The financial services industry is in the midst of a significant transformation, accelerated by the COVID-19 pandemic. And given the key role digitisation plays in the financial lives of more and more of the world’s population, electronic payments are at the epicentre of this transformation.

Payments are becoming increasingly cashless, and the industry’s role in fostering inclusion has become a significant priority. Payments also are supporting the development of digital economies and are driving innovation — all while functioning as a stable backbone for our economies.

We are therefore delighted that the first report we are launching in our 2025 & Beyond series focuses on the payments industry and the key themes that are influencing it. How the industry responds to these trends will define how successful it is in the coming years and its impact on society overall.

| Questions and Answers | Global | Asia Pac | EMEA | Americas |

|---|---|---|---|---|

| Regulatory Impact Thinking about the different areas that could potentially be impacted by regulatory changes over the next 5 years, which areas of regulation are you most concerned about? | ||||

Data shown:

|

||||

| AML (Anti Money Laundering) | 24% | 23% | 22% | 27% |

| Use of new technology | 30% | 33% | 23% | 32% |

| Enhanced accountability | 23% | 27% | 21% | 19% |

| Open Banking | 22% | 23% | 22% | 22% |

| Central Bank Digital Currency (CBDC) | 27% | 33% | 25% | 21% |

| Data privacy and cybersecurity | 48% | 40% | 50% | 57% |

| Environment and climate (e.g. ESG) | 28% | 36% | 26% | 20% |

| Customer communication | 25% | 28% | 19% | 26% |

| Digital identity authentication | 31% | 34% | 26% | 31% |

| E-money/Cryptocurrency | 27% | 28% | 25% | 26% |

| KYC (Know Your Customer) | 28% | 31% | 26% | 27% |

| Local regulatory pressures - different regulations in different regions | 30% | 35% | 28% | 26% |

| New business model (crowdfunding, peer-to-peer lending) | 26% | 35% | 22% | 18% |

| Other (please specify) | 0% | 0% | 0% | 1% |

| Don't know | 2% | 1% | 3% | 2% |

| Cybersecurity Strategy Which of the following factors will have the greatest impact in shaping your cybersecurity strategy over the next 5 years? | ||||

Data shown:

|

||||

| Shortage of cybersecurity talent | 35% | 37% | 36% | 32% |

| Introduction of new authentication technologies, such as biometrics | 30% | 33% | 25% | 29% |

| Increasing complexity of cyber threats | 45% | 42% | 42% | 51% |

| Introduction of fifth-generation (5G) cellular networks | 29% | 38% | 23% | 24% |

| Adoption of Internet of Things (IoT) hardware and software | 30% | 40% | 20% | 26% |

| Growing public concern over data privacy | 35% | 34% | 36% | 36% |

| Cybersecurity and data privacy regulations | 46% | 46% | 47% | 46% |

| Vulnerabilities in supply chains and business partners | 28% | 26% | 25% | 33% |

| Rising geopolitical tensions | 28% | 30% | 27% | 28% |

| Human vulnerabilities (unintentional or malicious) | 32% | 29% | 33% | 35% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 2% | 2% | 3% | 2% |

| M&A, Divestitures or Carve-out Is your organisation likely to consider any Merger & Acquisition (M&A), Divestitures or Carve-out activity in the next 5 years? | ||||

Data shown:

|

||||

| Yes - expect 1 or 2 M&A/Divestitures/Carve-out activities | 25% | 22% | 23% | 29% |

| Yes - expect 3 to 5 M&A/Divestitures/Carve-out activities | 32% | 40% | 31% | 24% |

| Yes - expect more than 5 M&A/Divestitures/Carve-out activities | 13% | 13% | 11% | 13% |

| No - we don't plan to consider any M&A/Divestitures/Carve-out activities expected within next 5 years | 18% | 15% | 23% | 18% |

| No - but we expect to be the target of an M&A/ ivestiture/Carve-out activity expected within next 5 years | 4% | 5% | 4% | 4% |

| Don't know | 8% | 5% | 8% | 11% |

| ESG Influence To what extent do you expect ESG (Environmental, Social and Corporate Governance) to influence the following aspects of your organisation's business model? | ||||

Data shown:

|

||||

| Selection of clients | 21%,43%,34%,3% | 13%,47%,38%,3% | 20%,42%,35%,3% | 30%,38%,29%,3% |

| Selection of suppliers (value chain partners) | 17%,46%,34%,3% | 13%,45%,40%,2% | 17%,49%,31%,3% | 21%,44%,31%,4% |

| Products/service offering | 13%,45%,39%,3% | 10%,48%,40%,2% | 11%,44%,41%,4% | 18%,44%,36%,2% |

| Investment decisions | 14%,41%,41%,3% | 13%,40%,46%,2% | 13%,41%,42%,4% | 17%,43%,36%,4% |

| Lending decisions | 19%,43%,35%,4% | 18%,44%,33%,4% | 13%,41%,42%,4% | 24%,38%,33%,5% |

| Recruitment of employees | 22%,43%,33%,3% | 17%,50%,32%,1% | 24%,37%,35%,4% | 26%,38%,32%,4% |

| Overall organisation's strategy | 12%,43%,42%,3% | 10%,44%,44%,2% | 14%,40%,41%,5% | 14%,44%,39%,3% |

| The role of employees in Financial Services The role of employees in Financial Services organisations is changing. Which of the following activities is your organisation planning topursue over the next 5 years to address a potential future skills gap? | ||||

Data shown:

|

||||

| Change the composition of the workforce between permanent and contingent staff | 35% | 40% | 33% | 31% |

| Hire from competitors | 30% | 28% | 33% | 30% |

| Acquire a firm to access new skills/expertise | 34% | 43% | 26% | 29% |

| Establish a strong pipeline direct from education | 40% | 45% | 30% | 43% |

| Hire from outside the industry | 29% | 31% | 28% | 28% |

| Undertake significant retraining/upskilling | 47% | 47% | 44% | 49% |

| Outsource non-core activities to third parties | 36% | 41% | 29% | 36% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 4% | 3% | 6% | 4% |

| Macro trends in FS Thinking about macro trends in the financial services industry, which of the statements below do you think is most likely to be true in the 2025? | ||||

Data shown for Trend 1:

|

||||

Data shown for Trend 2:

|

||||

Data shown for Trend 3:

|

||||

Data shown for Trend 4:

|

||||

Data shown for Trend 5:

|

||||

Data shown for Trend 6:

|

||||

Data shown for Trend 7:

|

||||

| Trend 1: Interest rates | 62%,30%,7% | 68%,26%,6% | 57%,34%,9% | 60%,33%,7% |

| Trend 2: Alternative finance | 53%,38%,9% | 62%,31%,8% | 46%,43%,11% | 46%,43%,11% |

| Trend 3: Sources of capital | 56%,32%,12% | 65%,26%,9% | 49%,36%,15% | 50%,38%,13% |

| Trend 4: Regulatory initiatives | 47%,41%,12% | 48%,44%,7% | 46%,35%,18% | 46%,41%,13% |

| Trend 5: Globalisation | 34%,48%,17% | 40%,52%,8% | 29%,43%,28% | 32%,48%,20% |

| Trend 6: Digital v Bricks & Mortar | 68%,22%,10% | 67%,25%,8% | 66%,20%,14% | 70%,21%,8% |

| Trend 7: Big tech in FS | 61%,30%,8% | 63%,31%,6% | 57%,31%,11% | 63%,29%,8% |

| Thinking ahead to 2025 And finally, thinking ahead to 2025,what do you expect to be your organisation's top 3 challenges over the next 5 years in the order of priority for your organisation? - Ranked 1-3 | ||||

Data shown:

|

||||

| New and digital only market entrants | 14% | 13% | 15% | 14% |

| Inadequacy of basic infrastructure | 8% | 11% | 6% | 6% |

| Increasing frequency of cyber threats | 19% | 18% | 21% | 19% |

| Regulatory compliance | 20% | 16% | 21% | 24% |

| Investor demands | 12% | 12% | 13% | 10% |

| Low or zero interest rate environment | 17% | 18% | 17% | 17% |

| Increasing inequality | 9% | 12% | 9% | 7% |

| Geopolitical uncertainty | 15% | 13% | 17% | 15% |

| Climate change and environmental issues e.g. ESG | 15% | 18% | 13% | 13% |

| Crisis response preparedness | 14% | 15% | 15% | 13% |

| Customers loss of trust in their financial institutions | 13% | 16% | 15% | 9% |

| Attracting and retaining talented employees | 17% | 18% | 17% | 14% |

| Attracting new customers | 19% | 20% | 19% | 19% |

| Retaining existing customers | 15% | 14% | 16% | 14% |

| Increasing profitability of customers | 16% | 16% | 15% | 18% |

| Impact of new technologies | 21% | 20% | 16% | 26% |

| Product development | 11% | 12% | 10% | 11% |

| Pressure on Fees | 15% | 13% | 18% | 15% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Digital transformation | 22% | 19% | 23% | 26% |

| Don't know | 1% | 1% | 1% | 1% |

| Questions and Answers | Global | Asia Pac | EMEA | Americas |

|---|---|---|---|---|

| Regulatory Impact Thinking about the different areas that could potentially be impacted by regulatory changes over the next 5 years, which areas of regulation are you most concerned about? | ||||

