New convertible debt accounting guidance (updated August 2020)

Observations from the front lines

Summary

- In August the FASB issued a new standard (ASU 2020-06) to reduce the complexity of accounting for convertible debt and other equity-linked instruments.

- For certain convertible debt instruments with a cash conversion feature, the changes are a trade-off between simplifications in the accounting model (no separation of an “equity” component to impute a market interest rate, and simpler analysis of embedded equity features) and a potentially adverse impact to diluted EPS by requiring the use of the if-converted method.

- The new standard will also impact other financial instruments commonly issued by both public and private companies. For example, the separation model for beneficial conversion features is eliminated simplifying the analysis for issuers of convertible debt and convertible preferred stock. Also, certain specific requirements to achieve equity classification and/ or qualify for the derivative scope exception for contracts indexed to an entity’s own equity are removed, enabling more freestanding instruments and embedded features to avoid mark-to-market accounting.

- As a result, the new standard may affect net income and EPS, and therefore performance measures, whether GAAP or non-GAAP, and increase debt levels which may impact debt covenant compliance.

- The new standard is effective for companies that are SEC filers (except for Smaller Reporting Companies) for fiscal years beginning after December 15, 2021 and interim periods within that year, and two years later for other companies. Companies can early adopt the standard at the start of a fiscal year beginning after December 15, 2020. The standard can either be adopted on a modified retrospective or a full retrospective basis.

- This document highlights some of the key changes in the new standard. For a complete summary refer to our recent In depth publication.

Podcast: Listen to a panel of PwC experts summarize what’s changed and the impacted areas.

Significant accounting changes: convertible debt with cash conversion features

The current accounting by issuers for convertible debt instruments can vary dramatically depending on the instrument’s terms. There are a number of different models for convertible debt, including separation of the conversion option as a derivative liability (this model remains a part of the accounting framework).

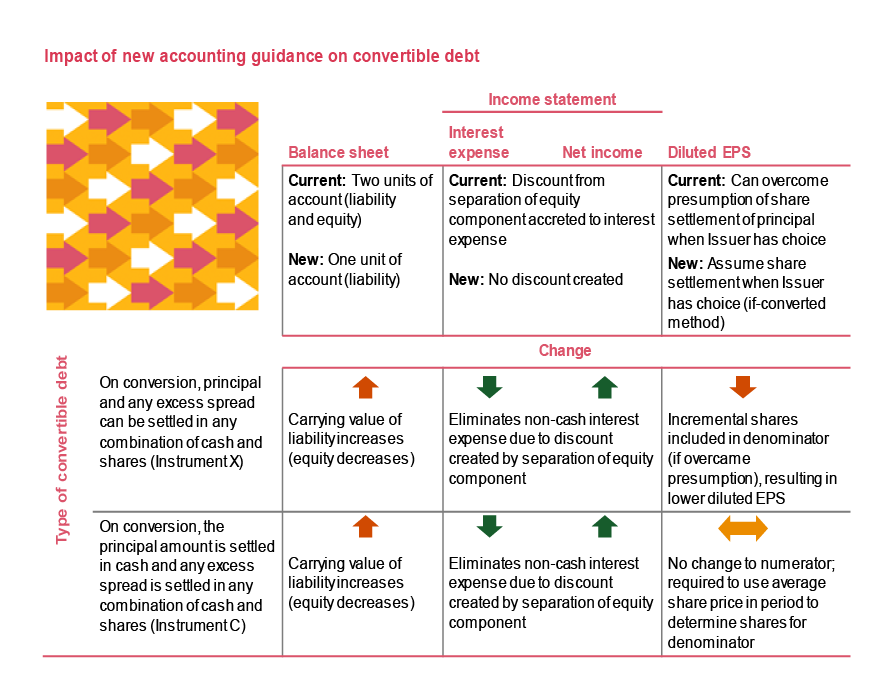

For convertible debt instruments (with conversion features that do not require bifurcation as a derivative) that can be settled in cash or shares at the issuer’s option (frequently issued by public companies), current accounting typically separates the instrument into two units of account: a liability component and an equity component. The circumstances when convertible debt issued by public companies is currently accounted for as a single unit of account are more limited.

