COVID-19 continues to cast a long shadow on societies, economies and businesses worldwide. As insurers, your immediate imperatives have been business continuity and customer and employee support.

The insurance industry has generally responded well, enabling remote work and addressing immediate capital questions. With the circuit breaker measures easing gradually from 1 June 2020, Singapore insurers’ focus is now turning to what the competitive landscape will look like in the immediate future, what it means for their business, and how to emerge stronger.

We share some of the specific challenges that insurance companies in Singapore might be facing, along with suggestions of what you can do now, as well as in the medium to long term, to manage effectively through this crisis.

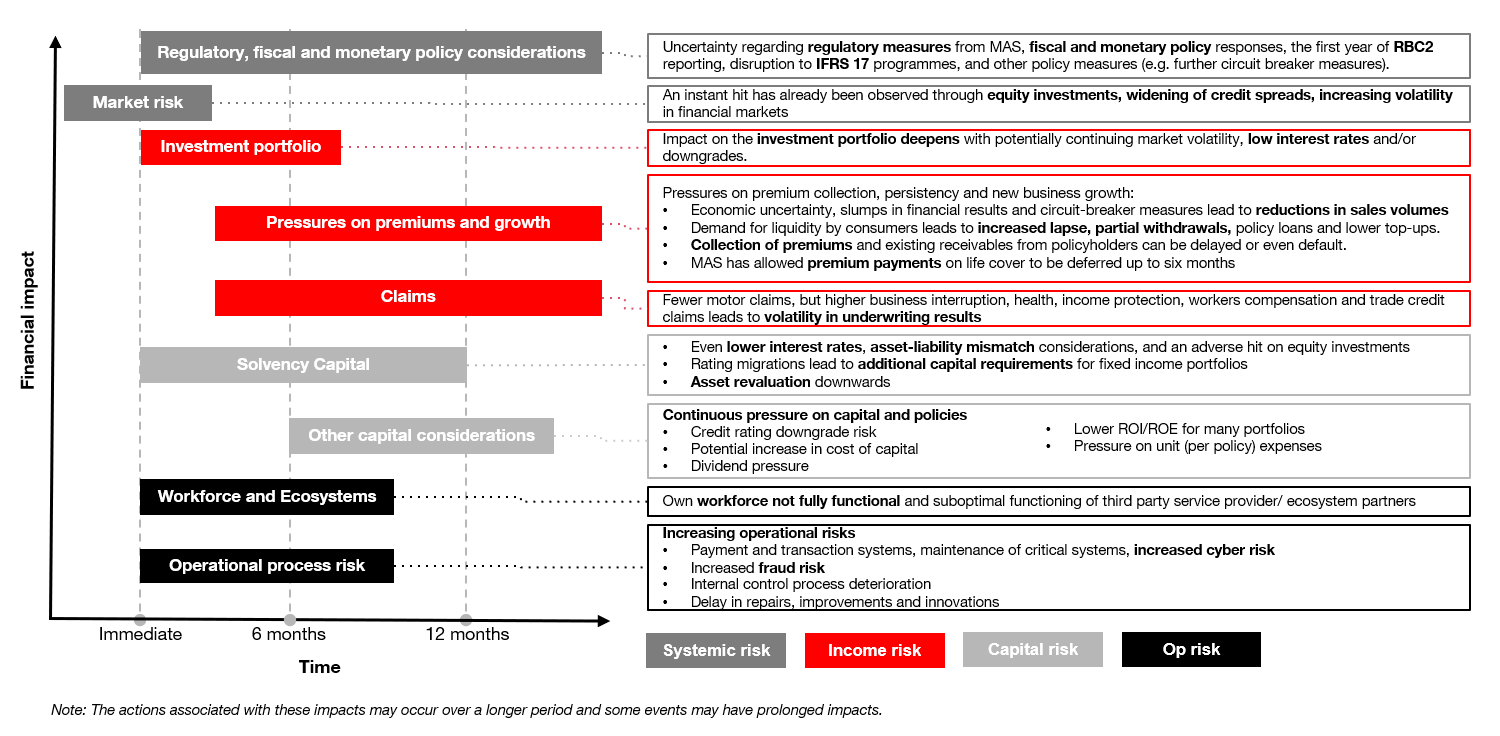

The impact of COVID-19 on insurers may continue over a longer period

Key actions insurers should take from the following perspectives

The COVID-19 pandemic, along with the associated economic impact, has a number of key financial implications for insurers including uncertainty in business volumes, claim frequency and severity, capital impacts, customers’ ability to make premium payments as well as changing risk profile and business mix.