Data shown:

|

||||

| AML (Anti Money Laundering) | 25% | 26% | 29% | 22% |

| Use of new technology | 31% | 33% | 27% | 32% |

| Enhanced accountability | 19% | 24% | 20% | 13% |

| Open Banking | 22% | 26% | 20% | 16% |

| Central Bank Digital Currency (CBDC) | 25% | 30% | 31% | 15% |

| Data privacy and cybersecurity | 51% | 41% | 47% | 66% |

| Environment and climate (e.g. ESG) | 32% | 34% | 37% | 25% |

| Customer communication | 21% | 24% | 14% | 23% |

| Digital identity authentication | 31% | 35% | 22% | 32% |

| E-money/Cryptocurrency | 26% | 30% | 27% | 20% |

| KYC (Know Your Customer) | 29% | 36% | 18% | 25% |

| Local regulatory pressures - different regulations in different regions | 33% | 41% | 29% | 25% |

| New business model (crowdfunding, peer-to-peer lending) | 24% | 34% | 16% | 16% |

| Other (please specify) | 1% | 0% | 0% | 3% |

| Don't know | 3% | 0% | 8% | 4% |

| Cybersecurity Strategy Which of the following factors will have the greatest impact in shaping your cybersecurity strategy over the next 5 years? | ||||

Data shown:

|

||||

| Shortage of cybersecurity talent | 33% | 42% | 22% | 27% |

| Introduction of new authentication technologies, such as biometrics | 23% | 28% | 14% | 22% |

| Increasing complexity of cyber threats | 47% | 41% | 41% | 59% |

| Introduction of fifth-generation (5G) cellular networks | 27% | 36% | 20% | 20% |

| Adoption of Internet of Things (IoT) hardware and software | 32% | 49% | 14% | 20% |

| Growing public concern over data privacy | 36% | 38% | 24% | 39% |

| Cybersecurity and data privacy regulations | 48% | 51% | 47% | 46% |

| Vulnerabilities in supply chains and business partners | 31% | 30% | 27% | 35% |

| Rising geopolitical tensions | 33% | 34% | 31% | 34% |

| Human vulnerabilities (unintentional or malicious) | 30% | 25% | 35% | 33% |

| Other (please specify) | 0% | 0% | 0% | 1% |

| Don't know | 1% | 1% | 4% | 0% |

| M&A, Divestitures or Carve-out Is your organisation likely to consider any Merger & Acquisition (M&A), Divestitures or Carve-out activity in the next 5 years? | ||||

Data shown:

|

||||

| Yes - expect 1 or 2 M&A/Divestitures/Carve-out activities | 31% | 23% | 14% | 27% |

| Yes - expect 3 to 5 M&A/Divestitures/Carve-out activities | 22% | 38% | 33% | 20% |

| Yes - expect more than 5 M&A/Divestitures/Carve-out activities | 22% | 9% | 8% | 11% |

| No - we don't plan to consider any M&A/Divestitures/Carve-out activities expected within next 5 years | 10% | 23% | 24% | 19% |

| No - but we expect to be the target of an M&A/ Divestiture/Carve-out activity expected within next 5 years | 4% | 5% | 4% | 4% |

| Don't know | 11% | 3% | 16% | 19% |

| ESG Influence To what extent do you expect ESG (Environmental, Social and Corporate Governance) to influence the following aspects of your organisation's business model? | ||||

Data shown:

|

||||

| Selection of clients | 21%,43%,33%,2% | 9%,49%,39%,3% | 22%,45%,31%,2% | 37%,34%,28%,1% |

| Selection of suppliers (value chain partners) | 15%,46%,35%,5% | 6%,43%,49%,2% | 16%,53%,24%,6% | 25%,44%,23%,8% |

| Products/service offering | 13%,43%,41%,3% | 5%,51%,43%,1% | 10%,35%,49%,6% | 24%,39%,33%,4% |

| Investment decisions | 12%,42%,43%,3% | 5%,44%,50%,1% | 10%,41%,45%,4% | 23%,41%,33%,4% |

| Lending decisions | 21%,43%,30%,5% | 12%,49%,36%,3% | 16%,49%,31%,4% | 37%,33%,23%,8% |

| Recruitment of employees | 19%,46%,32%,3% | 10%,53%,35%,2% | 27%,45%,24%,4% | 27%,37%,32%,5% |

| Overall organisation's strategy | 13%,44%,40%,2% | 7%,44%,48%,1% | 14%,47%,39%,0% | 22%,43%,32%,4% |

| The role of employees in Financial Services The role of employees in Financial Services organisations is changing. Which of the following activities is your organisation planning topursue over the next 5 years to address a potential future skills gap? | ||||

Data shown:

|

||||

| Change the composition of the workforce between permanent and contingent staff | 40% | 44% | 35% | 37% |

| Hire from competitors | 27% | 26% | 24% | 28% |

| Acquire a firm to access new skills/expertise | 31% | 45% | 22% | 18% |

| Establish a strong pipeline direct from education | 45% | 49% | 24% | 52% |

| Hire from outside the industry | 27% | 30% | 16% | 30% |

| Undertake significant retraining/upskilling | 46% | 45% | 37% | 52% |

| Outsource non-core activities to third parties | 37% | 40% | 29% | 37% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 6% | 4% | 12% | 4% |

| Macro trends in FS Thinking about macro trends in the financial services industry, which of the statements below do you think is most likely to be true in the 2025? | ||||

Data shown for Trend 1:

|

||||

Data shown for Trend 2:

|

||||

Data shown for Trend 3:

|

||||

Data shown for Trend 4:

|

||||

Data shown for Trend 5:

|

||||

Data shown for Trend 6:

|

||||

Data shown for Trend 7:

|

||||

| Trend 1: Interest rates | 63%,31%,6% | 68%,29%,3% | 59%,33%,8% | 59%,33%,8% |

| Trend 2: Alternative finance | 53%,38%,8% | 67%,30%,3% | 45%,47%,8% | 42%,43%,15% |

| Trend 3: Sources of capital | 60%,30%,10% | 68%,28%,4% | 51%,33%,16% | 56%,29%,15% |

| Trend 4: Regulatory initiatives | 49%,37%,15% | 56%,38%,6% | 45%,33%,22% | 42%,37%,22% |

| Trend 5: Globalisation | 29%,53%,18% | 38%,54%,8% | 14%,51%,35% | 25%,53%,22% |

| Trend 6: Digital v Bricks & Mortar | 69%,21%,10% | 72%,24%,5% | 69%,16%,14% | 66%,22%,13% |

| Trend 7: Big tech in FS | 59%,33%,9% | 58%,37%,5% | 53%,37%,10% | 63%,24%,13% |

| Thinking ahead to 2025 And finally, thinking ahead to 2025,what do you expect to be your organisation’s top 3 challenges over the next 5 years in the order of priority for your organisation? - Ranked 1-3 | ||||

Data shown:

|

||||

| New and digital only market entrants | 11% | 10% | 12% | 11% |

| Inadequacy of basic infrastructure | 6% | 6% | 6% | 5% |

| Increasing frequency of cyber threats | 24% | 22% | 27% | 25% |

| Regulatory compliance | 24% | 23% | 22% | 27% |

| Investor demands | 15% | 15% | 16% | 14% |

| Low or zero interest rate environment | 14% | 11% | 16% | 16% |

| Increasing inequality | 6% | 9% | 2% | 5% |

| Geopolitical uncertainty | 21% | 11% | 22% | 6% |

| Climate change and environmental issues e.g. ESG | 13% | 15% | 8% | 14% |

| Crisis response preparedness | 17% | 18% | 22% | 14% |

| Customers loss of trust in their financial institutions | 11% | 15% | 10% | 8% |

| Attracting and retaining talented employees | 15% | 18% | 12% | 14% |

| Attracting new customers | 15% | 21% | 18% | 6% |

| Retaining existing customers | 12% | 18% | 22% | 24% |

| Increasing profitability of customers | 18% | 20% | 20% | 15% |

| Impact of new technologies | 25% | 25% | 14% | 32% |

| Product development | 10% | 12% | 10% | 9% |

| Pressure on Fees | 16% | 13% | 20% | 16% |

| Other (please specify) | 0% | 0% | 0% | 1% |

| Digital transformation | 22% | 18% | 16% | 30% |

| Don't know | 0% | 0% | 0% | 1% |

| Questions and Answers | Global | Asia Pac | EMEA | Americas |

|---|---|---|---|---|

| Regulatory Impact Thinking about the different areas that could potentially be impacted by regulatory changes over the next 5 years, which areas of regulation are you most concerned about? | ||||

