Almost a third (28%) of Caribbean CEOs believe their company won’t be viable for more than 10 years if it continues on its current path. This stark data echoes the findings of the last Caribbean CEO Survey, where the urgency to reinvent for the future was clear. But where do we stand now?

Some CEOs are seizing the moment, rapidly capturing growth and value-creation opportunities that are a part of the defining forces of our time. They’re investing in generative AI, addressing the challenges and opportunities of climate change, and reinventing their operations and business models to deliver value in new ways. However, many others are lagging, held back by leadership mindsets and processes that feed inertia.

This latter group has two options: either accelerate their reinvention efforts or bet on hope—hope that, with just a few tweaks, today’s operating and business models will continue to deliver results even as AI and the transition to a low-carbon economy set value in motion across economies. The message is clear: Tomorrow starts now.

Two defining issues: AI and Climate change

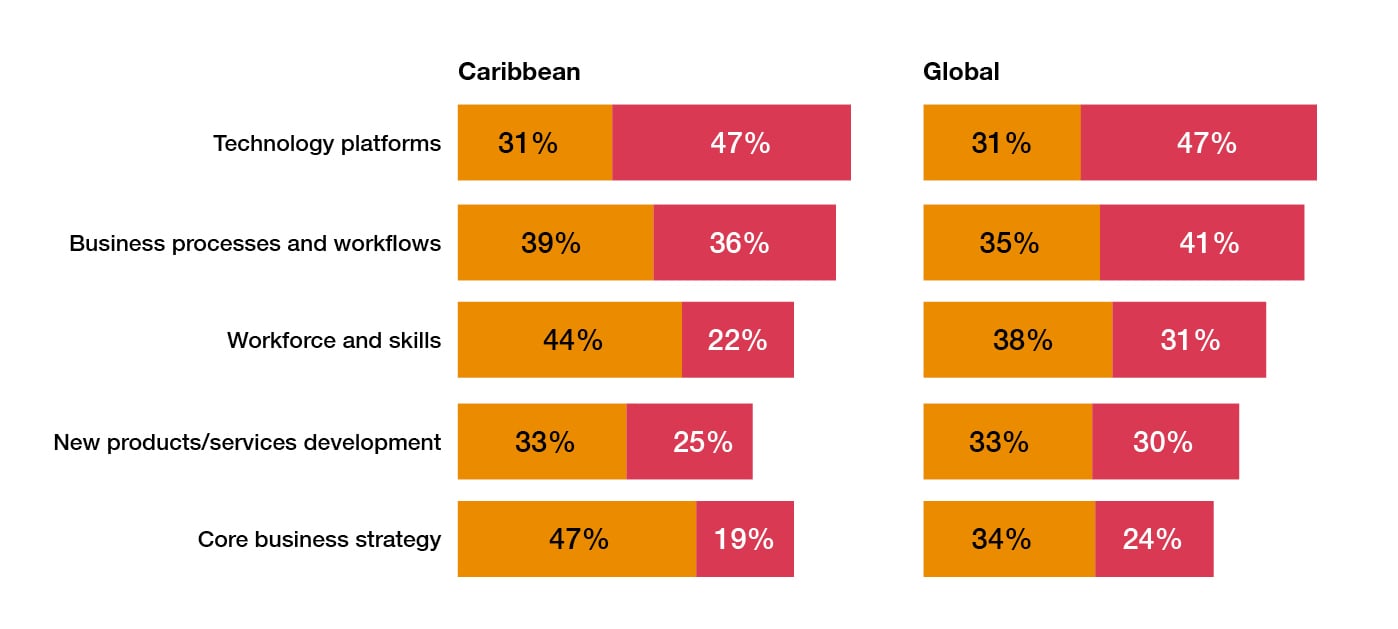

Almost half of Caribbean CEOs report plans to integrate AI into tech platforms, and over one third into business processes and workflows to a large extent in the next 3 years. These results are similar to CEOs in the rest of the world, though adoption is understandably slower with many Caribbean CEOs reporting that adoption will be integrated to a moderate extent. Encouragingly, almost half (47%) responded ‘to a moderate extent’ for integrating AI into their core business strategy, positioning them to seize potential opportunities and be ready for the inevitable disruption. When added to a further 19% who responded ‘to a large/very large extent’ that’s almost 70%. This could be a result of those CEOs already seeing the benefits of AI in their current adoption. Similarly, 22% of CEOs are planning to integrate AI into workforce and skills strategy ‘to a large/very large extent’. ‘To a moderate extent’ responses are higher (44%) indicating a more cautious approach but still reasonable given AI adoption rates. The integration of AI into the workforce is important given the potential of GenAI will depend on employees knowing when and how to use AI tools in their work - and understanding the potential pitfalls.

