The Philippine startup ecosystem has changed over the last three years. The 2019 signing of the implementing rules and regulations for the Innovative Startup Act or Republic Act 11337 as well as the Revised Corporation Code allowing the incorporation of one person corporations show the government’s support in promoting entrepreneurship. The recent investments of global investors such as Kohlberg Kravis Roberts & Co. L.P. (KKR), Tencent Holdings, and Ant Financial Services Group prove that the Philippines has a promising and stronger startup ecosystem.

As a follow-through to our 2017 Philippine startup survey, we revisited the startup founders to know where they are now, and understand their plans. This year, we also gathered the insights of the startup investors to help bridge the financing gap.

According to the founders, majority of them are scaling up. While capital requirements remain the top concern of the founders, we are seeing that the challenges shifted from regulatory to business concerns. Majority of the founders are also very confident about the prospects for revenue growth, and almost all are planning to enter new territories in the succeeding years.

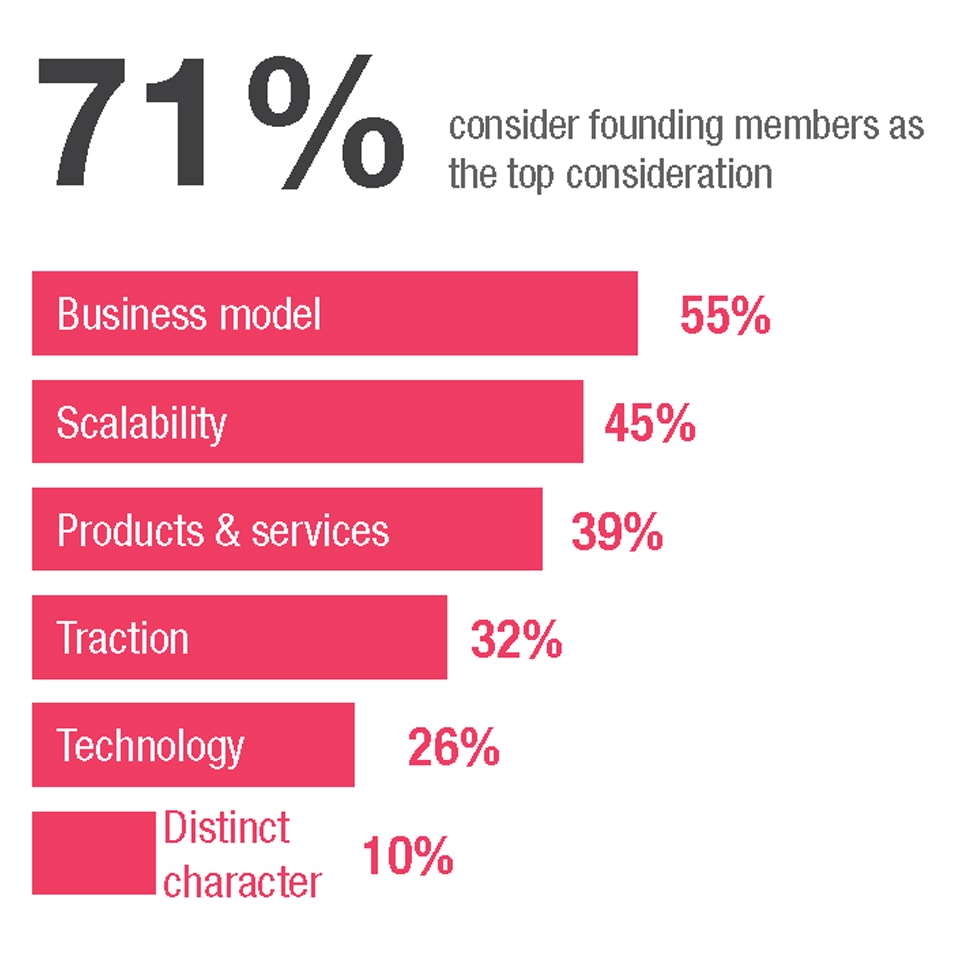

Similarly, the startup investors are confident about the growth prospects of the Philippine startups. According to the investors, financial technology (Fintech), e-commerce, and medical and healthcare technology are the top sectors that will be successful in the Philippines. The investors also said that their top investment considerations for startups are the founding members, business model, and scalability.

We hope that the data and stories from this report will encourage the participation of more players in the ecosystem. While we need more investors to help fund our startups, we also need the private sector to help by becoming the customers of our startups. We all need to work together to build sustainable businesses that will provide opportunities for the Filipinos.

Founders

Thirty-one percent of the founders say that they are earning annual revenues ranging from over PHP2m to over PHP100m. The founders are focusing on improving their revenues and profitability. Having sizeable and stable revenues are critical for our startups to raise external capital.