Data shown:

|

||||

| AML (Anti Money Laundering) | 26% | 23% | 24% | 30% |

| Use of new technology | 27% | 26% | 19% | 34% |

| Enhanced accountability | 26% | 29% | 22% | 27% |

| Open Banking | 27% | 23% | 29% | 30% |

| Central Bank Digital Currency (CBDC) | 31% | 35% | 26% | 31% |

| Data privacy and cybersecurity | 43% | 31% | 52% | 46% |

| Environment and climate (e.g. ESG) | 26% | 33% | 28% | 19% |

| Customer communication | 24% | 27% | 19% | 26% |

| Digital identity authentication | 31% | 33% | 30% | 31% |

| E-money/Cryptocurrency | 32% | 32% | 32% | 32% |

| KYC (Know Your Customer) | 30% | 30% | 28% | 31% |

| Local regulatory pressures - different regulations in different regions | 24% | 23% | 27% | 23% |

| New business model (crowdfunding, peer-to-peer lending) | 25% | 24% | 27% | 23% |

| Other (please specify) | 0% | 0% | 1% | 0% |

| Don't know | 1% | 0% | 0% | 2% |

| Cybersecurity Strategy Which of the following factors will have the greatest impact in shaping your cybersecurity strategy over the next 5 years? | ||||

Data shown:

|

||||

| Shortage of cybersecurity talent | 36% | 34% | 39% | 35% |

| Introduction of new authentication technologies, such as biometrics | 26% | 20% | 26% | 32% |

| Increasing complexity of cyber threats | 45% | 45% | 38% | 50% |

| Introduction of fifth-generation (5G) cellular networks | 30% | 38% | 20% | 31% |

| Adoption of Internet of Things (IoT) hardware and software | 27% | 31% | 23% | 28% |

| Growing public concern over data privacy | 35% | 30% | 42% | 34% |

| Cybersecurity and data privacy regulations | 46% | 38% | 48% | 50% |

| Vulnerabilities in supply chains and business partners | 28% | 21% | 25% | 36% |

| Rising geopolitical tensions | 27% | 25% | 28% | 27% |

| Human vulnerabilities (unintentional or malicious) | 35% | 40% | 38% | 29% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 2% | 2% | 2% | 2% |

| M&A, Divestitures or Carve-out Is your organisation likely to consider any Merger & Acquisition (M&A), Divestitures or Carve-out activity in the next 5 years? | ||||

Data shown:

|

||||

| Yes - expect 1 or 2 M&A/Divestitures/Carve-out activities | 31% | 24% | 24% | 30% |

| Yes - expect 3 to 5 M&A/Divestitures/Carve-out activities | 26% | 35% | 31% | 28% |

| Yes - expect more than 5 M&A/Divestitures/Carve-out activities | 15% | 24% | 11% | 15% |

| No - we don't plan to consider any M&A/Divestitures/Carve-out activities expected within next 5 years | 17% | 10% | 22% | 13% |

| No - but we expect to be the target of an M&A/ Divestiture/Carve-out activity expected within next 5 years | 5% | 4% | 4% | 6% |

| Don't know | 6% | 2% | 8% | 9% |

| ESG Influence To what extent do you expect ESG (Environmental, Social and Corporate Governance) to influence the following aspects of your organisation's business model? | ||||

Data shown:

|

||||

| Selection of clients | 16%,42%,38%,5% | 10%,43%,43%,4% | 19%,41%,35%,5% | 19%,41%,35%,5% |

| Selection of suppliers (value chain partners) | 15%,45%,38%,3% | 14%,45%,40%,1% | 15%,46%,35%,4% | 15%,44%,38%,3% |

| Products/service offering | 11%,48%,38%,3% | 10%,51%,37%,2% | 14%,41%,41%,4% | 10%,51%,35%,3% |

| Investment decisions | 14%,41%,42%,3% | 13%,40%,47%,0% | 13%,40%,41%,6% | 15%,43%,38%,4% |

| Lending decisions | 14%,43%,41%,2% | 12%,45%,43%,0% | 18%,41%,38%,3% | 11%,43%,42%,4% |

| Recruitment of employees | 20%,42%,36%,2% | 13%,52%,35%,0% | 24%,33%,40%,3% | 22%,41%,34%,3% |

| Overall organisation's strategy | 11%,38%,47%,4% | 11%,41%,48%,0% | 14%,34%,43%,9% | 9%,40%,50%,2% |

| The role of employees in Financial Services The role of employees in Financial Services organisations is changing. Which of the following activities is your organisation planning topursue over the next 5 years to address a potential future skills gap? | ||||

Data shown:

|

||||

| Change the composition of the workforce between permanent and contingent staff | 35% | 33% | 38% | 34% |

| Hire from competitors | 34% | 33% | 34% | 34% |

| Acquire a firm to access new skills/expertise | 35% | 38% | 28% | 40% |

| Establish a strong pipeline direct from education | 38% | 40% | 36% | 39% |

| Hire from outside the industry | 24% | 23% | 29% | 21% |

| Undertake significant retraining/upskilling | 44% | 41% | 45% | 47% |

| Outsource non-core activities to third parties | 33% | 35% | 30% | 34% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 4% | 3% | 5% | 4% |

| Macro trends in FS Thinking about macro trends in the financial services industry, which of the statements below do you think is most likely to be true in the 2025? | ||||

Data shown for Trend 1:

|

||||

Data shown for Trend 2:

|

||||

Data shown for Trend 3:

|

||||

Data shown for Trend 4:

|

||||

Data shown for Trend 5:

|

||||

Data shown for Trend 6:

|

||||

Data shown for Trend 7:

|

||||

| Trend 1: Interest rates | 62%,32%,6% | 69%,25%,5% | 58%,34%,8% | 60%,35%,5% |

| Trend 2: Alternative finance | 52%,40%,8% | 62%,33%,5% | 48%,44%,8% | 48%,42%,10% |

| Trend 3: Sources of capital | 55%,36%,9% | 70%,24%,5% | 51%,39%,10% | 45%,45%,10% |

| Trend 4: Regulatory initiatives | 49%,40%,12% | 56%,40%,4% | 40%,42%,18% | 50%,37%,12% |

| Trend 5: Globalisation | 41%,43%,16% | 48%,47%,4% | 34%,40%,26% | 42%,43%,15% |

| Trend 6: Digital v Bricks & Mortar | 66%,24%,10% | 69%,24%,7% | 60%,25%,15% | 69%,24%,8% |

| Trend 7: Big tech in FS | 65%,29%,6% | 74%,25%,1% | 63%,27%,10% | 58%,34%,8% |

| Thinking ahead to 2025 And finally, thinking ahead to 2025,what do you expect to be your organisation’s top 3 challenges over the next 5 years in the order of priority for your organisation? - Ranked 1-3 | ||||

Data shown:

|

||||

| New and digital only market entrants | 14% | 12% | 15% | 13% |

| Inadequacy of basic infrastructure | 8% | 15% | 6% | 5% |

| Increasing frequency of cyber threats | 17% | 13% | 21% | 16% |

| Regulatory compliance | 21% | 14% | 25% | 23% |

| Investor demands | 9% | 5% | 12% | 10% |

| Low or zero interest rate environment | 19% | 23% | 18% | 17% |

| Increasing inequality | 11% | 15% | 10% | 8% |

| Geopolitical uncertainty | 15% | 15% | 8% | 10% |

| Climate change and environmental issues e.g. ESG | 16% | 16% | 18% | 14% |

| Crisis response preparedness | 13% | 13% | 13% | 13% |

| Customers loss of trust in their financial institutions | 14% | 16% | 18% | 9% |

| Attracting and retaining talented employees | 17% | 19% | 15% | 16% |

| Attracting new customers | 18% | 19% | 12% | 24% |

| Retaining existing customers | 11% | 10% | 16% | 17% |

| Increasing profitability of customers | 17% | 15% | 15% | 20% |

| Impact of new technologies | 20% | 16% | 16% | 27% |

| Product development | 9% | 12% | 7% | 9% |

| Pressure on Fees | 15% | 14% | 19% | 12% |

| Other (please specify) | 0% | 2% | 3% | 1% |

| Digital transformation | 26% | 21% | 25% | 30% |

| Don't know | 2% | 0% | 0% | 0% |

| Questions and Answers | Global | Asia Pac | EMEA | Americas |

|---|---|---|---|---|

| Regulatory Impact Thinking about the different areas that could potentially be impacted by regulatory changes over the next 5 years, which areas of regulation are you most concerned about? | ||||

Data shown:

|

||||

| AML (Anti Money Laundering) | 55% | 46% | 51% | 66% |

| Use of new technology | 28% | 23% | 20% | 38% |

| Enhanced accountability | 29% | 27% | 31% | 29% |

| Open Banking | 29% | 27% | 31% | 29% |

| Central Bank Digital Currency (CBDC) | 26% | 35% | 29% | 17% |

| Data privacy and cybersecurity | 17% | 25% | 12% | 16% |

| Environment and climate (e.g. ESG) | 17% | 21% | 14% | 16% |

| Customer communication | 17% | 19% | 14% | 19% |

| Digital identity authentication | 21% | 27% | 18% | 19% |

| E-money/Cryptocurrency | 27% | 27% | 22% | 31% |

| KYC (Know Your Customer) | 23% | 27% | 12% | 28% |

| Local regulatory pressures - different regulations in different regions | 23% | 29% | 22% | 17% |

| New business model (crowdfunding, peer-to-peer lending) | 11% | 8% | 8% | 16% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 4% | 6% | 6% | 0% |

| Cybersecurity Strategy Which of the following factors will have the greatest impact in shaping your cybersecurity strategy over the next 5 years? | ||||