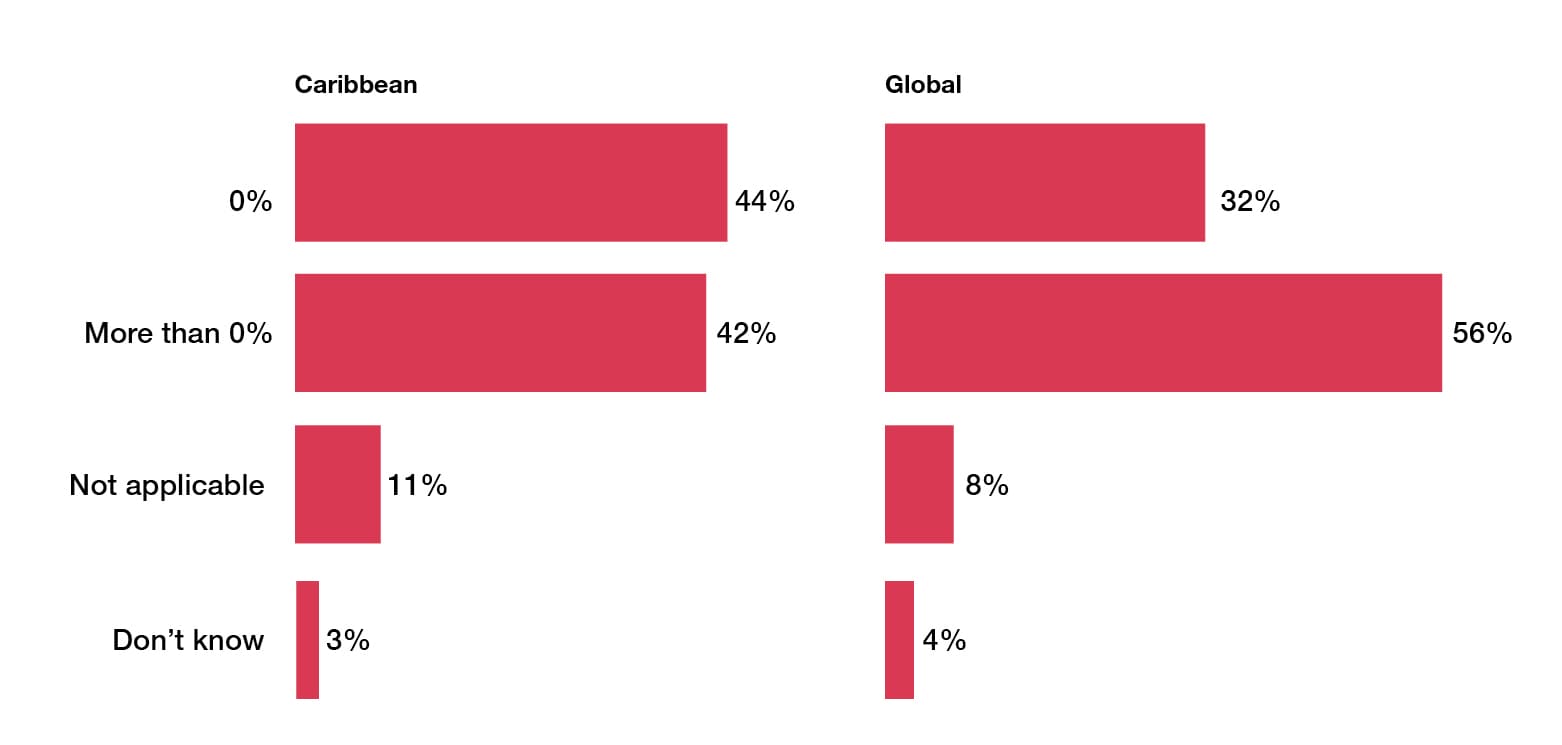

Almost half of Caribbean CEOs (42%) said their personal incentive compensation was linked in some measure to sustainability metrics. The higher the percentage of CEO compensation at stake, the more revenue is likely to be coming from climate-friendly investments. Although there may be initial expenditure, CEOs will hopefully start to see faster revenue growth as they transition their businesses toward climate solutions so we expect this percentage to increase. The recent Caribbean Corporate Governance Pulse Survey 2024: Turning words into actions provides a further lens on the need to build sustainable goals into executive compensation. It mirrors the views of our Caribbean CEOs demonstrating businesses are heading in the right direction.