The new standard only provides for two separation models for conversion options in all convertible debt. That is, only if:

(1) the conversion option meets the definition of derivative, is not clearly and closely related, and does not qualify for a scope exception from derivative accounting

- or -

(2) if the debt is issued at a substantial premium, would an amount need to be separated.

The other separation models would be eliminated, including the model for convertible debt that can be settled in cash or shares. As a result, in more cases, convertible debt will be accounted for as a single instrument (a liability).

The earnings per share (EPS) treatment for convertible debt that can be settled in any combination of cash or shares at the issuer’s option will be impacted significantly. Today, companies can, in certain circumstances, assume cash settlement of the principal amount and only include shares in the diluted EPS denominator for the value of the conversion spread (if any). However, under the new standard, companies would have to apply the potentially more dilutive if-converted method, which assumes share settlement of the entire convertible debt instrument and therefore increases the number of shares to be added to the denominator of the diluted EPS calculation.

Why it matters

Separating convertible debt into two units of account under the cash conversion accounting model results in the debt being recorded at a discount to the principal amount, and that discount is recognized as incremental non-cash interest expense over the expected life of the convertible debt. By requiring this convertible debt to be treated as a single instrument, non-cash interest expense resulting from the creation of a discount against the debt will be eliminated.

Companies will welcome the lower interest expense, which was historically very significant relative to the low coupon interest rate on these instruments. However, companies may not appreciate the more dilutive impact of the changes to EPS for instruments that may be settled in any combination of cash or shares. Additionally, issuers should be mindful of the changes to, and divergence between, the accounting for extinguishments and conversions for instruments accounted for as a single unit.

Other accounting changes

- Equity vs. liability classification

- Removal of BCF model

Equity vs. liability classification

A key area of the accounting guidance is determining equity or liability classification and/or whether mark-to-market accounting is required for embedded equity-linked features (e.g., conversion option) or freestanding instruments (e.g., warrants to issue common stock) is the guidance for contracts in an entity’s own equity. Among other requirements, this guidance requires specific criteria to be met in order to qualify for equity classification. The new standard removes certain of these specific criteria and clarifies another criterion. However, the new standard does not amend the scope of specific guidance which requires certain freestanding instruments to be reported as liabilities and mark-to-market accounting for certain instruments (ASC 480).

Why it matters: By removing certain criteria that must be met, the new standard makes it easier for more equity-linked features and certain freestanding instruments to avoid mark-to-market accounting. This would reduce earnings volatility. However, all of remaining criteria must still be met and may necessitate a re-examination of other criteria not previously considered, These changes may also result in new provisions being included in agreements (e.g., collateral posting requirements) which may have additional accounting and disclosure implications. Issuers and investors or counterparties should consider the economic value and impact of including these types of features.

Removal of BCF model

Under current guidance, a conversion option within a convertible instrument (such as debt or preferred stock) may in certain circumstances require separate accounting within equity if it is in-the-money at issuance, commonly referred to as a beneficial conversion feature (BCF).

Why it matters: The changes may provide relief to private companies with complex venture capital financing arrangements, as well as public companies. The reduction in accounting models, in particular the elimination of the BCF guidance, may significantly reduce the reporting burden associated with convertible instruments and bundled transactions.

The bottom line

Companies and their financial statement users should take note of these changes, as they could have a significant impact on future reporting, particularly for issuers of convertible debt and other equity-linked instruments. Companies also need to consider the implications of the new standard on performance measures, whether GAAP or non-GAAP, and other areas of reporting such as debt covenant compliance. The consequences of early adoption and the method of adoption (modified retrospective vs. full retrospective) should be understood prior to discussing the impact of the new guidance with stakeholders.

This may not be the end of changes relating to debt and equity. In February 2020, the FASB decided to add a separate project to its technical agenda to explore improvements to aspects of the derivative scope exception for contracts in an entity’s own equity.

How PwC can help

There are many complexities in the new standard to work through, and public companies looking to early adopt need to act quickly as they have a small window of opportunity to do so at the beginning of next year. Issuers will need to assess the impact of the changes to their existing convertible debt agreements and derivative contracts as well as to future issuances. PwC can assist companies in thinking through these complexities.

“Observations from the front lines” provides PwC’s insight on current economic issues, our perspective regarding the financial reporting complexities, and what companies should be thinking about to effectively address those issues. For more information, visit www.pwc.com/us/cmaas.