Data shown:

|

||||

| Shortage of cybersecurity talent | 43% | 42% | 45% | 41% |

| Introduction of new authentication technologies, such as biometrics | 45% | 42% | 45% | 47% |

| Increasing complexity of cyber threats | 36% | 29% | 37% | 41% |

| Introduction of fifth-generation (5G) cellular networks | 37% | 33% | 43% | 36% |

| Adoption of Internet of Things (IoT) hardware and software | 30% | 25% | 22% | 40% |

| Growing public concern over data privacy | 24% | 21% | 20% | 29% |

| Cybersecurity and data privacy regulations | 32% | 25% | 37% | 33% |

| Vulnerabilities in supply chains and business partners | 23% | 23% | 33% | 16% |

| Rising geopolitical tensions | 21% | 19% | 22% | 22% |

| Human vulnerabilities (unintentional or malicious) | 25% | 19% | 24% | 29% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 5% | 6% | 4% | 5% |

| M&A, Divestitures or Carve-out Is your organisation likely to consider any Merger & Acquisition (M&A), Divestitures or Carve-out activity in the next 5 years? | ||||

Data shown:

|

||||

| Yes - expect 1 or 2 M&A/Divestitures/Carve-out activities | 23% | 25% | 33% | 26% |

| Yes - expect 3 to 5 M&A/Divestitures/Carve-out activities | 28% | 17% | 29% | 22% |

| Yes - expect more than 5 M&A/Divestitures/Carve-out activities | 23% | 8% | 12% | 10% |

| No - we don't plan to consider any M&A/Divestitures/Carve-out activities expected within next 5 years | 10% | 21% | 22% | 26% |

| No - but we expect to be the target of an M&A/ Divestiture/Carve-out activity expected within next 5 years | 6% | 10% | 4% | 5% |

| Don't know | 10% | 19% | 0% | 10% |

| ESG Influence To what extent do you expect ESG (Environmental, Social and Corporate Governance) to influence the following aspects of your organisation's business model? | ||||

Data shown:

|

||||

| Selection of clients | 26%,44%,29%,1% | 15%,44%,40%,2% | 22%,45%,33%,0% | 40%,43%,17%,0% |

| Selection of suppliers (value chain partners) | 21%,50%,26%,3% | 21%,48%,25%,6% | 20%,53%,27%,0% | 22%,48%,26%,3% |

| Products/service offering | 15%,45%,39%,1% | 10%,42%,46%,2% | 8%,57%,33%,2% | 24%,38%,38%,0% |

| Investment decisions | 15%,44%,39%,3% | 17%,38%,46%,0% | 16%,43%,39%,2% | 12%,50%,33%,5% |

| Lending decisions | 25%,46%,25%,5% | 21%,50%,27%,2% | 22%,49%,22%,6% | 31%,40%,24%,5% |

| Recruitment of employees | 23%,45%,28%,5% | 29%,46%,25%,0% | 16%,45%,33%,6% | 24%,43%,26%,7% |

| Overall organisation's strategy | 14%,46%,37%,3% | 13%,40%,46%,2% | 16%,43%,39%,2% | 14%,55%,28%,3% |

| The role of employees in Financial Services The role of employees in Financial Services organisations is changing. Which of the following activities is your organisation planning topursue over the next 5 years to address a potential future skills gap? | ||||

Data shown:

|

||||

| Change the composition of the workforce between permanent and contingent staff | 26% | 33% | 27% | 21% |

| Hire from competitors | 26% | 21% | 37% | 21% |

| Acquire a firm to access new skills/expertise | 27% | 33% | 22% | 26% |

| Establish a strong pipeline direct from education | 34% | 29% | 24% | 45% |

| Hire from outside the industry | 28% | 21% | 31% | 33% |

| Undertake significant retraining/upskilling | 49% | 44% | 53% | 50% |

| Outsource non-core activities to third parties | 35% | 42% | 29% | 34% |

| Other (please specify) | 0% | 0% | 0% | 0% |

| Don't know | 5% | 4% | 4% | 7% |

| Macro trends in FS Thinking about macro trends in the financial services industry, which of the statements below do you think is most likely to be true in the 2025? | ||||

Data shown for Trend 1:

|

||||

Data shown for Trend 2:

|

||||

Data shown for Trend 3:

|

||||

Data shown for Trend 4:

|

||||

Data shown for Trend 5:

|

||||

Data shown for Trend 6:

|

||||

Data shown for Trend 7:

|

||||

| Trend 1: Interest rates | 54%,34%,12% | 50%,33%,17% | 53%,35%,12% | 59%,33%,9% |

| Trend 2: Alternative finance | 50%,37%,12% | 52%,35%,13% | 45%,37%,18% | 53%,40%,7% |

| Trend 3: Sources of capital | 46%,32%,22% | 48%,25%,27% | 41%,37%,22% | 50%,33%,17% |

| Trend 4: Regulatory initiatives | 44%,43%,14% | 33%,50%,17% | 55%,27%,18% | 43%,50%,7% |

| Trend 5: Globalisation | 30%,44%,26% | 35%,44%,21% | 33%,41%,27% | 24%,47%,29% |

| Trend 6: Digital v Bricks & Mortar | 61%,24%,15% | 35%,40%,25% | 76%,12%,12% | 71%,21%,9% |

| Trend 7: Big tech in FS | 60%,27%,13% | 58%,27%,15% | 55%,29%,16% | 66%,26%,9% |

| Thinking ahead to 2025 And finally, thinking ahead to 2025,what do you expect to be your organisation’s top 3 challenges over the next 5 years in the order of priority for your organisation? - Ranked 1-3 | ||||

Data shown:

|

||||

| New and digital only market entrants | 19% | 21% | 22% | 14% |

| Inadequacy of basic infrastructure | 15% | 15% | 14% | 17% |

| Increasing frequency of cyber threats | 19% | 15% | 14% | 26% |

| Regulatory compliance | 25% | 21% | 31% | 24% |

| Investor demands | 17% | 19% | 16% | 17% |

| Low or zero interest rate environment | 16% | 15% | 16% | 17% |

| Increasing inequality | 19% | 19% | 27% | 14% |

| Geopolitical uncertainty | 14% | 13% | 12% | 17% |

| Climate change and environmental issues e.g. ESG | 13% | 13% | 16% | 10% |

| Crisis response preparedness | 13% | 15% | 12% | 12% |

| Customers loss of trust in their financial institutions | 10% | 13% | 27% | 28% |

| Attracting and retaining talented employees | 23% | 10% | 12% | 9% |

| Attracting new customers | 11% | 13% | 12% | 9% |

| Retaining existing customers | 15% | 13% | 18% | 16% |

| Increasing profitability of customers | 16% | 27% | 10% | 12% |

| Impact of new technologies | 11% | 13% | 12% | 9% |

| Product development | 12% | 10% | 10% | 14% |

| Pressure on Fees | 12% | 13% | 12% | 10% |

| Other (please specify) | 10% | 15% | 4% | 10% |

| Digital transformation | 2% | 0% | 0% | 0% |

| Don't know | 0% | 2% | 0% | 3% |

| Questions and Answers | Global | Asia Pac | EMEA | Americas |

|---|---|---|---|---|

| Regulatory Impact Thinking about the different areas that could potentially be impacted by regulatory changes over the next 5 years, which areas of regulation are you most concerned about? | ||||

Data shown:

|

||||

| AML (Anti Money Laundering) | 13% | |||

| Use of new technology | 26% | |||

| Enhanced accountability | 17% | |||

| Open Banking | 30% | |||

| Central Bank Digital Currency (CBDC) | 30% | |||

| Data privacy and cybersecurity | 39% | |||

| Environment and climate (e.g. ESG) | 30% | |||

| Customer communication | 26% | |||

| Digital identity authentication | 13% | |||

| E-money/Cryptocurrency | 22% | |||

| KYC (Know Your Customer) | 26% | |||

| Local regulatory pressures - different regulations in different regions | 26% | |||

| New business model (crowdfunding, peer-to-peer lending) | 17% | |||

| Other (please specify) | 0% | |||

| Don't know | 0% | |||

| Cybersecurity Strategy Which of the following factors will have the greatest impact in shaping your cybersecurity strategy over the next 5 years? | ||||

Data shown:

|

||||

| Shortage of cybersecurity talent | 26% | |||

| Introduction of new authentication technologies, such as biometrics | 30% | |||

| Increasing complexity of cyber threats | 39% | |||

| Introduction of fifth-generation (5G) cellular networks | 26% | |||

| Adoption of Internet of Things (IoT) hardware and software | 26% | |||

| Growing public concern over data privacy | 30% | |||

| Cybersecurity and data privacy regulations | 48% | |||

| Vulnerabilities in supply chains and business partners | 17% | |||

| Rising geopolitical tensions | 26% | |||

| Human vulnerabilities (unintentional or malicious) | 30% | |||

| Other (please specify) | 0% | |||

| Don't know | 0% | |||

| M&A, Divestitures or Carve-out Is your organisation likely to consider any Merger & Acquisition (M&A), Divestitures or Carve-out activity in the next 5 years? | ||||

