Family Offices: One size does not fit all

John West started his farming business in the 1960s at the same time that he began growing his family. The business grew as his children grew, and many of the business’ employees felt like family to the Wests.

As the second generation (G2) entered adulthood, they naturally turned to the business’s CFO to help them with important financial matters including buying their first homes, making investments outside of the business and their tax compliance. John’s longtime assistant helped plan the family’s vacations, and the HR department started playing a more active role in securing appropriate insurance for the family. The West family did not realize it at the time, but they were slowly creating an embedded family office (FO) within the operating business.

An embedded family office leverages the skills, expertise and capacity of staff in the core operating business and can range from a single senior staff member providing advice, to more than 20 employees actively supporting the family owners. For some families, an embedded family office is ideal, supporting the family’s wealth and endeavors in a cost-effective way while leveraging the infrastructure of the business. Often, families such as the Wests, find that eventually the family outgrows this model.

By 2020, the third generation (G3) began to rely on the embedded family office, in addition to the G2 members. The family turned to employees for more support than ever before, causing the employees to be distracted from their official roles within the business. The G2 and G3 family members did not realize the additional pressure that these non-business related tasks placed on employees, including having to prioritize requests from family members relative to their day to day responsibilities. The embedded FO employees seemed to have only a part-time focus on their actual roles within the business, causing capacity issues and resentment from fellow staff members.

With G2 and G3 having grown to more than 10 adults, the investment portfolio had grown too large and too complex for the operating company’s CFO to oversee in addition to their full-time responsibilities. Additionally, the family had a desire to pursue investment opportunities that were outside of the CFO’s expertise. The list of tasks that the embedded FO supported continued to grow, including processing payroll for employees of G2’s outside business ventures, hiring and payroll for household staff, family vacation planning and other concierge services. With such a heavy task load, attention to detail dwindled, leaving the family vulnerable to errors and security risks. Additionally, G2 wanted to consider selling the family business in the near future, bringing new demands on a limited number of people, raising considerations related to how the existence of this structure would be perceived by potential buyers, and also raising concerns about how the family’s needs would be met post a potential transaction.

If this narrative sounds familiar, it may be time to consider some alternative options for meeting the growing needs of your family. Below are some highlights of the various options available to you:

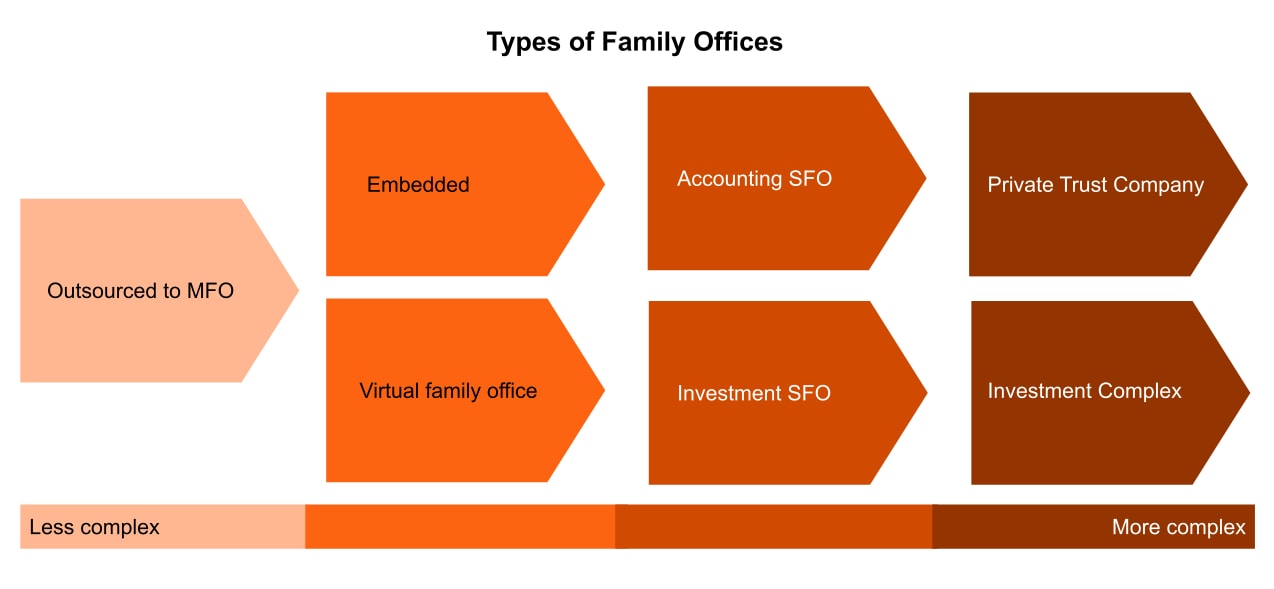

Outsource to a Multi-Family Office (MFO). A multi-family office is great for families that are low on the spectrum of complexity and can be a cost effective model. With this structure, however, the family loses the personal touch of having a full-time staff to support their wealth and personal needs. MFOs also typically rely on managing investments for the family and deriving management fees to subsidize the additional services which some families may or may not be interested in.

Create a Single Family Office (SFO). As a family and its business grow, the time may come when a single family office that is dedicated to the family full time becomes the best solution. This model allows the family to fully separate its personal dealings from the business, and can make it easier to eventually sell or go public with their legacy operating entity. An SFO can also provide a high degree of privacy and confidentiality and can handle more customized tasks and requests, but is often the least cost-effective option.

Employ a Virtual Family Office (VFO). As family office technologies become more sophisticated and secure, virtual family offices are becoming more prevalent and attractive. At a time where much of the world is working remotely, the virtual family office has proven to be a viable option for administration, accounting and reporting and analysis as well as document management and communication, especially for globally diverse teams and families. Virtual family offices allow families to outsource all or part of their family office and provide wealth owners real-time reporting, analysis and support. This method can be extremely cost-effective for families, because the virtual family office can take the place of multiple family office employees, while maintaining control for family owners.

Choose a hybrid model. For some families, none of the options listed above fully meets their needs. These families may prefer a hybrid model where they can outsource aspects of their family office while still maintaining an embedded family office for select functions. This model can be the best of both worlds for families — they can maintain the relationships and status quo of their embedded FO, while lightening the load of the embedded FO by outsourcing services such as bill pay, bookkeeping and reporting or complex and specialized investment functions.

After learning of the potential options, the West family knew that they had to evolve their family office in order to best support the family, but G2 wanted to keep the personal support provided by the loyal employees within the family business. The family found their solution with a hybrid model — the embedded family office shrunk to a single dedicated employee, and the bookkeeping, bill pay and reporting have been outsourced to a managed services provider. Technology-enabled virtual family offices are typically easier to implement as they leverage digital technology and automation tools. Although the new outsourced aspect of the family office was virtual, the family has a dedicated team to openly communicate with and turn to with any issues or questions.

Each family office is as unique as the family it supports. By carefully considering the needs of the family and the business goals and needs, the family can determine if the embedded family office model can continue to provide support or if an alternative model would better serve both the family and the business.