Fewer founders say that capital requirements is their biggest challenge

What were the challenges you faced when you were starting your business?

What are the top three areas that your startup is looking to innovate in the next three years?

How much external funding are you planning to raise in the next three to five years?

Reasons for walking away from partnerships

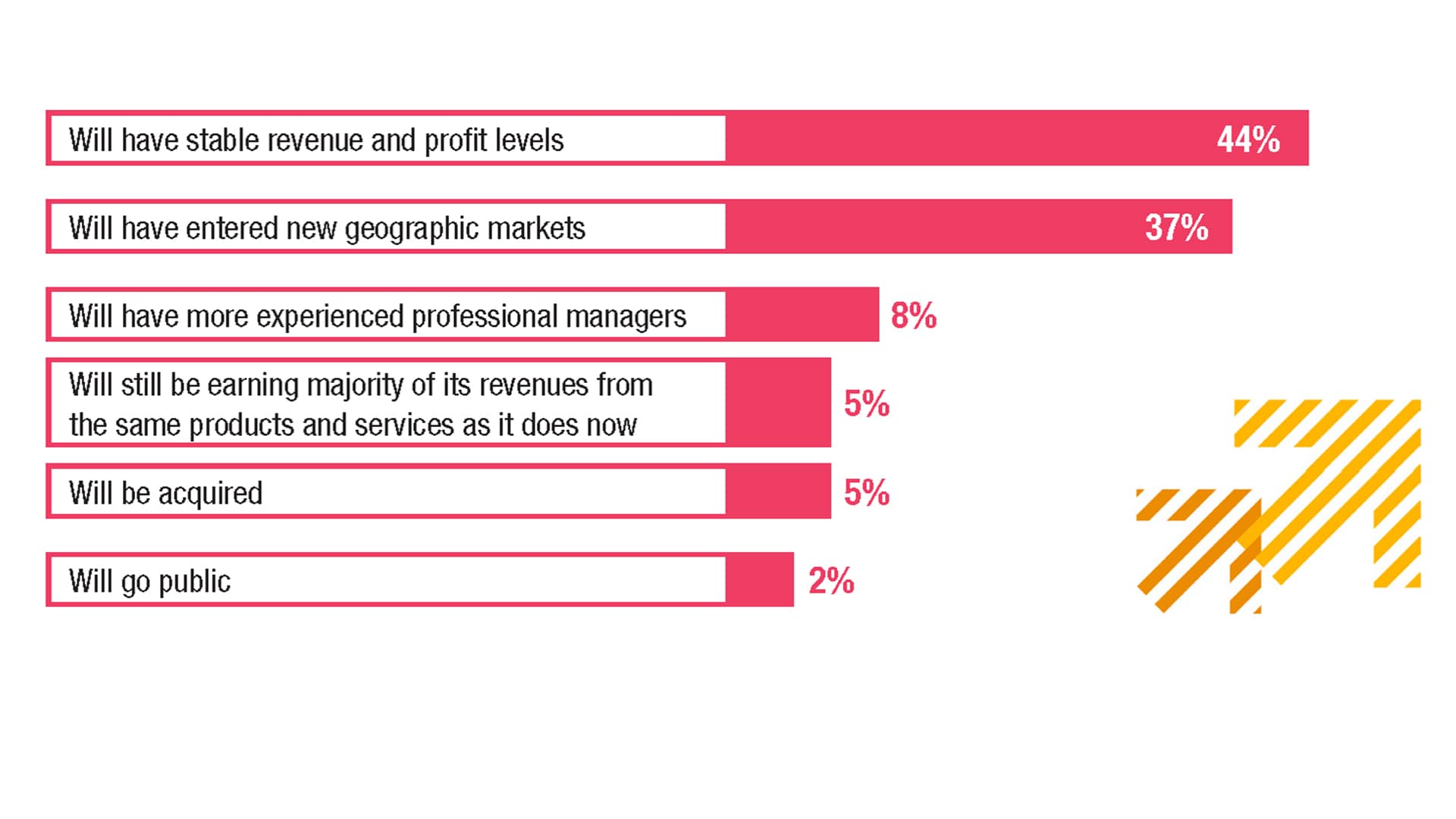

Only 2% see that their startups will go public in the next three years

Where do you see your startup in the next three years?

How confident are you about the prospects for revenue growth for your startup over the next two years?

Investors

While annual recurring revenues are critical to investors, majority of the respondents ranked the startup’s team as their top valuation consideration. In fact, majority of the investors say that they have walked away from potential partnerships because of the mismatch of personalities with the startup’s management team, or a weak startup’s management team.