Data shown:

|

||||

| Yes - expect 1 or 2 M&A/Divestitures/Carve-out activities | 30% | |||

| Yes - expect 3 to 5 M&A/Divestitures/Carve-out activities | 30% | |||

| Yes - expect more than 5 M&A/Divestitures/Carve-out activities | 13% | |||

| No - we don't plan to consider any M&A/Divestitures/Carve-out activities expected within next 5 years | 17% | |||

| No - but we expect to be the target of an M&A/ Divestiture/Carve-out activity expected within next 5 years | 0% | |||

| Don't know | 9% | |||

| ESG Influence To what extent do you expect ESG (Environmental, Social and Corporate Governance) to influence the following aspects of your organisation's business model? | ||||

Data shown:

|

||||

| Selection of clients | 13%,30%,52%,4% | |||

| Selection of suppliers (value chain partners) | 22%,30%,43%,4% | |||

| Products/service offering | 9%,43%,43%,4% | |||

| Investment decisions | 4%,43%,43%,9% | |||

| Lending decisions | 13%,48%,35%,4% | |||

| Recruitment of employees | 17%,35%,48%,0% | |||

| Overall organisation's strategy | 9%,39%,43%,9% | |||

| The role of employees in Financial Services The role of employees in Financial Services organisations is changing. Which of the following activities is your organisation planning topursue over the next 5 years to address a potential future skills gap? | ||||

Data shown:

|

||||

| Change the composition of the workforce between permanent and contingent staff | 17% | |||

| Hire from competitors | 22% | |||

| Acquire a firm to access new skills/expertise | 22% | |||

| Establish a strong pipeline direct from education | 39% | |||

| Hire from outside the industry | 52% | |||

| Undertake significant retraining/upskilling | 26% | |||

| Outsource non-core activities to third parties | 52% | |||

| Other (please specify) | 0% | |||

| Don't know | 0% | |||

| Macro trends in FS Thinking about macro trends in the financial services industry, which of the statements below do you think is most likely to be true in the 2025? | ||||

Data shown for Trend 1:

|

||||

Data shown for Trend 2:

|

||||

Data shown for Trend 3:

|

||||

Data shown for Trend 4:

|

||||

Data shown for Trend 5:

|

||||

Data shown for Trend 6:

|

||||

Data shown for Trend 7:

|

||||

| Trend 1: Interest rates | 65%,22%,13% | |||

| Trend 2: Alternative finance | 52%,26%,22% | |||

| Trend 3: Sources of capital | 65%,22%,13% | |||

| Trend 4: Regulatory initiatives | 52%,43%,4% | |||

| Trend 5: Globalisation | 39%,43%,17% | |||

| Trend 6: Digital v Bricks & Mortar | 83%,13%,4% | |||

| Trend 7: Big tech in FS | 74%,26%,0% | |||

| Thinking ahead to 2025 And finally, thinking ahead to 2025,what do you expect to be your organisation’s top 3 challenges over the next 5 years in the order of priority for your organisation? - Ranked 1-3 | ||||

Data shown:

|

||||

| New and digital only market entrants | 9% | |||

| Inadequacy of basic infrastructure | 22% | |||

| Increasing frequency of cyber threats | 4% | |||

| Regulatory compliance | 0% | |||

| Investor demands | 13% | |||

| Low or zero interest rate environment | 13% | |||

| Increasing inequality | 26% | |||

| Geopolitical uncertainty | 0% | |||

| Climate change and environmental issues e.g. ESG | 13% | |||

| Crisis response preparedness | 9% | |||

| Customers loss of trust in their financial institutions | 9% | |||

| Attracting and retaining talented employees | 22% | |||

| Attracting new customers | 26% | |||

| Retaining existing customers | 30% | |||

| Increasing profitability of customers | 17% | |||

| Impact of new technologies | 35% | |||

| Product development | 17% | |||

| Pressure on Fees | 13% | |||

| Other (please specify) | 0% | |||

| Digital transformation | 17% | |||

| Don't know | 0% | |||

Where are we now?

Sending a text to pay for a bus ticket in Turkey, using a QR code to pay for groceries in China, or tapping a sales terminal with a mobile phone in the US.

