What is a triangular transaction?

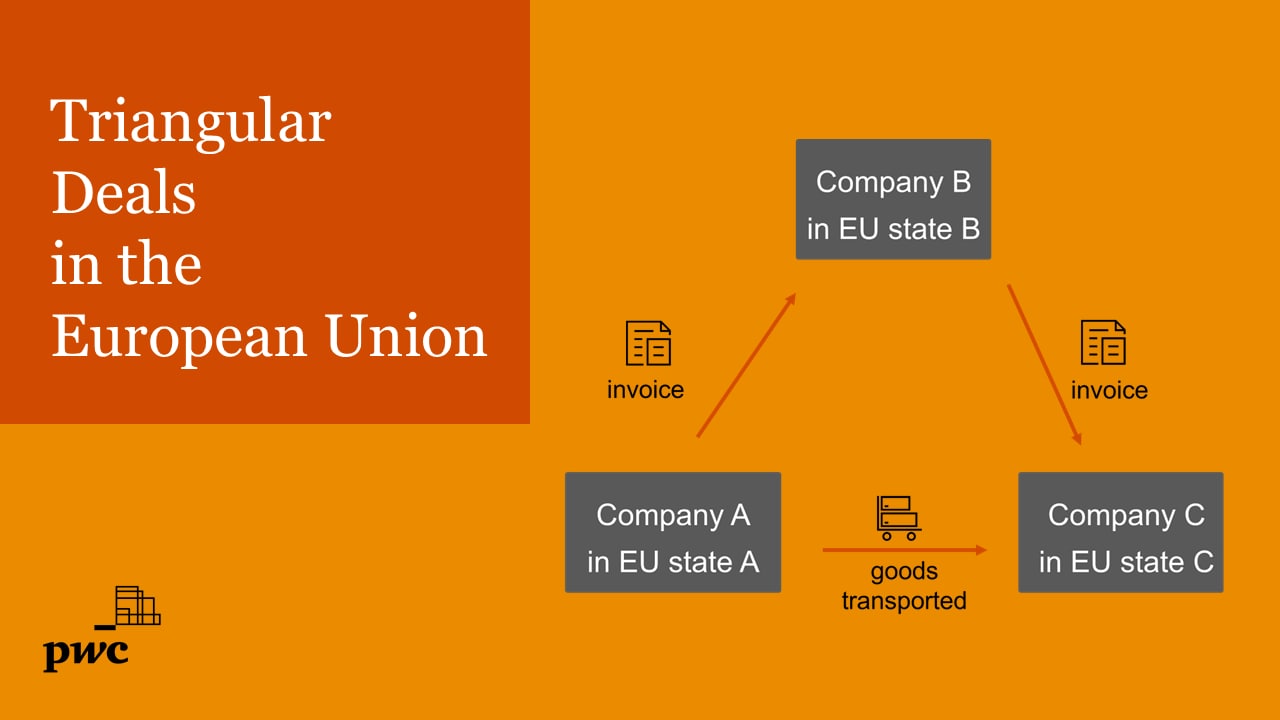

A triangular transaction is a simplification rule in the European Union's VAT system for the taxation of trade between three different VAT-registered businesses in different member states. The purpose of such a transaction is to exclude the intermediary from VAT obligations in the destination member state. In a triangular transaction, there are three parties involved:

1. First business (A) - the seller, who is located in the first member state and sells goods to the second business (B).

2. Second business (B) - the intermediary, who is located in the second member state and buys goods from the first business (A) but sells them to the third business (C). The intermediary should not have a place of business or VAT registration in the destination member state.

3. Third business (C) - the final buyer, who is located in the third member state and to whom the goods are delivered directly from the first member state.

In a triangular transaction, the goods move directly from the first member state to the third, and the transport of the goods must be arranged either by the seller or the intermediary. The following VAT accounting aspects are important for this transaction:

- The purchase and sale of the goods should occur in the same period, as the goods are delivered directly from the first member state to the third.

- The intermediary sells the same goods that they purchased.

- The invoices must include the VAT numbers of the parties involved.

- An Estonian VAT-registered seller must add a reference to either § 15(3)(2) of the VAT Act or Article 138 of the VAT Directive on the invoice. The sale is declared in the boxes 3, 3.1, and 3.1.1 of the VAT return and the VD report must also be completed.

- An Estonian VAT-registered intermediary must add a reference to the final buyer's reverse charge on the sales invoice. The Estonian intermediary does not reflect the acquisition and intra-community supply in the VAT return but completes column 4 (triangular transaction) in the VD report.

- An Estonian VAT-registered final buyer declares the acquisition in the boxes 1, 4, and 5 (if the purchased goods are eligible for input VAT deduction) of the VAT return, as well as in the informative box 7.

For additional questions you are welcome to contact specialists for VAT compliance services who are happy to provide advice.

Contact us