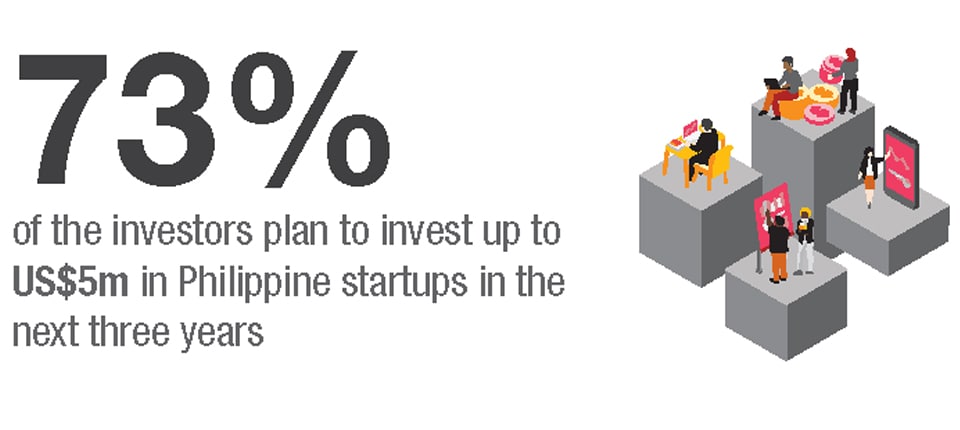

How much do you plan to invest in Philippine startups in the next three years? (US Dollars)

Reasons for walking away from partnerships

What are your top three considerations when investing in startups?

Investors say that the government should improve the ease of doing business, and introduce more incentives

What should the Philippine government prioritize to increase the investments in startups?

Investors say that financial constraints prevent the startups from being disruptive

Which of the following constraints do you think is stopping the Philippine startups from being disruptive?

Most investors see Fintech as the top sector that will be successful in the next two years

Which of the following sectors will be successful in the next two years in the Philippines?

“I think that the conglomerates should help the startups by creating adoption behaviors. Startups on the other hand, should not promote their products just to attract VC funds.”

~ Jojo Malolos, CEO, JG Digital Equity Ventures

“It’s no longer a shotgun approach. We gave the advertisers a sniper to hit their target market.”

~ Ellard Capiral, CEO, AdMov

“The government’s initiative and commitment to fund these startup enterprises will really help encourage a lot of startups to emerge and gain exposure through dedicated government programs.”

~ Jason Gaisano, Partner, Core Capital

“My big dream is to be the super app of health. I want to be that one-stop shop and household name for health. How do I get there? It will involve a lot of hard work. I want to hit five million Filipino users. Once we hit that, we can say that we’re really creating significant impact.”

~ Paolo Bugayong, Co-Founder & Chief Executive Officer, AIDE

“Now, we’re not just looking at enabling ten million Filipinos to invest. Another one of our goals is to be a Filipino tech company that can succeed and scale globally.”

~ JC Bisnar, CEO, Investagrams

“We’re very focused. We know which industry we want to tap. We really want to be the number one appliance and furniture same-day delivery provider. It takes great discipline to stay in that field.”

~ Dennis Ng, CEO, Mober

“The real estate market here in the Philippines is worth around US$50 billion. We plan to do more integrations with the Top 10 biggest developers in the country.”

~ Jesse Manalansan, Co-founder and CTO, Qwikwire

“Our goal really is for InvestEd to help 10,000 students in the next two years. We want to prove that a student loan model with enough capital and good repayment rates can work in the Philippines.”

~ Carmina Bayombong, CEO and Co-Founder, InvestEd

“I think that a lot of the digital GDP of the world is going to the mobile phones. The battle is no longer in televisions, but in the mobile phones.. and that’s where we’re focused and strong.”

~ Roland Ros, Founder, Kumu

“Today, we have about 500 different merchants enrolled in our system, and this number keeps growing because more people are going online. They see this as a potential revenue channel that is not to be missed.”

~ Liron Gross, CEO and Co-Founder, Payo

“We’ve started with taxation because this is one of the biggest barriers to being productive. What we really want is to help businesses become more productive.”

~ Ginger Arboleda, Co-Founder and COO, Taxumo

“The policy and funds that are available should be directed to supporting early-stage startups in order to help them grow to the point in which they are investable.”

~ James Lette, Executive Director, Manila Angel Investors Network

Explore the survey data

The interactive dashboard shows multi-dimensional analyses of the survey data. It presents interactions among the characteristics of the survey participants and their responses. Through the power of Deals Data and Analytics (D&A), we can efficiently harness insight from large amounts of data.

Learn more about Deals Data and Analytics

pwcph-2020-philippine-startup-survey

Contact us

Mary Jade T. Roxas-Divinagracia, CFA, CVA

Deals and Corporate Finance Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Aldie P. Garcia

Vice Chairman and Assurance Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Karen Patricia Rogacion

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8845 2728