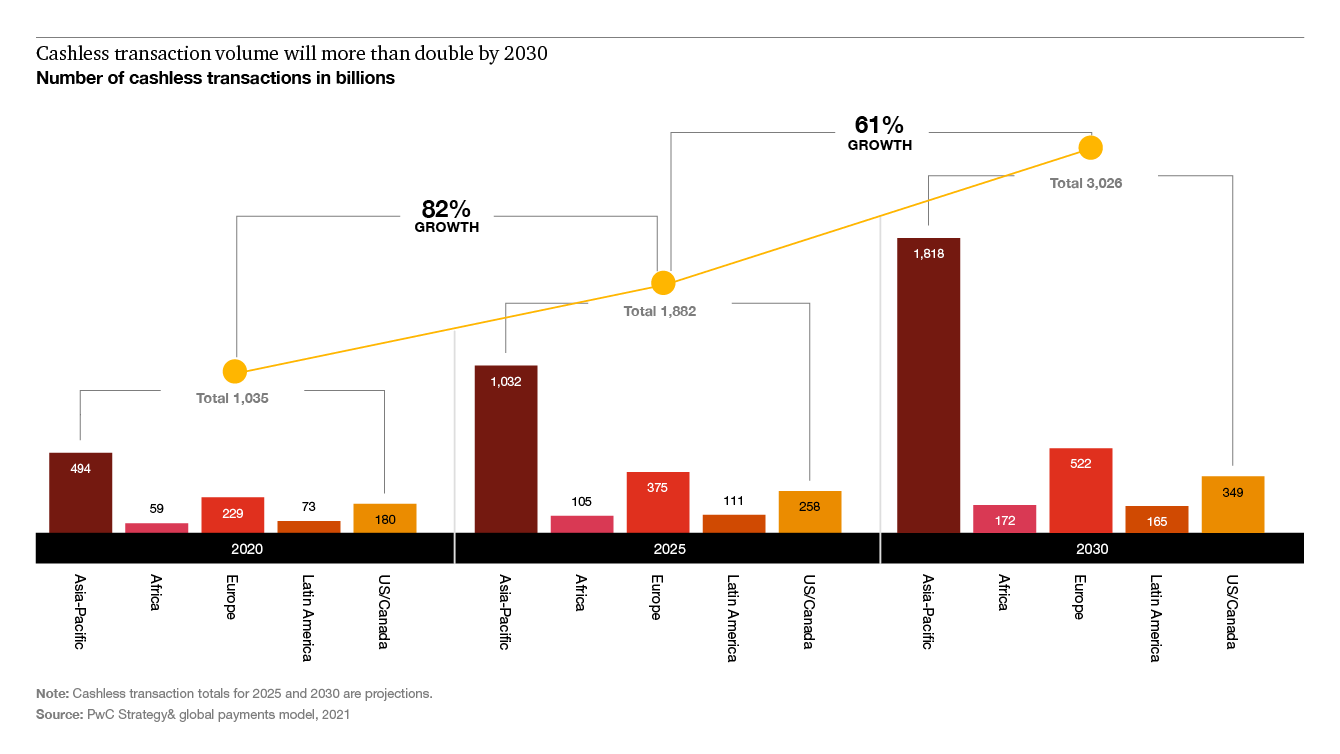

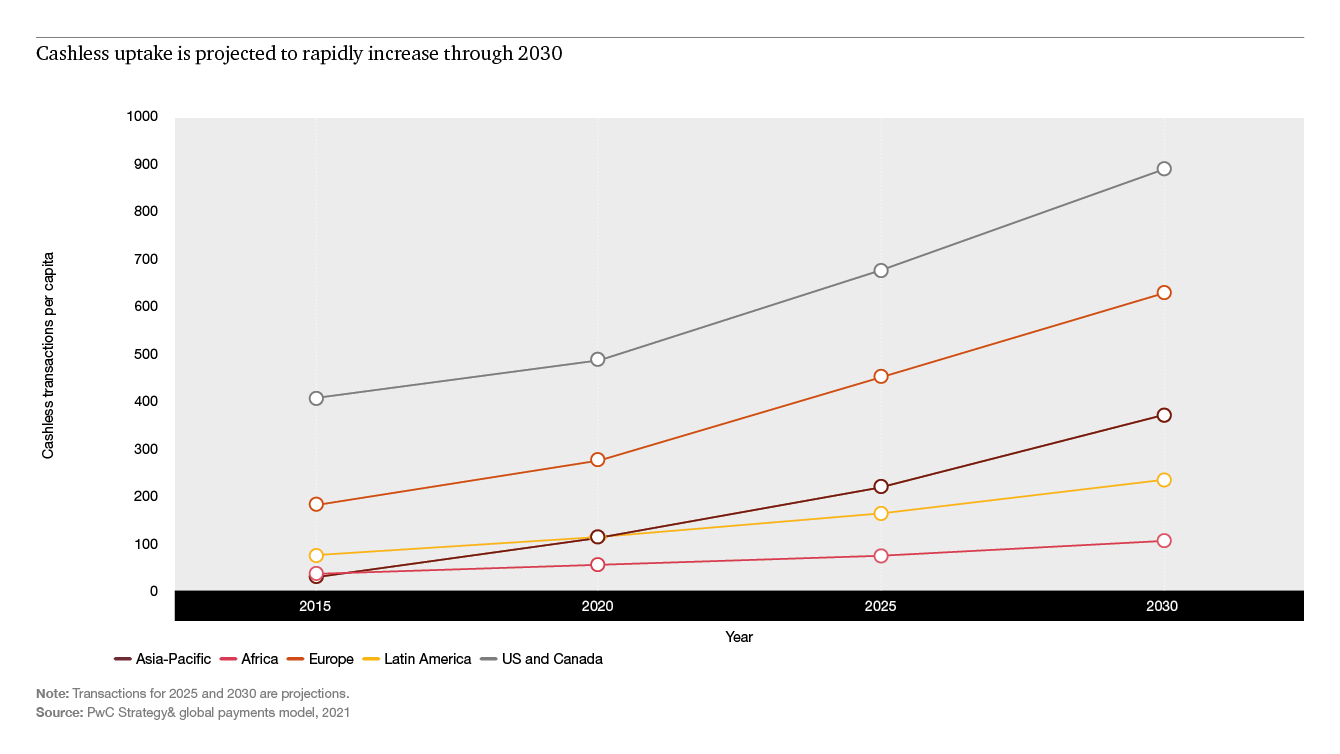

Even before COVID-19, these ways of paying for goods and services were evidence of a steady shift to digital payments— a shift that might ultimately lead to a cashless global society. Global cashless payment volumes are set to increase by more than 80% from 2020 to 2025, from about 1tn transactions to almost 1.9tn, and to almost triple by 2030, according to analysis by PwC and Strategy&.

Asia-Pacific will grow fastest, with cashless transaction volume growing by 109% until 2025 and then by 76% percent from 2025 to 2030, followed by Africa (78%, 64%) and Europe (64%, 39%). Latin America comes next (52%, 48%), with the US and Canada growing least rapidly (43%, 35%).

This means that by 2030 the number of cashless transactions will be about double to triple the current level, across regions.

During COVID-19 lockdowns, many people adopted digital behaviours, accelerating the proliferation of mobile-first digital economies and rendering cash even less relevant to daily life than it already was (although in less developed economies, cash remained essential). In our latest global survey of banking, fintech and payments organisations, 89% of respondents agreed that the shift towards e-commerce would continue to increase, requiring significant investment in online payment solutions. Not only that, but they agreed (97%) that there will be a shift towards more real-time payments.

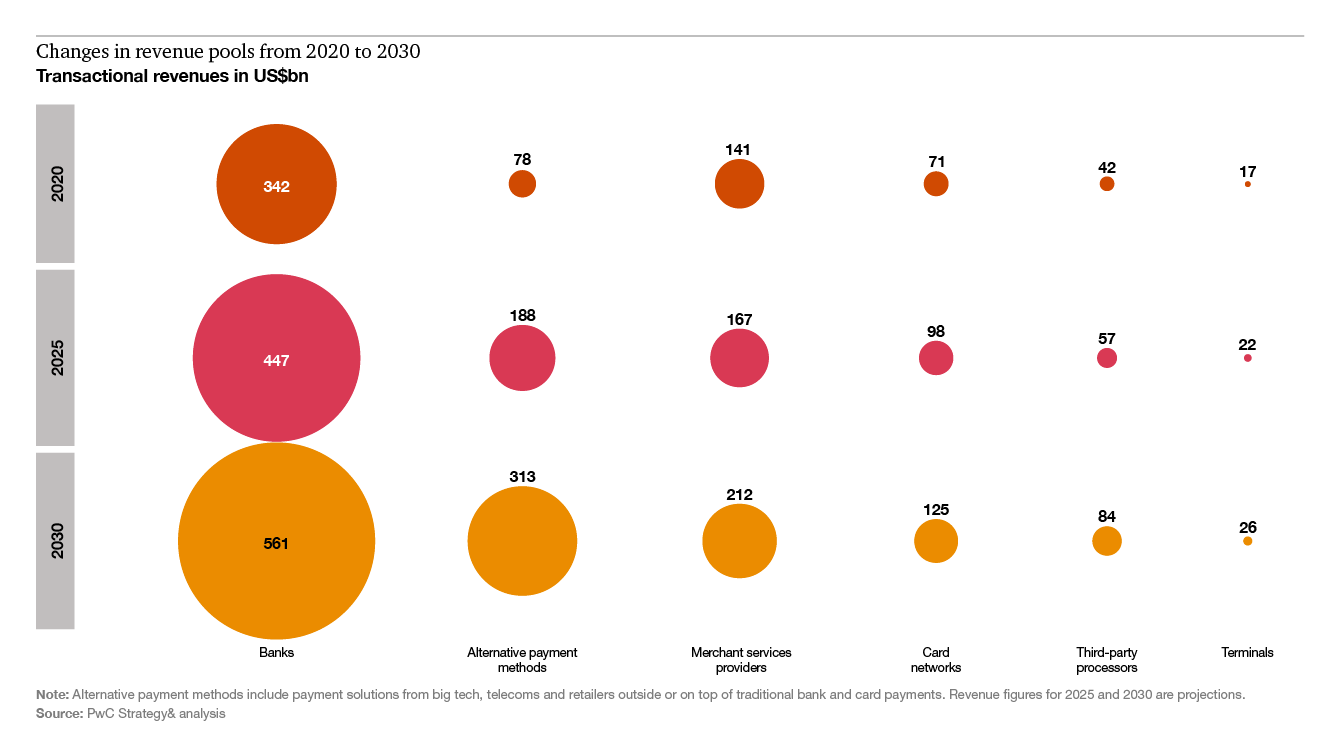

Underneath the shift to cashless lies a larger, more profound change. Not only are traditional ways of paying for goods and services — including the humble paper check and analogue invoices — set for radical transformation, but the entire infrastructure of payments is being reshaped, with new business models emerging.

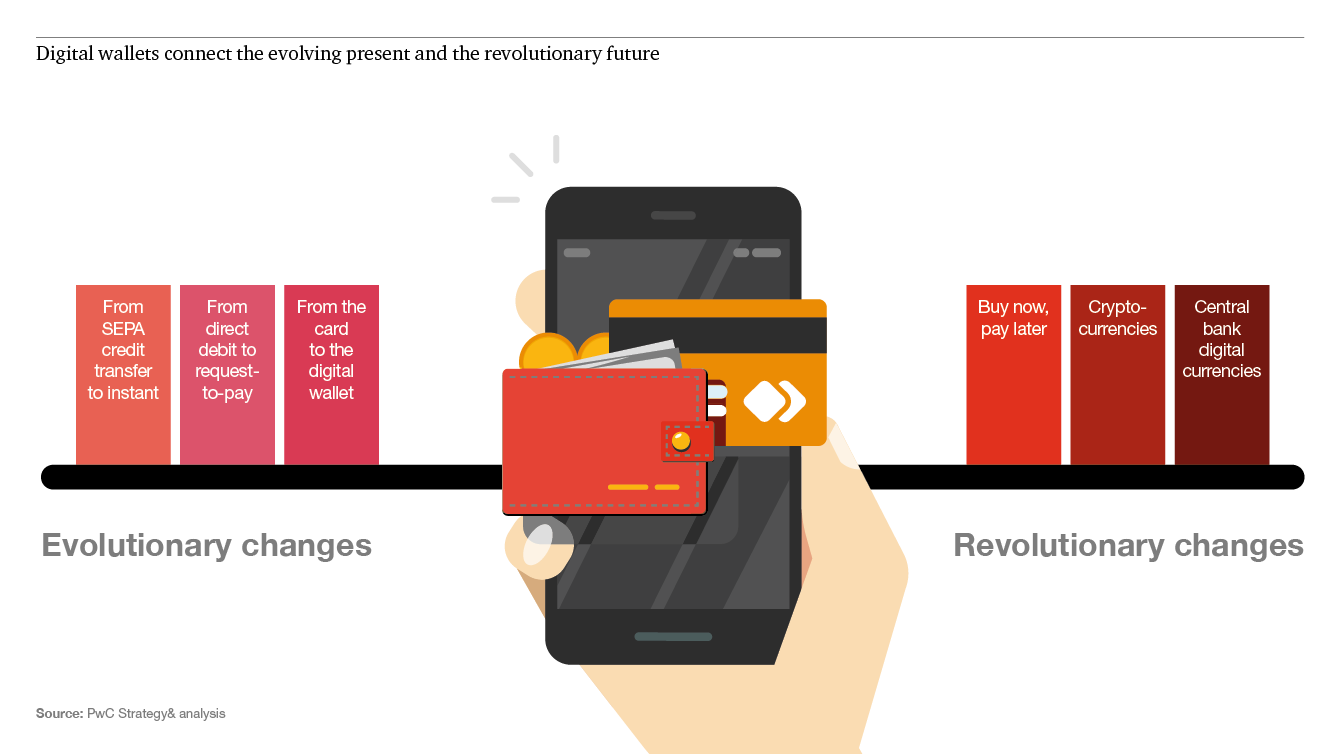

That reshaping involves two parallel trends: an evolution of the front- and back-end parts of the payment system (instant payments; bill payments and request to pay; and plastic cards and digital wallets); and a revolution involving huge structural changes to the payment mix and ecosystem (emergence of so-called “buy now, pay later” offerings; cryptocurrencies; and work underway on central bank digital currencies).