Some recommended actions include:

Immediate

- Consider various stress test scenarios to assess impacts on revenue, profitability, liquidity and solvency.

- Assess the effects of lower sales of certain products, or changing the timeline for introduction of new products.

- Consider customer communication and customer engagement plans and strategies.

Short-term

- Assess the need for repricing current products or modifying product offerings to be more relevant in COVID-19 environment.

- Assess the existing reinsurance arrangements to understand the exposure to different counterparties and limits.

- Assess the appropriateness of the current investment and hedging strategies.

Medium to Long-term

- Assess your investment portfolio, macro and micro hedge strategies, and future asset allocation options.

- Undertake a capital optimisation exercise, including assessing reinsurance solutions.

- Consider strategic disposals, mergers and acquisitions options.

- Gain a deeper understanding of future risk and changing risk profiles.

COVID-19 and the resulting circuit-breaker have challenged insurers to rethink the way in which they engage with customers, change their working arrangements, focus on elevated data and cyber risks, expand distribution channels, accelerate digital transformation and assess reliance on outsourced service providers. As a result, insurers need to assess the flow-on impacts on cost-structure and productivity.

Some recommended actions include:

Immediate

- Set up a work practice to cultivate a corporate culture that encourages personal accountability by co-creating goals and expectations together.

- Review supplier networks and associated service agreements to understand the extent to which they are affected by COVID-19, and assess whether sufficient contingency plans are in place.

Short-term

- Accelerate cloud migration plans to reduce the reliance on physical on-site data, actuarial and accounting centers.

- Review and update guidelines for data protection and data handling in the remote working environment. Insurers should also consider the inclusion of guidelines on "digital ethics".

- Continue assessing the performance and delivery of outsourced services

Medium to Long-term

- Evaluate the extent to which remote working arrangements can continue and potential costs reductions can be achieved through reviewing office space and infrastructure requirements.

- Consider platform and data rationalisation in order to reduce reliance on multiple sources and systems.

- Establish a digital transformation road-map for the entire insurance business

- Maximise the tax benefits from the investment costs in operationalisation of digital transformation.

Prior to COVID-19, insurers in Singapore were in the midst of preparing for RBC2 reporting and implementing IFRS 17. COVID-19 has not only disrupted the momentum but has also added in new challenges in the implementation of these programs concurrently. In the full publication, we have also summarised some of the regulatory measures across key Southeast Asian markets taken as a result of COVID-19.

Some recommended actions include:

Immediate

- Assess the impact of the current market conditions and additional stress scenarios on the balance sheet and the solvency position based on the new RBC2 regime.

- Assess the appropriateness of the existing IFRS 17 plan and timelines

- Consider how effective IFRS 17 programme communications are currently

Short-term

- Re-assess balance sheet management strategies in order to ensure appropriate investment and hedging strategies are followed to ensure the RBC2 balance sheet is optimised.

- Consider how necessary travel is for their IFRS 17 programmes, and whether it is possible to operate without physical co-location once travel restrictions are eased.

Medium to Long-term

- Ensure that the ORSA process considers and incorporates sufficient stress scenarios and recommendations on the actions for each scenario, in particular, where the current situation highlights gaps previously not identified.

Next steps

Insurers in Singapore have been resilient, effectively navigating industry challenges over the years, as well as adopting new regulatory requirements. Further, we have also seen the industry players reaching out to help the community through extended health cover for those who have contracted COVID-19. It is a chance for insurers today to uplift the reputation and branding of the industry and demonstrate how they can help the community overcome some of the challenges they are experiencing. As next steps, we recommend insurers to reflect on the following six points:

Assess the agility and resilience of operations and contingency planning as a result of COVID-19

Reconsider how best to utilise digitalisation and technology

Assess product offerings in light of changing risk profile and business mix

Reassess current strategy and market positioning beyond COVID-19

Reassess investment portfolios and strengthen capital efficiency

Assess impact on existing regulatory and other compliance programmes

Contact us

Ang Sock Sun

Insurance Accounting and Regulatory Advisory Leader, PwC Singapore

Tel: +65 8511 7108