Business (un)usual

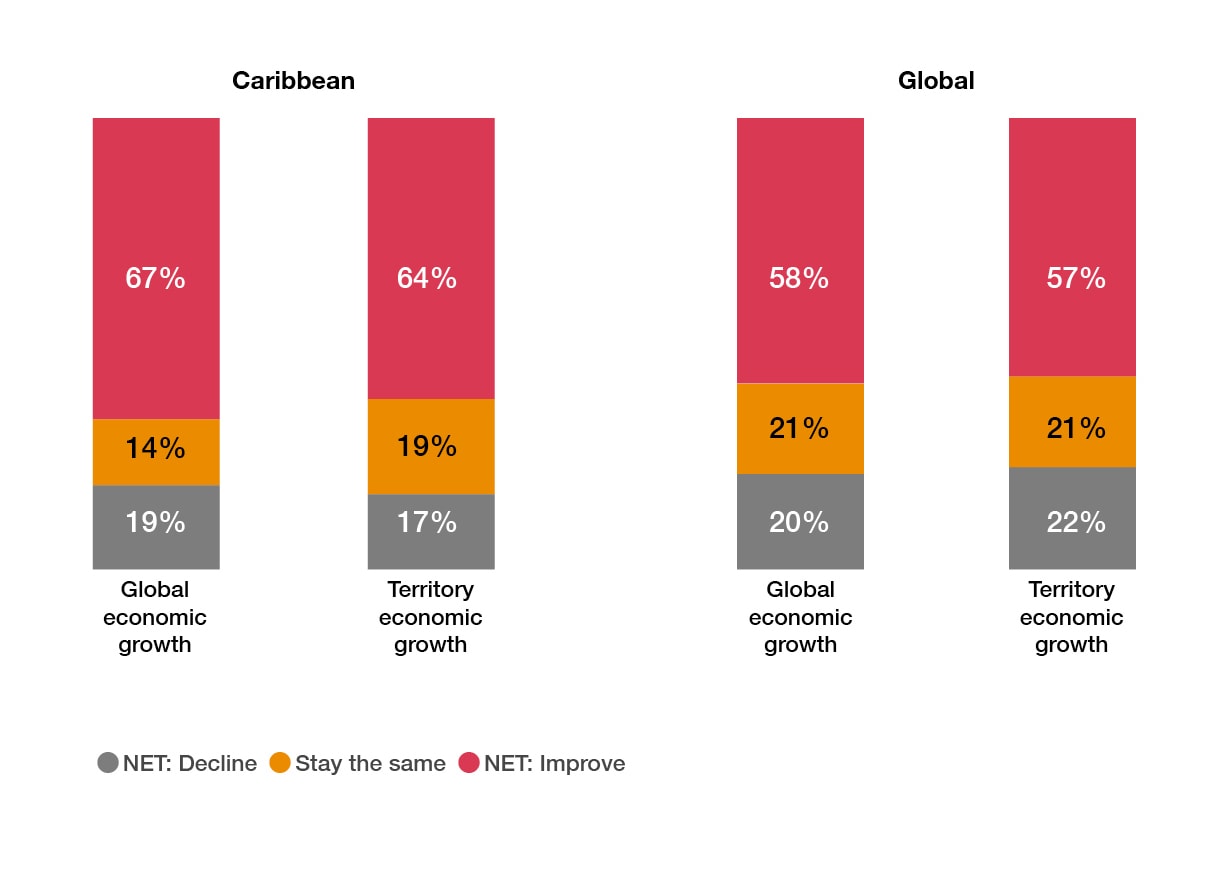

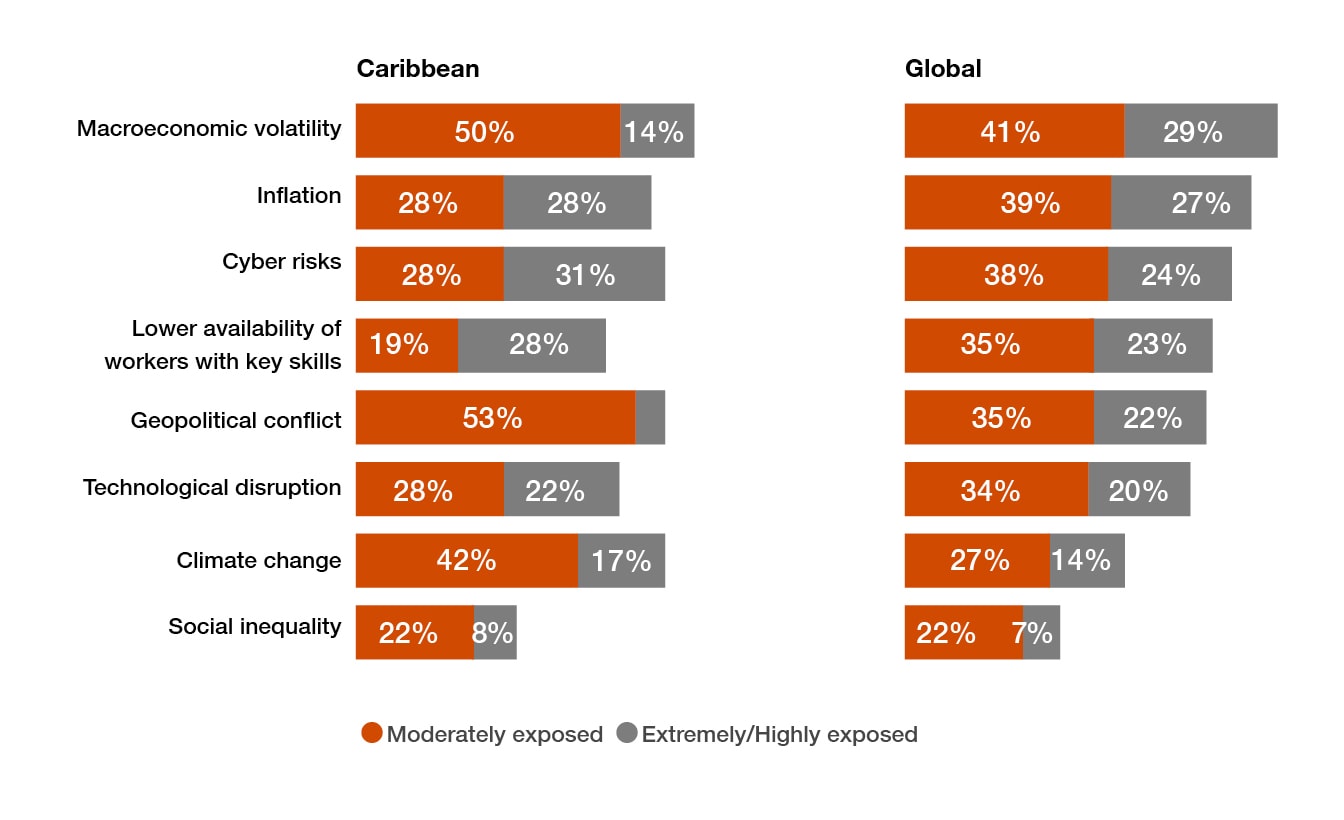

While long-term viability may still be a worry to many CEOs, this doesn’t appear to affect their optimism for global economic growth to increase over the next 12 months. Almost 70% agree it will improve, up from 52% in the last Caribbean CEO Survey. This optimism is more pronounced than the responses from counterparts across the globe (58%) but follows the same pattern and of course reflects the response that macroeconomic volatility isn’t seen as an extreme or high threat (14%), rather a moderate threat (50%) to Caribbean CEOs. With so many competing threats (as you’ll see further along in the report) and a world under constant scrutiny, it would be short sighted of CEOs to address just their biggest threats. The balancing act continues and the key is not to misjudge the importance of factoring in other key threats to ensure a sustainable business.

