CLM Platforms

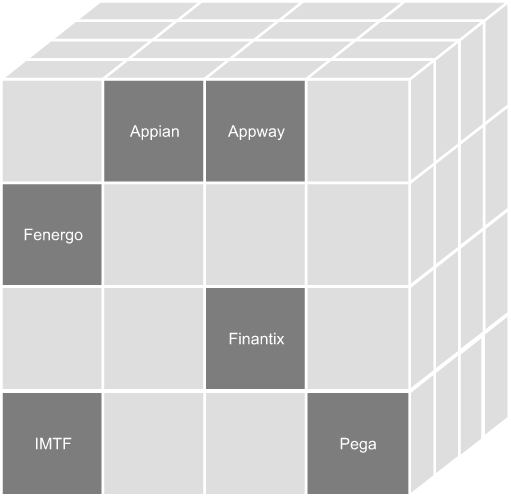

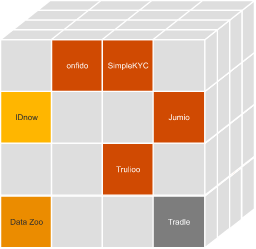

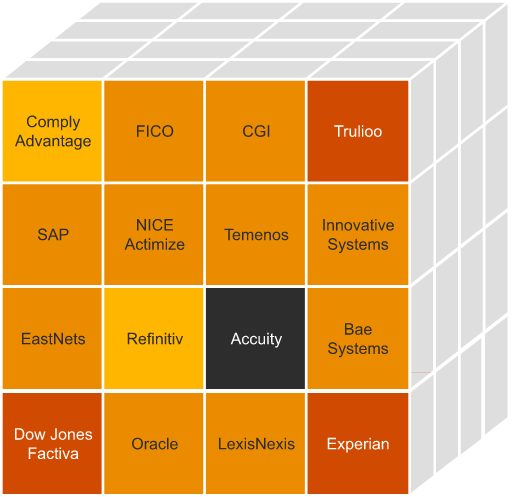

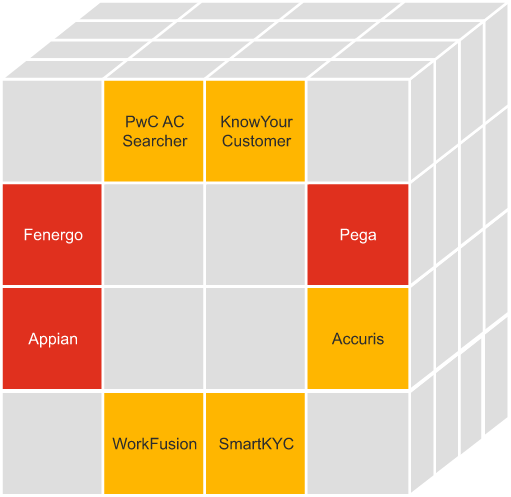

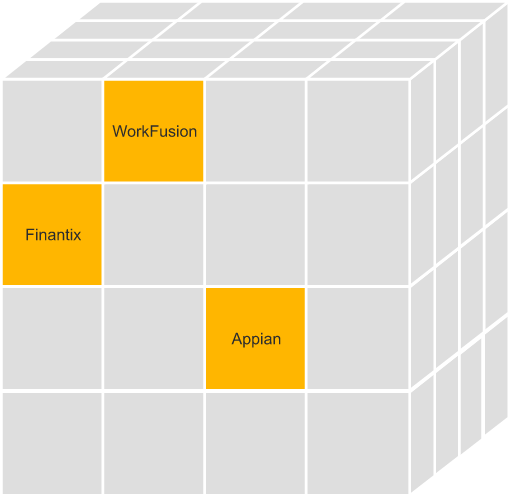

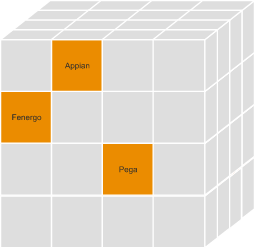

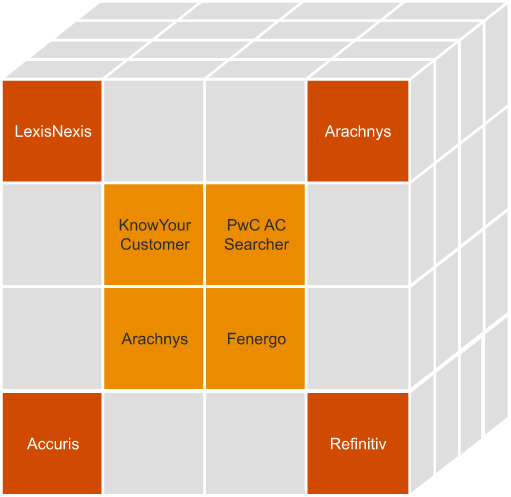

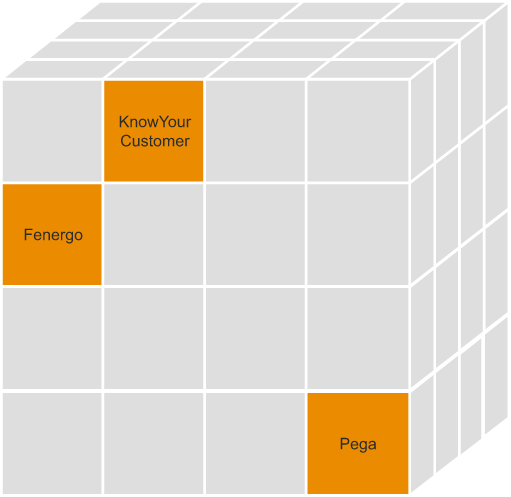

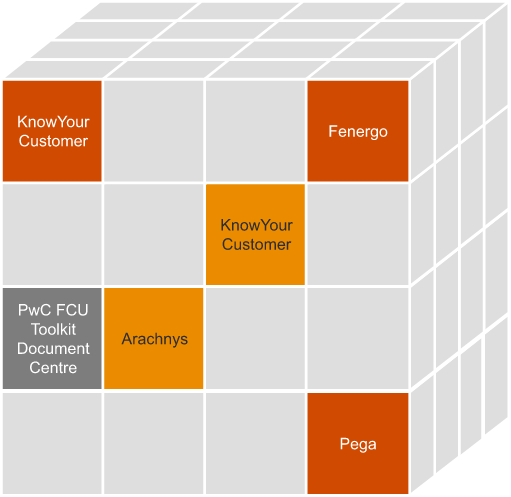

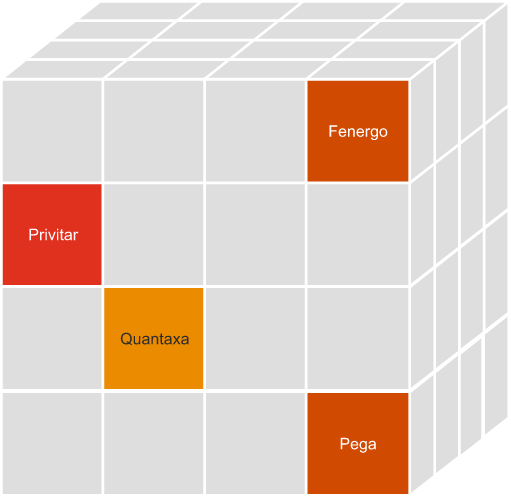

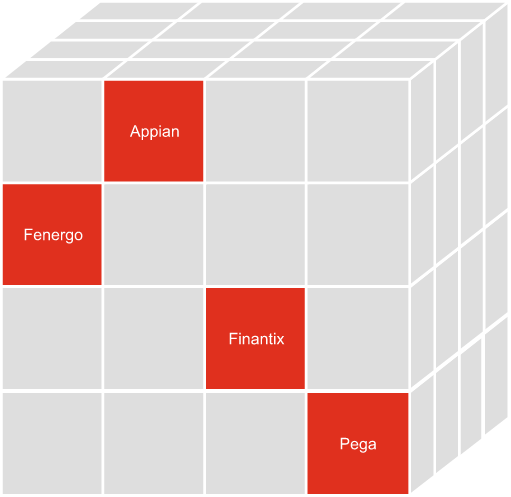

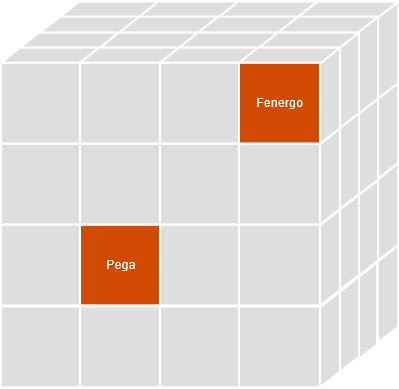

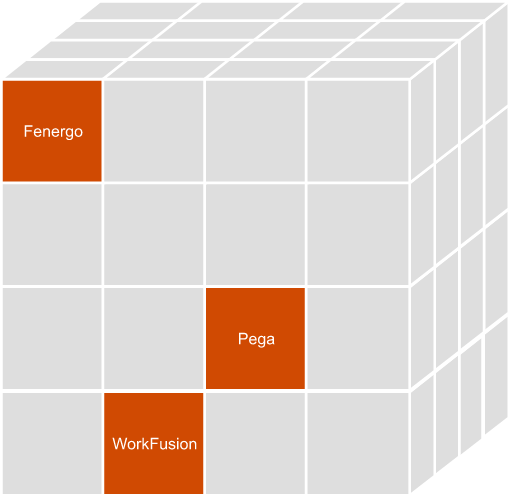

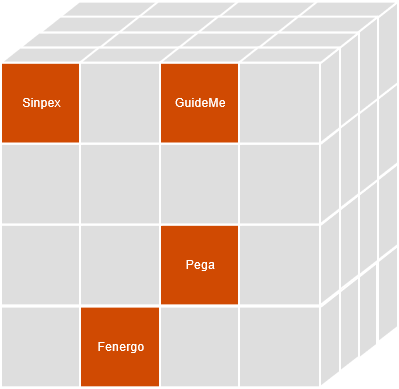

