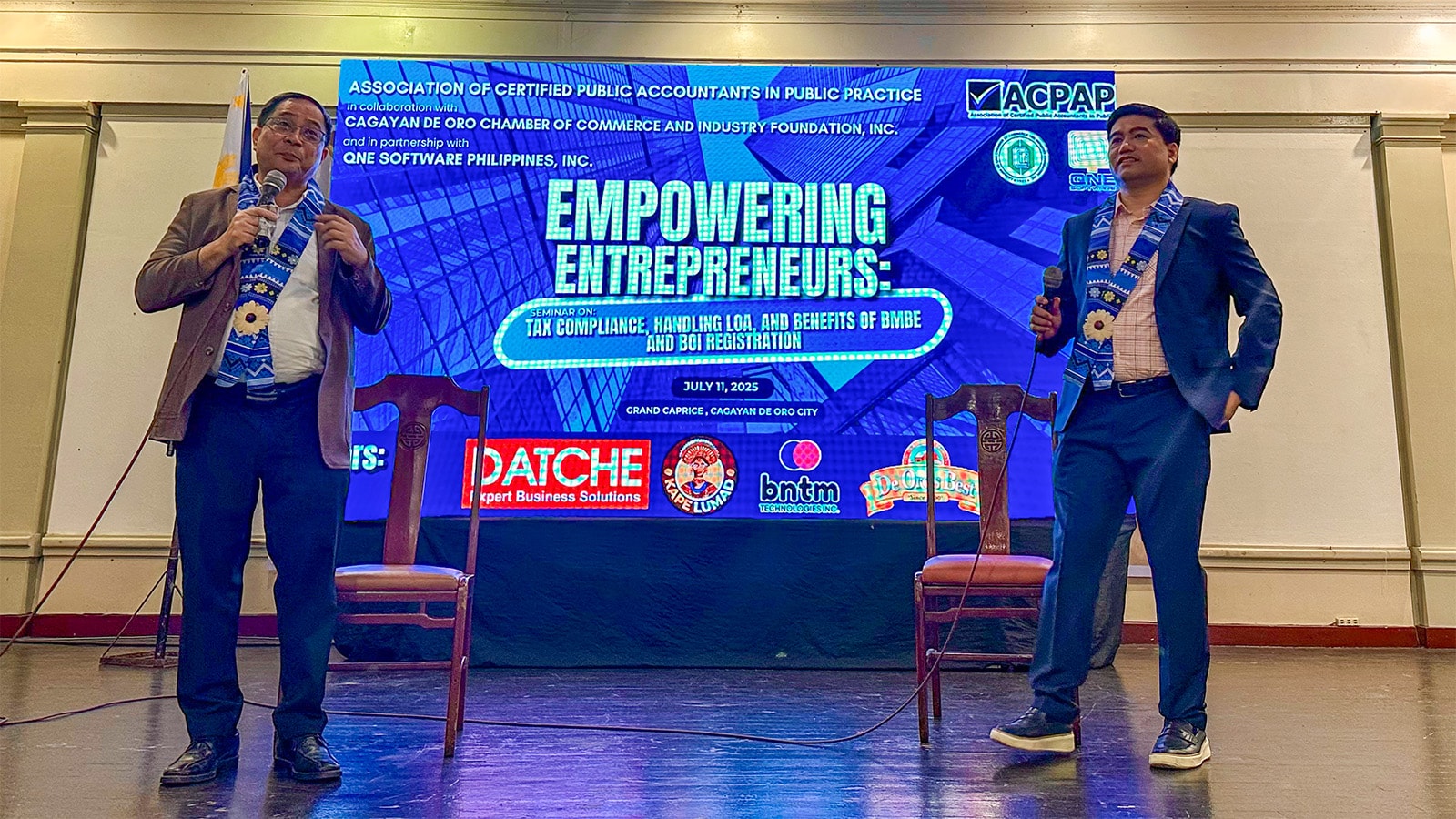

Isla Lipana & Co./PwC Philippines Tax Partner Nelson Soriano served as a resource speaker at a seminar titled “Empowering Entrepreneurs: Tax Compliance and Handling LOA.” Held on 11 July 2025 at the Grand Caprice Restaurant in Cagayan de Oro City, the event was organized by the Association of Certified Public Accountants in Public Practice (ACPAPP) in collaboration with the Cagayan de Oro Chamber of Commerce Industry Foundation.

The seminar gathered entrepreneurs, accountants and industry professionals, equipping them with the necessary knowledge and skills to navigate the tax compliance landscape. The discussion specifically focused on how to handle Letters of Authority (LOA) issued by the Bureau of Internal Revenue (BIR).

