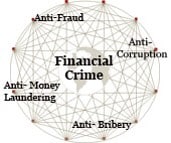

Financial Crimes Compliance

Financial Crimes Compliance is the classics of Financial Crimes Advisory. The financial services industry continues to face significant scrutiny from global regulators over AML, Sanctions and Fraud processes, systems and controls. We have created multiple service offerings which cover all main needs of financial institutions in this sphere.

Target Operating Models

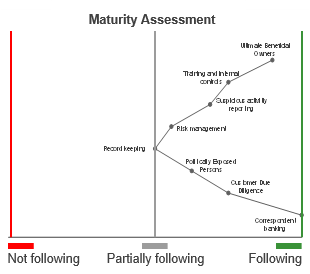

Maturity Assessment

Financial Crime Due Diligence

Program Compliance Assessment

Risk Assessment

Financial Crimes Technology

Financial Crimes Technology practice is aimed at advising the clients on the range of technology related topics appearing in the Financial Crime space. We start from vendor selection processes to providing clients with high-end PwC proprietary applications and process accelerators. Our service offering consists of the following categories:

Vendor Selection

Effectiveness Assessment

Business Technology

Financial Crime applications and process accelerators

Financial Crime Analytics

Financial Crime Analytics utilizes the latest technology and industry leading experts in the areas which are not yet well established in Financial Crime space. We provide services in the following cutting-edge scientific and technological spheres:

Applications

- AML Transaction Monitoring Optimization

- Sanctions testing

- PwC Automated on-boarding solution

- Fraud and Corruption Risk Assessment

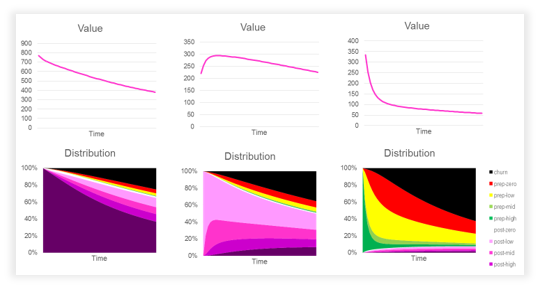

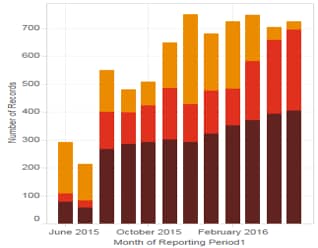

AML Transaction Monitoring Optimization

Advanced analytics solution to improve performance of AML transaction monitoring system. Improved analytics results in:

- Reducing overlaps between scenarios

- Capturing of all cases resulting in SAR

- Generating reasonable amount of alerts

that can be investigated - Improving precisions of predictions

- Maintaining transparency and comprehensiveness of methods and outcomes

- Utilizing expert knowledge and allowing manual inputs

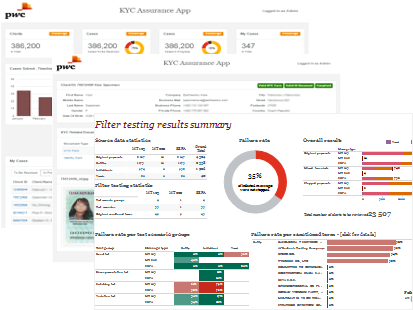

Sanctions testing

Do you trust your sanctions filter?

Focusing on your specifics and determining the most suitable testing approach, we tailor our testing approach to address your needs.

Using our proprietary application we will:

- create files to test agreed scenarios

- upload them to your screening engine to test the performance of your filters

- provide you with a comprehensive and independent interpretation of the results

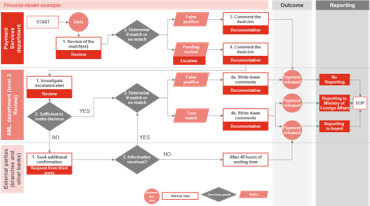

PwC Automated on-boarding solution

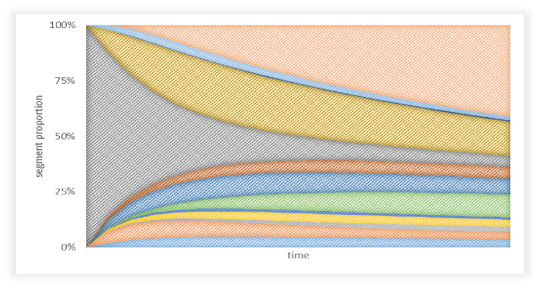

Where artificial intelligence (AI) meets robotics…

On-boarding processes consist of various steps but few banks unleash the true power of modern technologies for automation, robotics and artificial intelligence, which are available and already used by other industries.

PwC’s revolutionary automated on boarding solution utilising these measures and delivers an advanced easy to use platform to support business for this crucial process.

The secret in our solution is how we tackle this problem all together. We take unstructured problems and seek to structure this problem using deep learning and artificial intelligence techniques. We then use robotics to move from structure to automation. Once we get to this point, we apply intelligence / self-learning business logic and an easy to use platform to help make informed decisions when an alert is generated.

We designed a framework which manages the whole process and addresses these challenges.

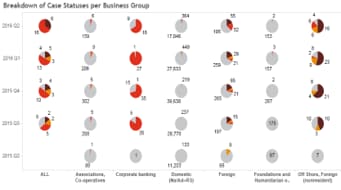

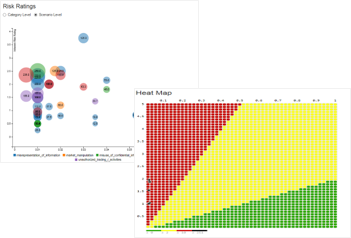

Fraud and Corruption Risk Assessment

PwC Methodology and App

Our recommended approach to fraud and corruption risk assessments involves focusing on how perpetrators can potentially leverage or exploit vulnerabilities across a organization’s value chain. This approach allows focus on the areas that introduce greatest vulnerability and risk and allows for development of targeted treatment plan. PwC is using a proprietary application which combines the qualitative and the quantitative approach to assessing the risks and building the remediation plan:

- Identify the inherent risks - By identifying the human components in an organisations‘ value chain we identify vulnerabilities to corruption risk.

- Controls Assessment - Based on the identified vulnerabilities we then assess the risks and their related controls.

- Measure the Residual Risk Levels - We then prioritize the areas within the organization that have the greatest vulnerability and exposure to risk

- Perform a Quantitative Assessment - The prioritized areas are then examined at a more granular level using a combination of data analytics, process reviews, executive interviews.

- Build a Remediation plan - We then develop improvement plans and importantly identify the relevant KPIs for on-going monitoring.