As financial institutions have come increasingly to see KYC/AML, account opening as well as tax declarations as part of an interconnected set of processes, industry technology providers have followed suit. Modern CLM platforms are important in providing financial institutions with the necessary technical capabilities for the maintenance of client relationships from on-boarding all the way up till the client is off-boarded.

We have mapped all key technical capabilities that make up an end to end CLM model and indicated some example solutions to show what is available in the market. The mapping is indicative only and further details and insights are available.

Find out more

Perpetual KYC

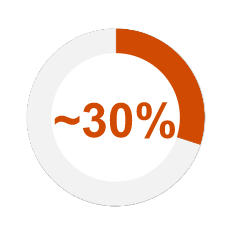

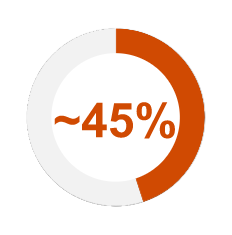

Perpetual know-your-customer (P-KYC) is an approach, powered by technology, that enables automation across all end-to-end periodic KYC review process steps, leaving only a small subset of the more complex cases that require some degree of human intervention.

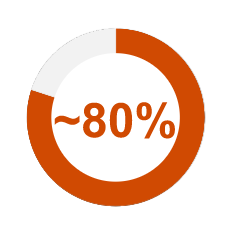

P-KYC enables the industry to address some of its long-standing KYC challenges, especially with the cost savings and quality improvements that can be potentially realised. In some cases, through the adoption of P-KYC, banks have achieved savings of up to 60%-80% of the total effort across the entire customer book.

Find out more