When asked what threats are most likely to impact their business in the next 12 months, the majority of Caribbean CEOs selected cyber risks (31%), closely followed by inflation and workforce capabilities (both 28%). Meanwhile, macroeconomic volatility (29%) tops the global results. Cyber risks have had the centre stage for some time now so it’s somewhat concerning that only 2% of organisations globally have implemented resilience actions as highlighted in the recent PwC report, Bridging the gaps to cyber resilience: The C-suite playbook- 2025 Global Digital Trust Insights Furthermore, the urgency for business reinvention was a central theme in the Caribbean Digital Readiness Survey 2024. Results showed that cyber security implementation was a key area of vulnerability as digitisation increases. It's important to put cyber security at the epicentre of digital innovation and operations by fostering organisation-wide understanding and responsibility for managing the risks. Even more so given the responses in this survey strongly suggest cyber is having an ongoing impact on Caribbean based businesses.

Continual reinvention

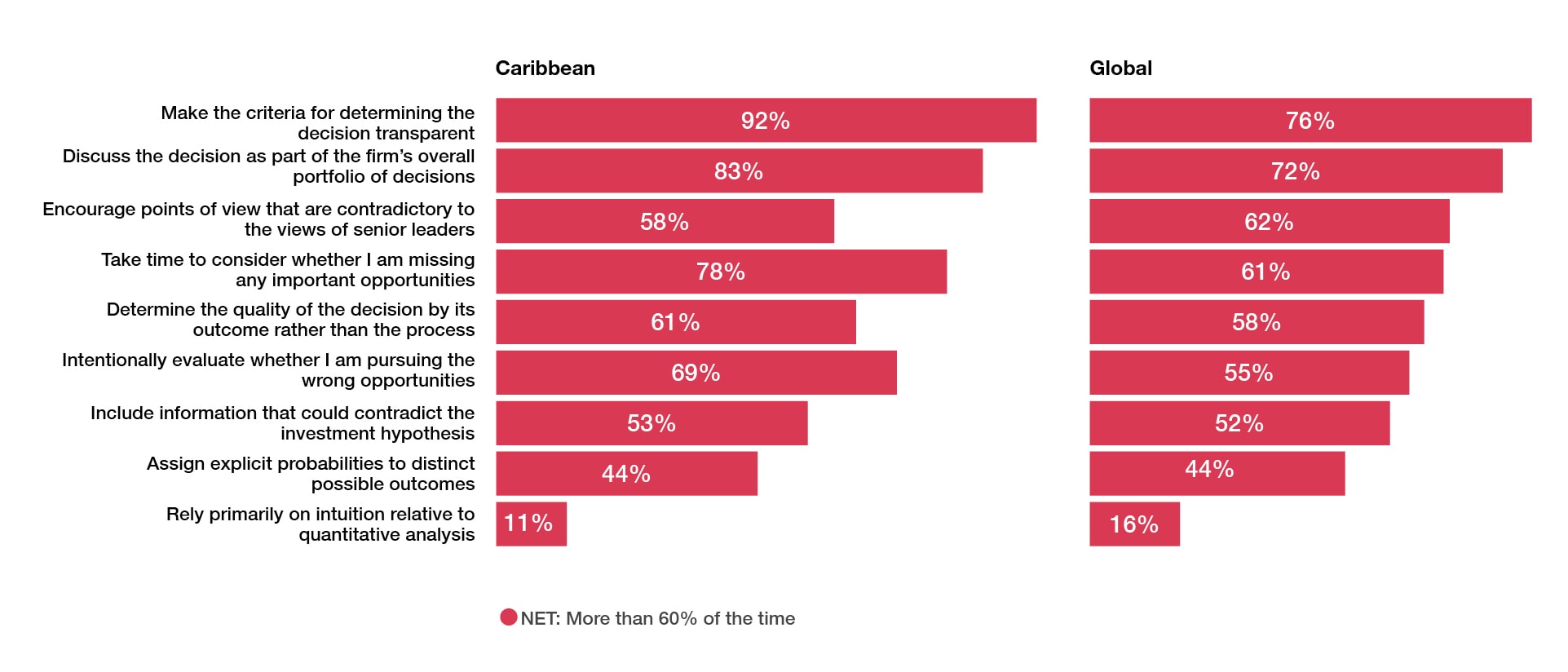

Leading a company during a period of great change requires decision-making that is well informed, disciplined and unbiased. Yet many CEOs tell us that their company’s strategic decision-making processes are inconsistent at best. For example, proven practices for countering confirmation bias include making decision criteria transparent in advance (a resounding 92%), while only about half of companies regularly employ techniques such as, deliberately canvassing alternative points of view (58%) and intentionally seeking out information that contradicts the investment hypothesis (53%).

