Mine 2021

Great expectations, seizing tomorrow

This year’s Top 40

The Top 40 mining companies have come out of the storms of 2020 in excellent financial shape.

Mining is one of the few industries that emerged from the worst of the COVID-19 pandemic economic crisis in excellent financial and operational shape. In fact, 2020 was a banner year for the mining sector.

And things are expected to get even better for the world’s biggest mining companies.

The Top 40 mining companies have never been in a stronger financial position to make a big, bold pivot towards the future. And the future is already visible today: the world is in the midst of an era-defining transition to a low-carbon, sustainable economy.

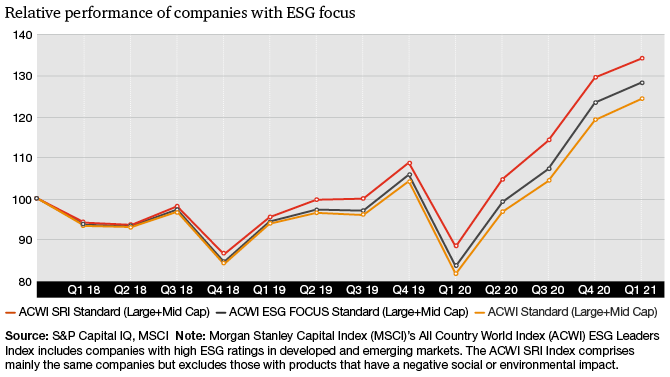

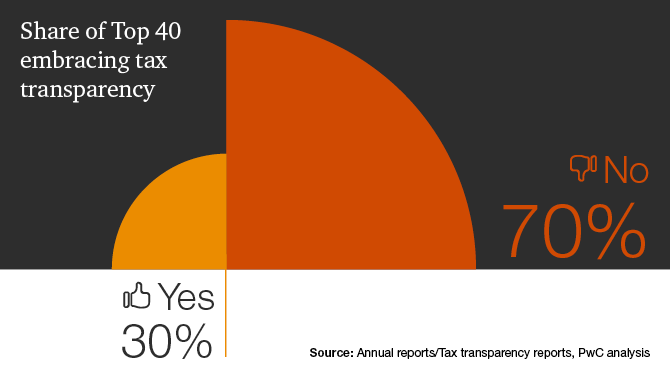

Making environmental, social and governance (ESG) issues the core of organisational strategy gives big miners a compelling path to build trust, grow and produce sustained outcomes.

Resourcing a more sustainable future

The challenges of COVID—and the new normal manifested by uncertainty about infection rates in different parts of the world—and environmental sustainability have created a volatile landscape that presents an opportunity for genuine, transformational change in the mining industry. Thanks to their excellent financial position, the Top 40 are better placed than most companies in other fields to pivot towards long-term value and growth. Now is the time for miners to make their move.