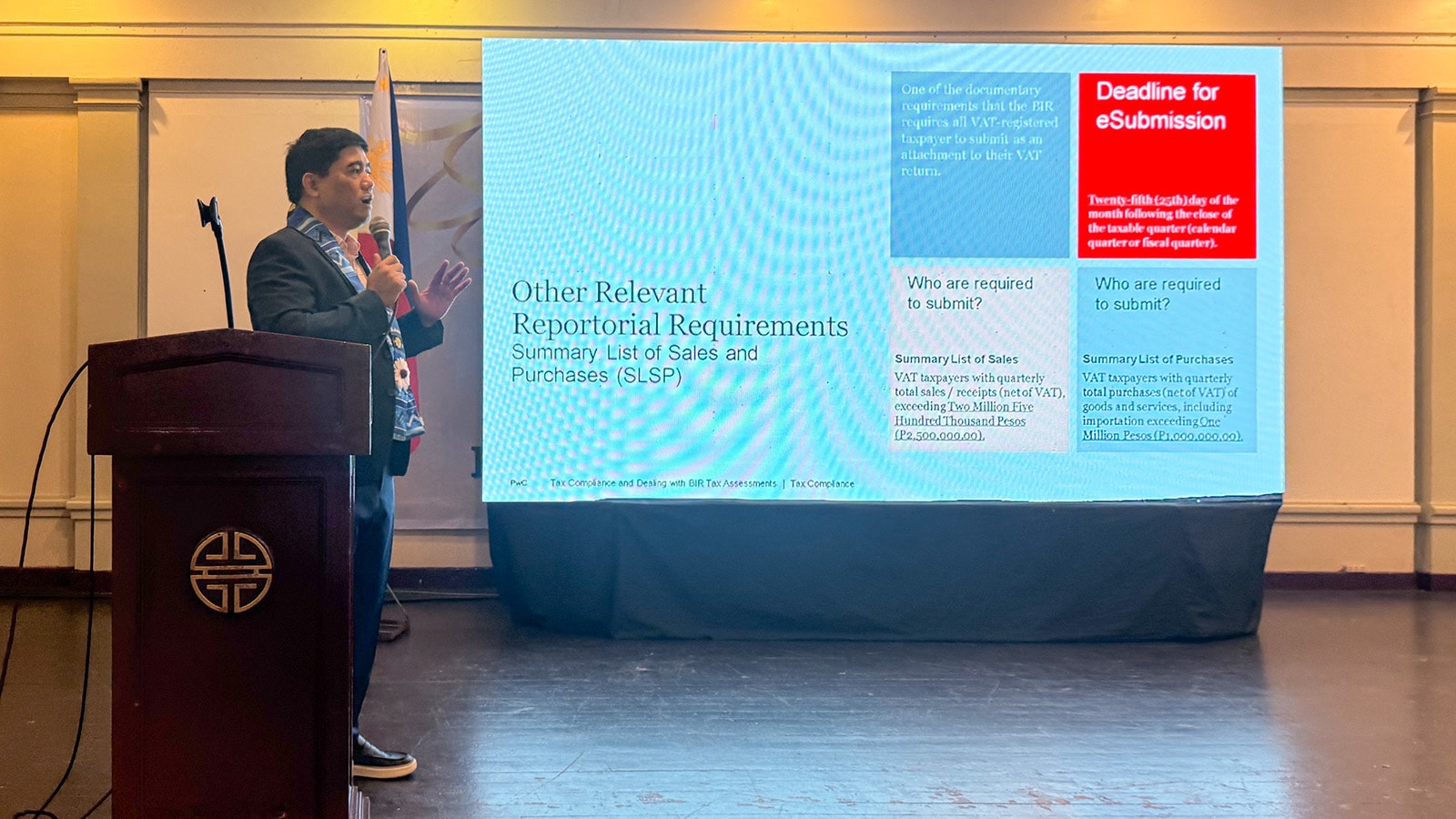

Nelson delved into the different aspects of tax compliance, emphasizing the importance of proper documentation and accurate financial records. He encouraged businesses to regularly review and assess their tax positions to ensure they are aligned with current regulations. He also urged the participants to stay informed about the latest tax rules, which will enable them to make educated decisions on tax risks and remain compliant with tax obligations.

Nelson also described how to handle LOA effectively. He explained the scope and limitations of this document as well as the complexities in the BIR assessment process, advising the participants to seek professional guidance if necessary. Nelson underscored the importance of timely and transparent communication with BIR examiners to resolve discrepancies and demonstrate efforts to comply with tax regulations.

The seminar provided entrepreneurs with an invaluable platform for networking and knowledge-sharing. After the seminar, Nelson engaged with the participants, who expressed their appreciation for his insights and guidance.

This event affirms Isla Lipana & Co.’s commitment to empowering businesses through thought leadership and professional engagement.

Contact us