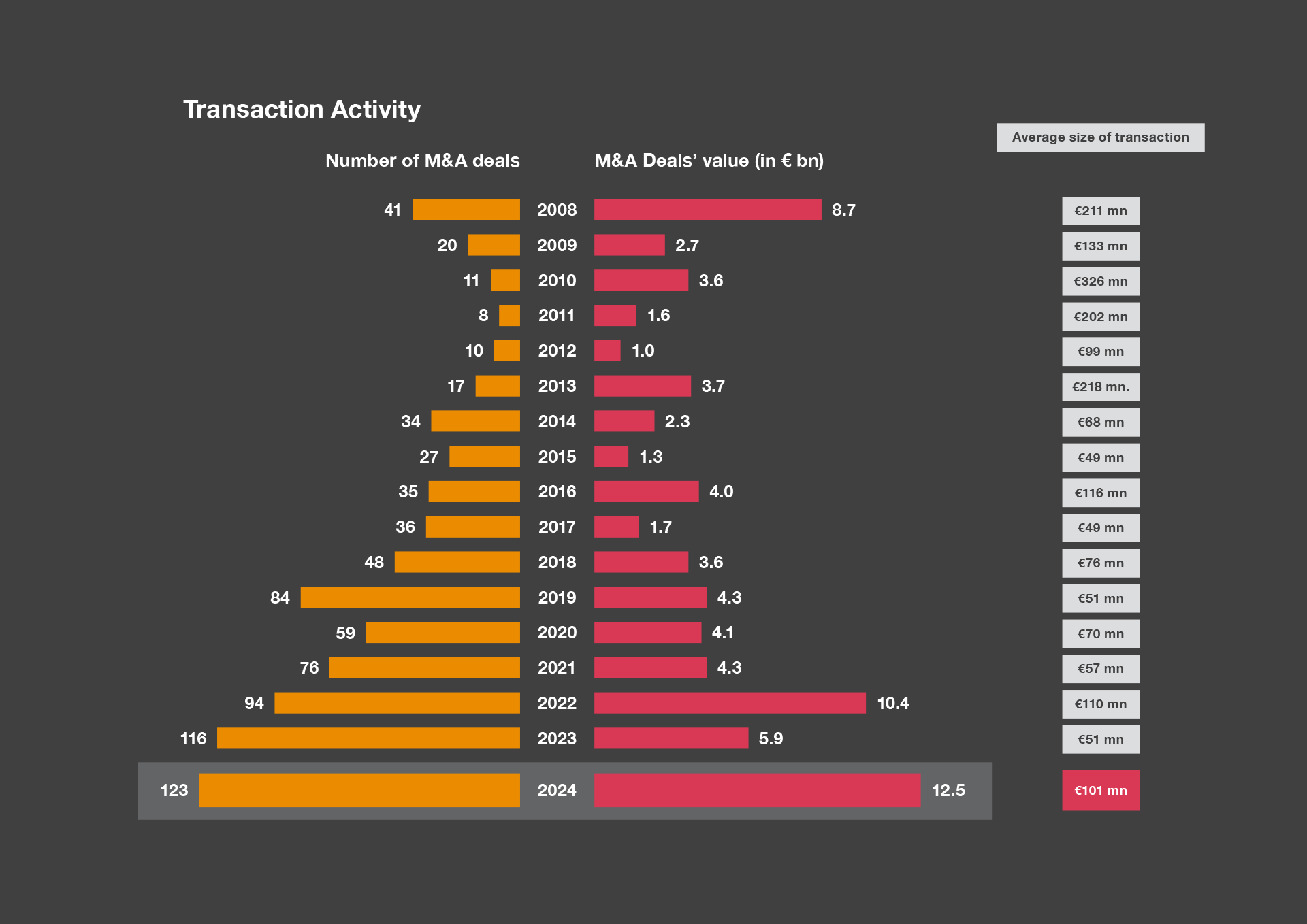

M&A transactions in 2024 increased both in number and value

The total value of transactions doubled compared to 2023 reaching €12.5 bn for the first time.

M&A deals* in 2024

Deal value

* Including Minority Holdings

The following sectors stood out:

Energy & Renewables: In 2024, the value of transactions in the Renewable Energy sector reached a historic high, further strengthening the market.

Financial Services: The privatization of Greek banks and the gradual exit of the HFSF mark a new era for the banking sector.

Telecom, Media & Technology (TMT): In 2024, Technology led the way in TMT sector transactions, as major players strengthened their positions through the acquisition of smaller companies.

Shipping: The increase in regulatory requirements drives a new wave of M&A deals in the shipping sector, involving transactions between shipping companies, not just the sale of ships.

Private Equity: 13.7% of the total transaction value for the year was driven by Private Equity companies.

In 2024, privatisations hit a historic record

of €6 bn, driven by key transactions such as the IPO of Athens International Airport (€785 mn), the concession of Attiki Odos (€3.3 bn), and two private placements in Piraeus Bank and National Bank of Greece (€1.3 bn & €691 mn respectively).