Both evolution and revolution are sweeping the globe, but in different ways and at different paces, creating a complex payments matrix. Many organisations are trying to figure out where to play — and win — in that matrix, as evidenced by the intense level of merger and acquisition (M&A) activity since 2017.

Trends driving M&A activity

Processor consolidation

This has been a US-led trend, with a focus on building domestic scale, culminating in three landmark, multibillion-dollar deals in 2019: the acquisition by Global Payments of TSYS; Fiserv buying FirstData; and FIS acquiring Worldpay.

Merchant services

An ongoing trend across the US and Europe. Examples include the acquisition of Ingenico by French firm Worldline the same year, following its purchase of Swiss-based SIX Payment Services in 2018.

Card networks moving closer to the user

This trend started with Mastercard acquiring UK’s Vocalink in 2016, and then purchasing another account-to-account business in 2020, the year which also saw Visa’s attempt to buy Plaid, the open banking aggregator.

Global mobile wallets and super-apps

A nascent theme yet could become one of the biggest. Alipay has been pursuing a global mobile wallet play with multiple investments in domestic mobile wallets and franchises in Asia. Big Tech firms are also investing in leading payment technologies globally.

Fast-growing Asian markets are driving new business models and innovation. In China, Alipay and WeChat Pay have created a new paradigm around “super-apps” as payment platforms. Our latest global survey of senior financial services executives showed that 78% of respondents said Asian institutions will move at a faster pace on globalisation and convergence than the rest of the world up to 2025, with those in Europe and the Americas struggling to keep up.

With rising strategic significance, some governments are developing payments infrastructure as part of industrial policy to control money flows and own digital and data platforms. These changes have resulted in a mushrooming of domestic payment methods on the back of those infrastructures, such as TROY in Turkey, Mir in Russia, and Brazil’s Elo and PIX systems.

The sector has also become increasingly important as a catalyst for reducing transaction costs, fostering growth and supporting the transition towards digitally enabled and inclusive economies. In developing economic regions in Africa, payments are growing faster than the global average and are allowing millions of “unbanked” people to gain access to goods and services without cash.

The key asset in all of this is data. Payments generate roughly 90% of banks’ useful customer data — information about who is buying what, how much, and when. This is creating new revenue streams for payments businesses that can monetise that data, yet also exposes them to issues and risks related to data privacy.

In our survey, data privacy and cybersecurity were the joint top concern (48%) in terms of the impact of regulatory changes over the next five years. This far outstrips second-ranked digital identity and authentication (31%), and well ahead of cryptocurrencies and central bank digital currencies (CBDCs) (both ranked joint fifth at 28%).

How the payments matrix develops will be determined by the response of banks, technology companies, regulators, governments and consumers to arguably the most profound change in how money moves — even what defines money in our society — for decades to come.

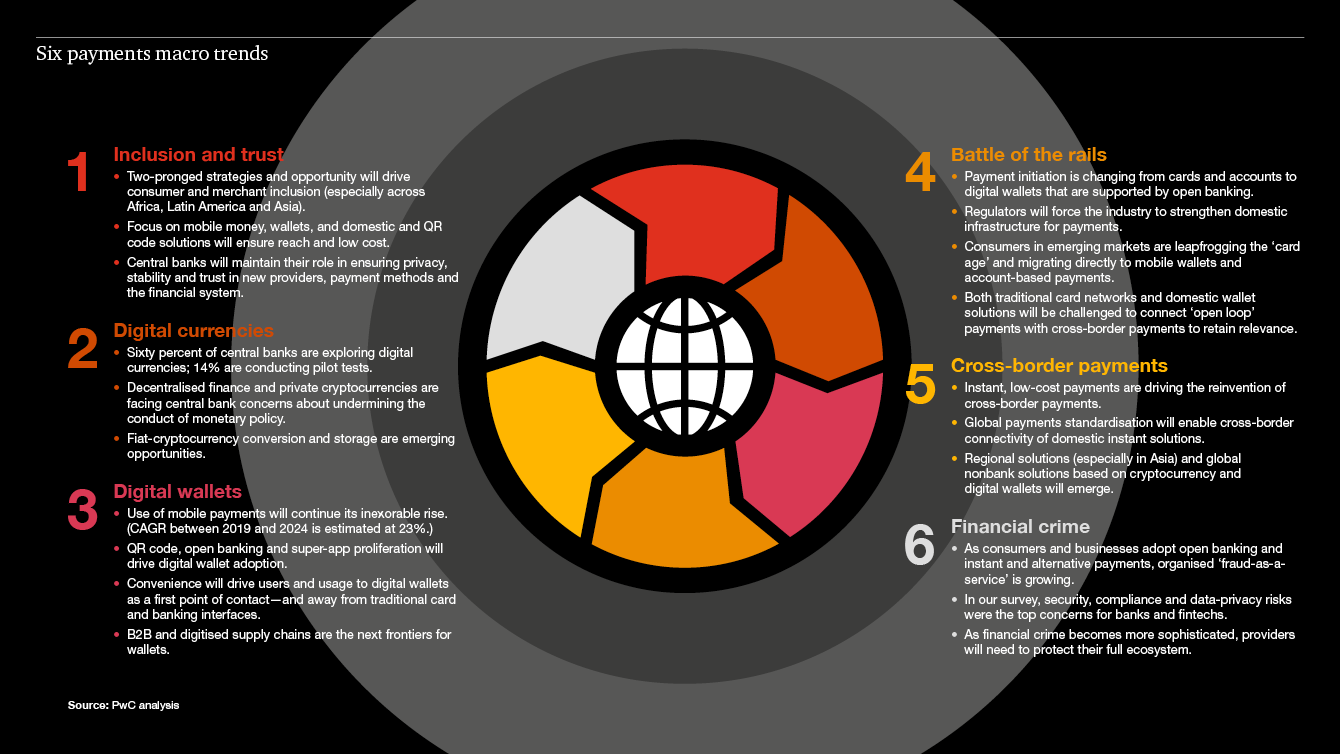

Six macrotrends affecting the future of payments

Six macro trends — driven by a combination of consumer preference, technology, regulation and M&A – will define how the next five years play out. We believe leadership teams need to understand each of these trends in order to properly plan for their future.

1. Inclusion and trust

In 2014, the World Bank set a goal under its Universal Financial Access program that by 2020, adults who were not part of the formal financial system would be able to have access to a transaction account to store money and send and receive payments.

That goal is still some way off from being achieved, but there’s a growing number of initiatives to address, like Thailand’s PromptPay which enables users to make and receive payments using bank accounts or digital wallets linked to their national ID, mobile phone number or email address. By 2019, it had attracted 43 million subscribers, in a country with a population at the time of 69.5 million.

In developing countries, financial inclusion will continue to be driven by mobile devices and providing access to affordable, convenient payment mechanisms. By 2025, smartphone penetration is estimated to reach 80% globally, driven by uptake in emerging markets like Indonesia, Pakistan, and Mexico. Trust in these systems, particularly as central banks consider the feasibility of CBDCs, puts new emphasis on the role of supervisors to ensure data privacy and traceability for consumers and businesses.