Decisions sometimes need to be made quickly, before every box has been ticked. But there is compelling evidence that stronger decision-making processes typically result in better decisions—especially under conditions of uncertainty, when intuition and experience are unreliable guides. In the current environment, with very high levels of uncertainty across multiple dimensions, decision quality is paramount.

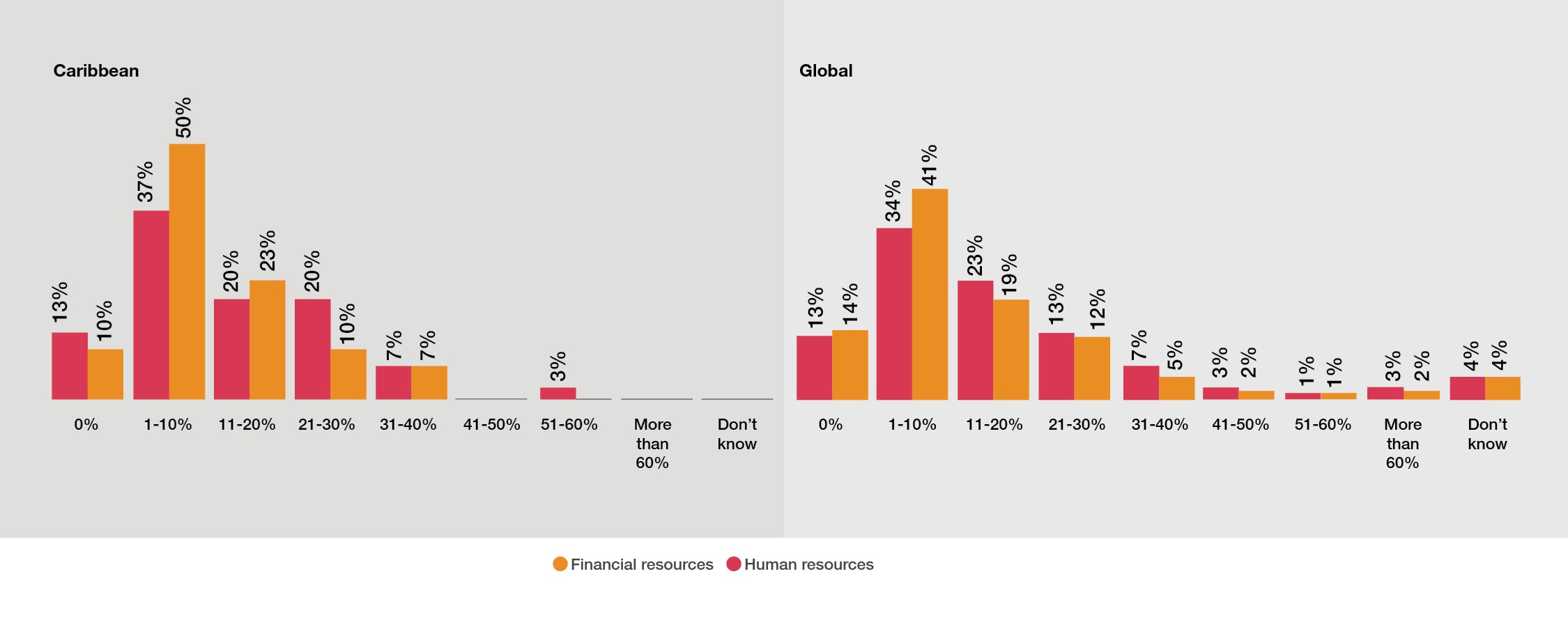

Dynamic resource reallocation is a prerequisite for reinvention. For example, it is impossible to rapidly build a large new business without actively reallocating resources from lower-priority projects. Yet a large majority of companies lack agility when it comes to moving financial investments and people between projects and business units. Around half of Caribbean CEOs tell us that they reallocate 10% or less of financial (50%) and human resources (60%) from year to year. Perhaps cognitive biases are at work. These include anchoring (an overreliance on arbitrary benchmarks, such as last year’s budget numbers) and naive diversification (the tendency to allocate resources equally across available options instead of weighting investments strategically).

Want to take the "Caribbean CEO Survey Insights" with you?

The Leadership Agenda

Sharp, actionable insights curated to help global leaders build trust and deliver sustained outcomes. Explore our latest content on the global issues affecting organisations today from ESG to value creation, technology and cyber to workforce transformation.

Contact us