2. Digital currencies

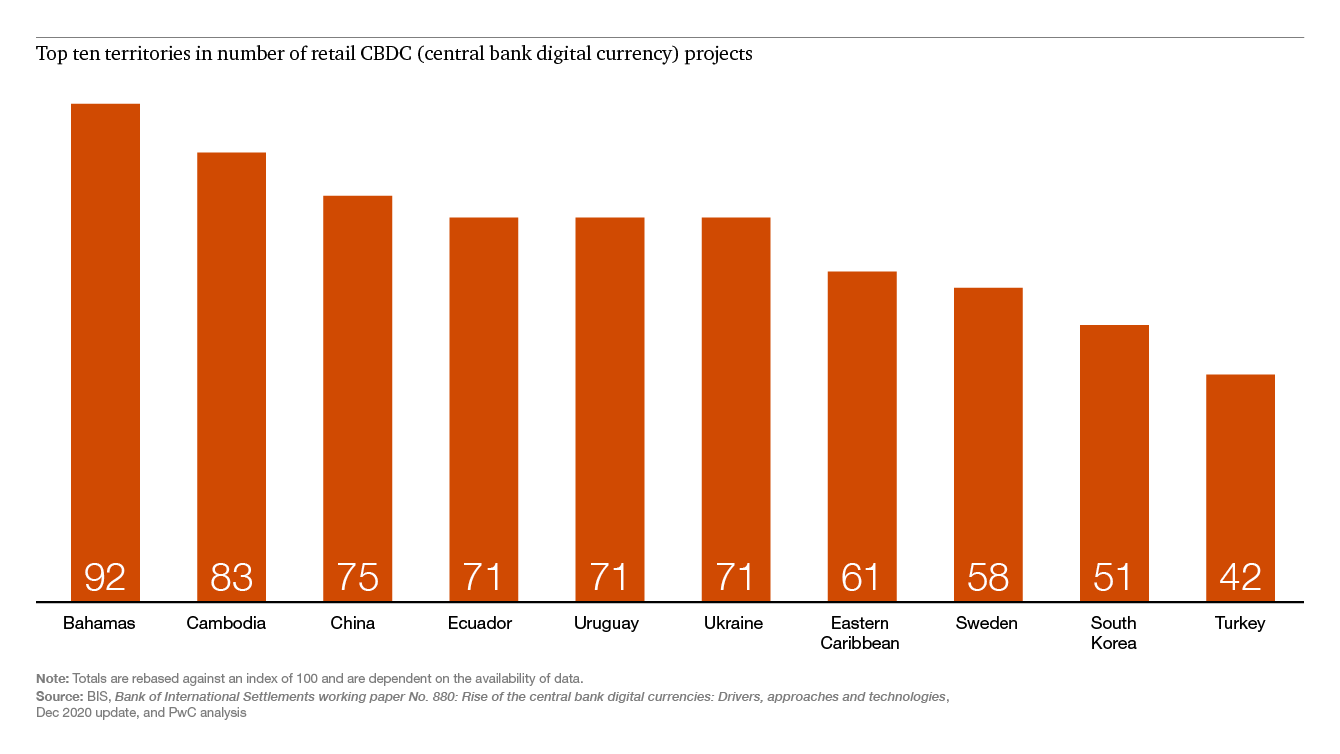

CBDCs — digital tokens or electronic records that represent the virtual form of a nation’s currency — along with private sector cryptocurrencies are predicted to have the biggest disruptive impact over the next 20 years (see Figure 4). In our survey, financial services organisations in Europe, the Middle East and Africa with more than US$5bn in revenues cited “market uncertainty and potential disruption,” such as the introduction of CBDCs, within their top three concerns.

Prominent private sector examples like the Diem, proposed in 2019 by Facebook as a form cryptocurrency that would be backed by a basket of sovereign currencies, could replace account-based payments with a tokenised system of non-sovereign payment systems.

Scepticism within central banks about the potential of private sector cryptocurrencies to undermine the conduct of monetary policy may begin to shift, as some players have recently said they’re prepared to facilitate use of such digital assets. While a recent BIS survey suggests that 60% of central banks are considering CBDCs, and 14% are actively conducting pilot tests. Observers believe that China may be the first to launch its digital renminbi — or “e-yuan” — at the Winter Olympics next year, in what may be seen as a prelude to the decentralisation of finance.

3. Digital wallets

Digital wallets allow consumers to load and store payment methods and access funding sources, such as cards or accounts, on their mobile devices. These wallets will be increasingly pivotal as a payment “front end,” as exemplified by Apple Pay, the relaunched Google Pay and the rise of super-apps WeChat Pay and Alipay in China.

The use of digital-wallet-based transactions grew globally by 7% in 2020, according to a report by FIS, a financial services technology group, which predicts that digital wallets will account for more than half of all e-commerce payments worldwide by 2024, as consumers shift from card-based to account- and QR code-based transactions.

In response, banks and card companies have been partnering with or investing in digital wallet businesses to create payments platforms with scale, such as Standard Chartered bank’s venture with Toss, the largest payments company in South Korea, operated by Viva Republica.

Looking ahead, as many as 86% of our survey respondents agreed with the prediction that traditional payments providers will collaborate with fintechs and technology providers for innovation. 45% of respondents “strongly agreed” that there will be increased investment in mobile technology beyond retail payments to support business-to-business (B2B) payments and the digitalisation of supply chains.

4. Battle of the rails

Behind-the-scenes payments processing — the “plumbing” of payments — is also changing, as payment initiation changes from cards and traditional accounts to digital wallets and as regulators force the industry to strengthen, or build up, domestic infrastructure for payments.

As a result, international card networks and card processors, often US-domiciled, are facing pressure on their core business, and have started to reposition themselves to retain relevance. Outsourcing of cloud and platform infrastructure will become increasingly important, too. In our survey, eight out of ten financial services organisations expected to have outsourced such infrastructure by 2025.

Other issues for processors and networks will be ensuring relevance in the merchant services space, where payments are initiated. They can double down on the provision of value-added services and open up the existing card rails to a wider range of payee and payer points. Digital wallet providers will look to adopt “open-loop” technologies and seek interoperability in order to benefit from (and not fall behind on) the ongoing globalisation of payment rails.

5. Cross-border payments

Frustration with the traditional correspondent banking model, both cumbersome and costly in a world of instant, low-cost payments, has led to the intensification of non-bank providers. New players and solutions are competing with bank and card-based solutions at scale, like the P27 initiative in the Nordic region, integrating 27m inhabitants across four countries and currencies in one “domestic” instant payments system.

In our survey, 42% of respondents felt strongly that there would be an acceleration of cross-border, cross-currency instant and B2B payments in the next five years. This is reinforced by the adoption of ISO 20022, a globally developed methodology for transmitting data which provides a consistent messaging standard for payments.

A recent pilot by Faster Payments Service, owned and operated by British retail payments authority Pay.UK, saw the fastest payment ever sent from Australia to a UK beneficiary, with confirmation of credit and funds available in just 36 seconds. Singapore and Thailand recently linked their respective national systems PayNow and PromptPay, allowing registered users on either system to instantly send money between the two countries using only a mobile phone number.

6. Financial crime

The pandemic’s effect in driving increased e-commerce provided an opening for fraudsters, with the average value of attempted fraudulent purchases rising by almost 70% in 2020, compared with the previous year, according to a report by digital fraud prevention company Sift.

Open banking, combined with a set of new players and the shift towards payment initiation and digital wallets, is also opening new doors for all types of financial crime, such as the increased risk to consumers from authorised push payments (APP) scams across payment networks, globally. Payment providers that help merchants and their customers move money across borders might also enable sanctions evasion and money laundering.

In our survey, security, compliance, and data-privacy risks and related issues were the top concern for banks, fintechs and asset managers in implementing a fully integrated technology strategy. All this points to the need for, and likelihood of, greater collaboration among banks, payment providers and the public sector in preventing fraud and money laundering, with expected trade-offs between cybersecurity measures and customer convenience, according to a recent Bank for International Settlements report.

What kinds of solutions are trending

Machine-learning-based tools

These are analytical services with machine learning and AI capabilities to identify authorised payment fraud. They encompass the necessary speed and processing capabilities that are required to analyse data in real-time.

Risk scoring tools

Risk scoring tools use statistical models to identify possibly fraudulent transactions. Risk scoring allocates a probability of fraud using evolving criteria.

Mule account modelling tools

Mule accounts (those set up by a real customer but with fraudulent papers or identity to enable criminal use) can be targeted using modelling tools that find behaviour patterns in anonymous crowdsourced intelligence from millions of daily consumer activities.

Implications for payments players

Understanding these trends is crucial for banks, card companies, fintechs and others to be able to map a new path to 2025 and beyond.

Banks need to work with business customers to help them integrate payments into their services directly. This will help them deal with a world in which increasingly multifunctional digital wallets and super-apps are proliferating. Bill payments and request-to-pay or instant cross-border offerings could provide opportunities for some larger banks.

Card processors might need to consider moves that position them more effectively for payment initiation, such as partnering with significant digital wallet providers. In this way, they can ensure relevance in the merchant services space, where payments are initiated. Processors also need to bridge the card- and account-based payment worlds and adopt cloud and artificial intelligence technologies to avoid being overtaken by a new generation of cloud-based solutions.

Payment services providers have to work on ensuring transparent global structures and creating trust and visibility with regard to client acceptance, their ability to bear credit risk, and ensuring efficient global supervision structures. They also need to fully master data to win in the race for global scale.

Central banks and supervisors will need to improve their knowledge in order to provide effective supervision of increasingly global players that are not banks.

A new way to think about the future of your business

One of the main challenges at any organisation is determining how to best allocate precious resources to bring about the types of change required to not only manage through the crises of today, but to be successful tomorrow. We’ve created a framework that gives examples of how payment leaders can determine gaps and priorities.

Accelerated by the pandemic, the shift to a cashless society and the rising role of payments as more than simply an exchange of value for goods and services create a once-in-a-lifetime opportunity for the payments industry to lead in financial services. At the same time, by becoming a cornerstone of the global economy, payments can serve as a catalyst for economic growth, innovation and inclusion.

Firms now need to define what their role will be in this evolution. It is critical for firms to understand what they need to do to stay relevant and how to improve the customer experience and contribute to a bigger societal purpose. We look forward to helping you and your institution successfully secure your tomorrow, today.